Overview

- The global economy suffered a significant injury with the COVID-19 pandemic. A piece of good news is that the worst of the global recession is likely behind us and the economy will expand in 2H 2020, assuming a second wave of infections is contained.

- With the gradual reopening, the second stage of this economic rehabilitation will be a return to full fitness. This will require a sustainable medical solution, such as a vaccine or effective COVID-19 treatment, and a return to pre-pandemic levels could take until 2021 or beyond. The possible revival of U.S.-China trade tensions is also a threat.

- Global central banks have few options left, except keeping policy rates at zero and government bond yields extremely low. Governments may need to dig deeper to support low-income families and businesses.

Growth rate to rebound, but sub-par activity level

Guide to the Markets – Australia. Data as of 30 June 2020

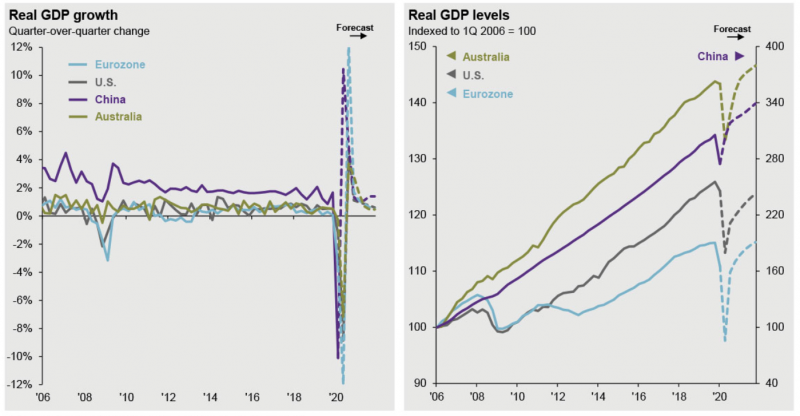

- These two charts reflect the level of economic output for the Australia, China, eurozone and the U.S. Although quarter-over-quarter gross domestic product (GDP) growth should rebound strongly in 2Q 2020 for China and 3Q 2020 for the other economies, it will take significantly longer for the level of economic activity to be restored to pre-pandemic levels.

- Distinguishing between the growth rate and the level of activity is imperative when considering the ramifications for markets. While the growth rate may show a sharper rebound, the level of activity, production or employment could be much duller.

The reopening of the global economy should mark April as the low point of this recession. But the road to a full recovery is long.

- Without a vaccine, efficient testing or treatment, the global economy will struggle to make a full recovery. Consumers are likely to continue to avoid crowded places, such as cinemas, sports stadiums and concert halls, and commercial flights.

- The global economy is only at the early stages of its economic recovery, with some important sectors still far from being back to full strength. This gap implies unemployment rates are likely to stay high, and the threat of bankruptcy persists for companies in these struggling sectors including retail, hospitality, travel and energy.

Governments and central banks keep the stimulus coming

Data as of 30 June 2020.

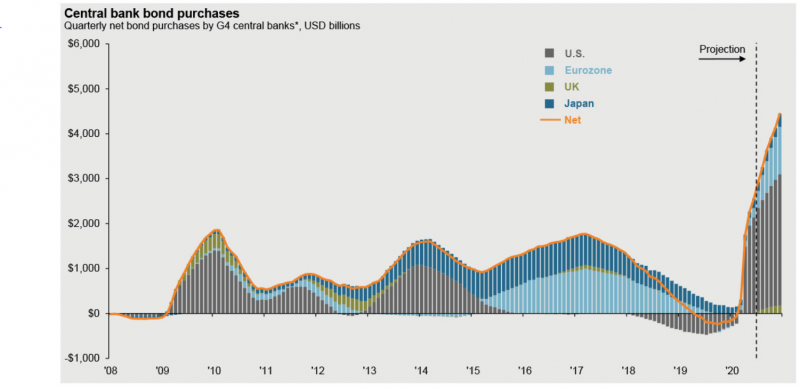

- This chart shows the 12-month rolling flow of bond purchases by G4 central banks. We can see the scale of asset purchases, especially by the Federal Reserve (Fed) and the European Central Bank (ECB), has been very aggressive even compared to the global financial crisis in 2008-2009.

