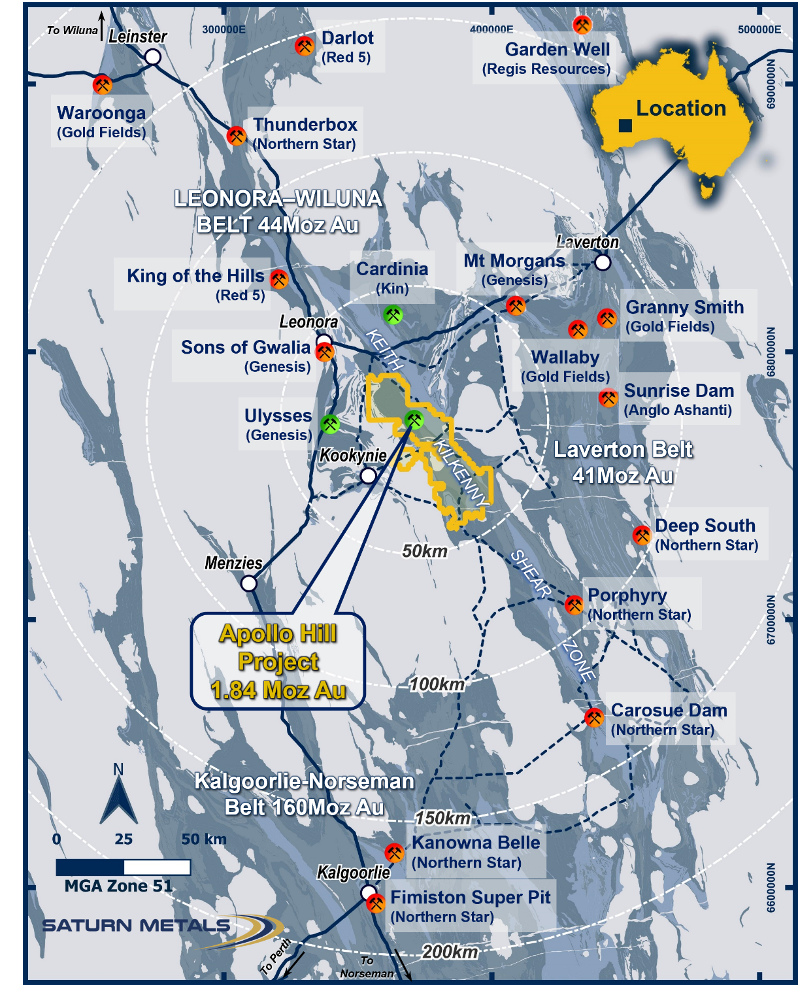

Saturn Metals’ (STN) Apollo Hill gold project in WA is set to become one of the hottest names in the gold space, and not only because the company most recently boosted its resource by 25 per cent to nearly two million ounces of gold.

The company first listed in Q1 of 2018 and has been plugging away with Apollo Hill in recent history as it marches on its path towards the ranks of WA-based gold producers. Saturn picked up the Apollo project from Peel Mining in mid-2017.

Apollo Hill sits on highly prospective acreage spanning over 1000 square kilometres in the Eastern Goldfields region of WA – a part of the state no stranger to the ups and downs of the mining industry through our country’s relatively young history.

The 1.839Moz gold project stands to become a significant money maker for Saturn, with shallow mineralisation allowing for a time-tested open pit design.

Challenging common beliefs

Interestingly, Saturn’s Apollo Hill stands set to challenge commonly held beliefs among the well-established Australian mining investment community.

Those beliefs relate to grades. Saturn’s 1.839Moz resource sits at a gold grade of 0.52g/t – a far cry from the 5g/t cut-off investment advisory provider Undervalued Equity uses to define “high grade” gold.

That 0.52g/t figure may, then, come across as a disappointing read for investors used to looking for high-grade gold hits in ASX announcement headlines, which anyone familiar will know reliably push up company share prices for brief spurts.

However, Saturn Mining is committed to proving that it can realise better value for shareholders without needing to worry about grades – and that’s to do with the way it’s treating its ore on-site.

Take it from Saturn Metals itself: the company recently achieved a 79 per cent gold recovery rate from an ore sample that graded at only 0.33g/t gold – a palpable confirmation that its downstream heap leaching approach is set to unlock serious value for shareholders.

Heap Leaching to boost value: Shaw and Partners

In a research note from analyst house Shaw and Partners, it’s the adoption of a downstream process typically found in overseas mines called heap leaching that will really unlock the value for Saturn’s shareholders.

