- Renergen (RLT) has ended the December quarter well funded for the future as it pursues becoming a helium and LNG producer in 2021

- The company spend ZAR$8.17 million (around A$726,000) on operating activities over the last three months

- It also had ZAR$295 million (roughly A$26.2 million) worth of cash and funding available, enough money to last the company for another 7.56 quarters

- Activities wise, Renergen made a number of helium related discoveries over the period including its solution for vaccine logistics

- RLT also signed a key agreement with Logico Logistics Group and extended its coverage with Total South Africa’s service stations

- Additionally, Renergen also reported that unexpected gas was encountered in the legacy well of its Virginia Gas Project in South Africa

- RLT shares are trading down 2.65 per cent at $1.10 each

Renergen (RLT) has ended the December quarter well funded for future as the company pursues becoming a significant helium and LNG producer.

Looking at RLT’s finances, the quarterly cashflow report shows it spent ZAR$8.17 million (around A$726,000) on operating activities over the last three months.

The helium and natural gas producer also spent ZAR$51.7 million (roughly A$4.59 million) on investing activities over the same period.

The company ended December with ZAR$295 million (about A$26.2 million) worth of cash and financing available, enough money to last another 7.56 quarters at that spend rate.

Activities wise, the fourth quarter of 2020 saw Renergen make a number of helium related discoveries over the period including its solution for vaccine logistics.

The Cryo-Vacc allows vaccines to be stored in extremely cold temperatures for 30 days without the need for a power supply as it uses helium as its coolant.

Additionally, Renergen launched its zero emission solution for cold storage logistics during the period after teaming up with trailer manufacturer Henred Fruehau.

Together the companies have created a truck which runs its engine and refrigeration system off LNG, allowing significant emissions reduction and lower capital costs as well.

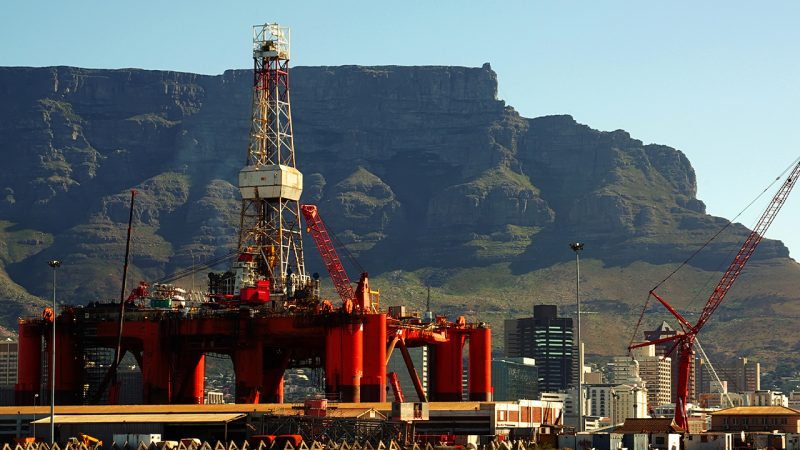

RLT also signed a key agreement with Logico Logistics Group at the beginning of the period, which covers the supply of natural gas in Total-branded service stations along the N3 route between Johannesburg and Durban.

The company has since extended that deal to cover the N1 route between Johannesburg and Cape Town.

Finally, Renergen also had some success at its Virgina Gas Project in South Africa, after previously having to abandon drilling in one hole after losing equipment.

But, the company reported in late October that gaseous odors were detected in a legacy well, an unexpected find as the hole had been determined to be too far from a gas bearing structure.

To date, Renergen admits that “drilling continues albeit at a pace slower than hoped” at its gas project.

However, the company said that should change in 2021 with more drilling results expected which will aid in updating the project’s resource and reserves.

Shares in RLT are trading down 2.65 per cent at $1.10 each at 11:09 am AEDT.