- The pace of asset purchases is likely to slow with improving economic data. However, it will take a considerable amount of time, and material improvements in economic conditions, for central banks to consider shrinking their balance sheets, especially given the surge in government debt.

The scale of monetary and fiscal stimulus around the world is unprecedented.

- Central banks in developed economies have opted for zero policy rates and more are engaging in asset purchases to maintain market liquidity and keep yields low. This first stage of recovery may persuade them to slightly ease the emergency measures, such as reducing the scale of asset purchases. We also do not expect the Fed to push policy rates below zero. A reversal of ultra-accommodative monetary policy is unlikely until we are clearly in the second stage of recovery.

- Likewise, governments may need to continue to support households and businesses until the economy is fully back on track. This implies fiscal deficits for 2020 and 2021 should be very high. Developed economies with asset purchase programmes and emerging markets (EM) with low government debt should be in a stronger position to keep spending.

An old foe returns

Guide to the Markets – Australia. Data as of 30 June 2020.

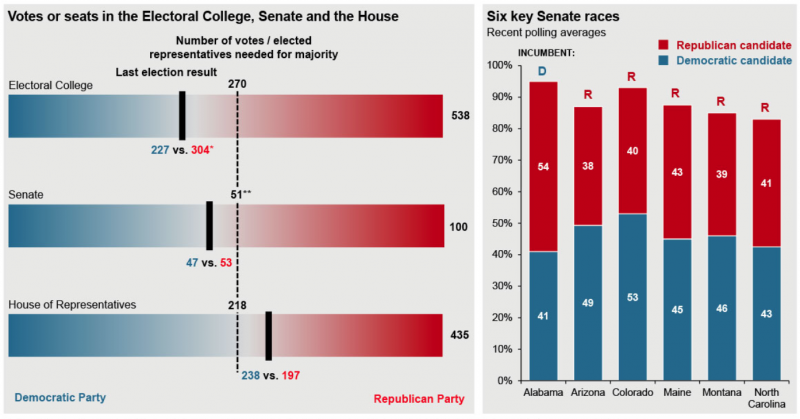

- This page illustrates how close the U.S. presidential election may be. The Republican Party has a slim majority in the Senate and the outcome of the election may come down to just how a few key states will vote.

- These “swing” states are the ones currently held by the Republican or Democratic party, but by a small margin and could easily change.

As policymakers and businesses are struggling with the impact of COVID-19, Washington has dialed up its pressure on Beijing via export restrictions on technology products and threatened to delist Chinese companies from U.S. stock exchanges.

- Regardless of the result of the presidential election in November, the relationship between China and the U.S. is likely to remain challenging.

- U.S. President Donald Trump has threatened to reintroduce tariffs on Chinese exports, but he must consider the potential negative impact on the U.S. economy and market sentiment.

- The need to diversify supply chain risks and being close to end-consumers could persuade businesses to diversify their investments across Asia and other emerging markets.

Investment Implications

- Economic data in 3Q 2020 could rebound slightly as economies gradually reopen. However, given a recession in 1H 2020, economic activity could still be below pre-pandemic levels. It is important to distinguish between the growth rate and the level of economic activity. Renewed trade tensions between the U.S. and China can also upset this recovery.

- Given the gradual recovery, we expect governments will need to introduce more economic stimulus in the coming months to support households and businesses. Developed economies, alongside central banks’ asset purchases, and economies with low government debt, such as Australia, should be in a better position to fund higher rates of spending.

- Yields are likely to stay low and the hunt for income will intensify. With the global economy stabilising, investors should search for yield across equities, fixed income and alternative assets.