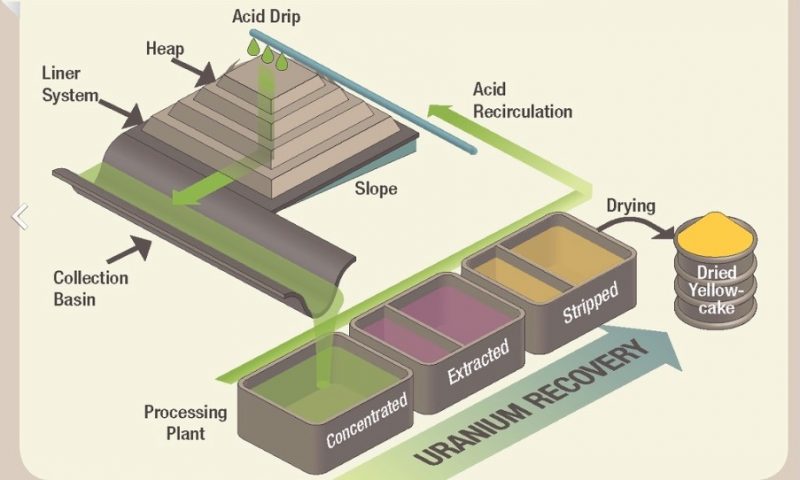

Here’s how it works: heap leaching is when a company collects crushed gold-bearing ore from a circuit, piles it onto an impermeable pad to protect the soil below, and then irrigates that heap of ore over an extended period with chemicals to dissolve the gold.

As liquid falls through the ore and collects on the impermeable pad, the liquid (technically called a leachant) is collected and re-sprayed onto the ore pile until such time the ore is depleted.

In essence, the ore pile is treated and re-treated in multiple passes per normal operations, with the ore-containing solution growing more and more concentrated in each pass. For this process, cyanide is used – the true and trusted companion of the gold industry for decades.

Heap leaching, while rare in Australia – only Newcrest’s Telfer mine in north-central WA and Norton Goldfields in Kalgoorlie using the process; according to Shaw and Partners – is exceedingly common overseas, and particularly in the USA.

In fact, according to Saturn Metals, almost half of the world’s produced gold – 46 per cent – derives from heap leaching operations.

There are two main key advantages: the first is low cost, and the second is recovery performance.

Recovery more important than grades

The second big advantage of heap leaching – and it’s a whopper – is this: from an average grade of only 0.7g/t, heap leaching achieves an average gold recovery of 65%.

That means that the company is able to produce a leachant with significant concentrations of gold from a low-grade ore stock.

If you need an example, look at NYSE-listed Kinross Gold Corporation. Last year, that company produced 214,000 ounces of gold from one of its operations reserve of 41 million tonnes of ore at a grade of 0.6g/t gold in 2022 and an operating cost of around US$972/oz.

Saturn Metals, with over one hundred million tonnes of ore to process, then starts to look like a different kind of play altogether.

At Apollo Hill, Saturn has now successfully included 4.7 million tonnes of ore at 0.55g/t gold in the high-confidence measured classification for a JORC resource, for the first time. Fifty per cent of the total resource – 912,000 ounces of gold – is now classified as ‘Indicated.’

Shallow mineralisation discovered in the central area of the Apollo Hill deposit greatly helped the company reach this impressive position through infill drilling campaigns. Future resource growth remains likely, according to Shaw and Partners.

Saturn Metals is seriously undervalued

Saturn’s Apollo Hill can be likened to the Reward and Bullfrog Gold Projects in Nevada USA, being developed by TSE-listed Augusta Gold.

Both projects have similar grades with similar deposit profiles and both projects are likely to use heap leaching.

Apollo, however (according to Shaw’s), stands aside on the international stage: its Apollo Hill metrics are far superior with the existing resource – which is set to grow further – currently 373,000 ounces of gold larger than Augusta’s.

Apollo Hill also boasts a lower CapEx profile, with one single open pit superseding Augusta’s multiple-pit design.

Further, Apollo Hill also boasts a strip ratio of 1.5x, compared to Augusta’s much higher metric. Strip ratios refer to the volume of waste materials required for removal per volume of ore recovered.

However, Apollo’s market cap sits at $29 million, compared to Augusta’s $142.75 million.

Looking at resource multiples, Shaw and Partners note, this implies $12/oz for Saturn, while Augusta boasts $108/oz. Saturn’s larger peer group averages $87/oz.

What does this mean?

It’s simple – Saturn Metals is undervalued, and it’s only a matter of time until the rest of the market figures that out.

-1280x720-800x430.jpg)

-1280x720.jpg?v=1)