Despite rainfall causing issues on site, Gold Road (ASX:GOR) has confirmed its original FY24 guidance is unchanged.

Shares were up 2.75% in early afternoon trades on Thursday.

Updating the market on its Gruyere play, the company confirmed that a planned gold production ramp-up rolls on despite a “significant rain event” in March impacting daily rates.

In short: the company had to suspend mining ops and instead has been feeding its plant stockpiles, a trend that has remained dominant through most of March.

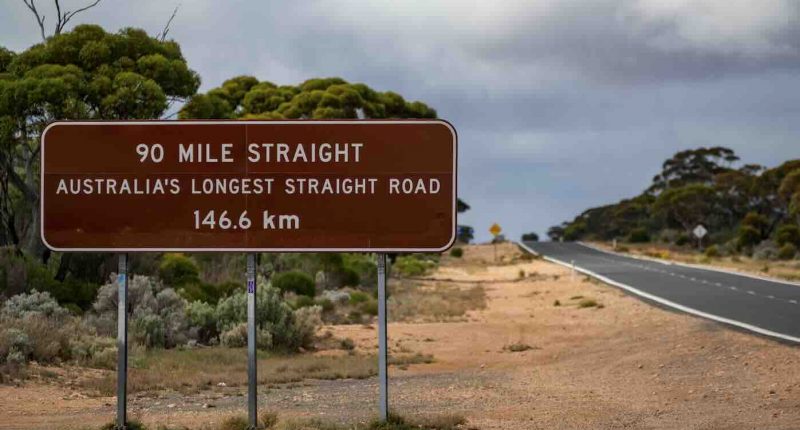

A “significant rain event” is one way of putting it – Australia’s east and west coasts are once again disconnected as the Nullarbor becomes harder to navigate due to heavy rains. This is the second time the desert has flooded in as many years.

But Gold Road isn’t fussed – and shareholders rewarded the news its production guidance for 300-350Koz of gold remains intact, citing an all in cost of between A$1.9-2.05K.

As of 1pm AEDT on Thursday, the Australian gold price is fetching $3.2K/oz (USD$2.17K/oz).

The company says production increases will carry on through 2HFY24 and 1HFY25 should prove even more promising.

Shares last traded at $1.59/sh.