- Tesserent (TNT) signs a deal with Thales Australia for the acquisition of its entire share capital

- The proposed scheme of arrangement offers Tesserent shareholders 13 cents per share in cash, representing a premium of 165.3 per cent to its last closing price

- If all applicable conditions are met, this transaction would value Tesserent’s equity at approximately $176 million

- The board of Tesserent has unanimously recommended shareholders vote in favour of the acquisition

- Tesserent soared 145 per cent to 12 cents at market close

Australian cybersecurity company Tesserent’s (TNT) shares have skyrocketed after signing a deal with Thales Australia, a subsidiary of France’s Thales, for the acquisition of its entire share capital.

Thales offered to acquire the company at 13 cents per share, representing a premium of 165.3 per cent to the last closing price of 4.9 cents per share, and 157.4 per cent to the one-month volume weighted average price (VWAP) of 5.05 cents per share.

The board of Tesserent has unanimously recommended shareholders vote in favour of the share scheme.

Thales, a renowned global technology company, will fully fund the acquisition using its own internal resources and cash reserves. As of December 31, 2022, the group reported having approximately €5 billion (A$7.97 billion) in cash and cash equivalents.

Before the acquisition can be finalised, it will be subject to various customary conditions and approvals, including from the Foreign Investment Review Board (FIRB).

If all applicable conditions are met, this transaction would value Tesserent’s equity at approximately $176 million.

This proposed acquisition marks a significant milestone for Tesserent and its ongoing growth trajectory.

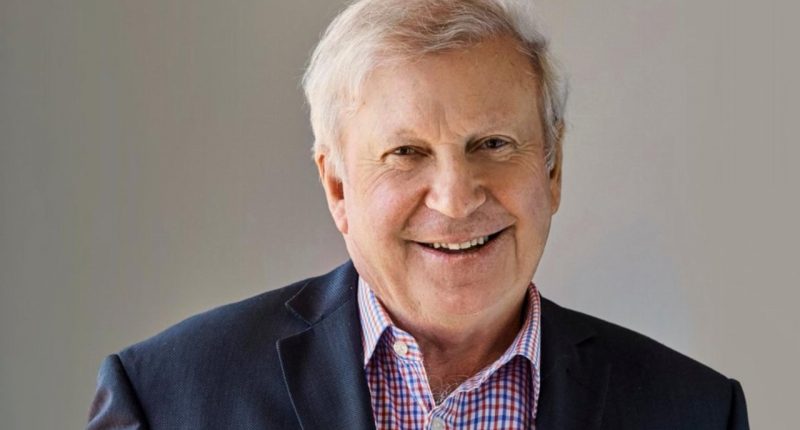

“Tesserent’s customers are expected to benefit from Thales’ enhanced product suite, global service capabilities and the acceleration of Tesserent’s existing growth and customer service strategy,” Tesserent Chairman Geoff Lord said.

Tesserent shot up 145 per cent, trading at 12 cents at market close.