By now, you’ve heard about lithium batteries for EVs.

Slick and quiet, Teslas made Elon Musk rich; it’s now cool to drive green on Wall Street, and robust demand for EVs has turned a litany of small miners into billion-dollar behemoths.

But what if we could make an EV battery bigger – big enough to power a town?

And what if we could use that battery to store the electricity generated by solar and wind power for long stretches of time?

We already can. Consider that the Western Australian government recently committed $1 billion to funding such a technology.

Decarbonisation’s crucial ingredient

There is one common misconception regarding solar and wind power that its critics love to use, to their own detriment – the notion that solar power is only useful during the day.

Sure, a household can install a little battery and use some solar-generated electricity at night to boil the kettle. Fair play.

But surely, solar and wind power will never keep a whole city’s lights on. Right?

Big plans need big batteries

Welcome to the world of Battery Energy Storage Systems (BESSies), otherwise known as big batteries.

Practically unheard of in the media landscape only half a decade ago, BESS assets are now seen as a crucial component of the out-of-rhythm global march towards decarbonisation.

Or the energy transition. Or “net zero”, whatever that actually means. (Don’t get me wrong, I swear I’m not an oil baron.)

The basic rundown

The batteries – we’re talking batteries the size of a sea container at least – store energy produced by wind and solar in the day and then dispatch that power at night into the grid.

Best case scenario, they hold onto that charge for days at a time.

This is the fundamental value proposition that big batteries afford, and the market is listening. Tesla’s BESS ‘Megapack’ products are now the most profitable part of its business.

Take the time to think about that – cars aren’t even Tesla’s biggest money maker anymore. Big batteries are. They netted the company US$1.5 billion in Q3 CY23.

This stays the case even though the Megapack assets appear to dislike Australia’s hot temperatures.

So how do they work?

Well, that depends on what type of battery we’re talking about.

There are a range of different battery types used for EVs, and that’s equally true for big batteries.

Those include lithium-ion batteries – by far the dominant type currently used in the EV and BESS market.

But lithium-ion is just the style of battery that was first scaled and made economically viable to produce.

Battery ecosystem not just lithium

They aren’t even the best-performing type of battery, in terms of charge, duration, and safety.

You’ve also got solid-state batteries, lithium-sulfur batteries, flow batteries and sodium-ion batteries (we’ll come back to these shortly), aluminium-ion batteries and magnesium-ion batteries. This isn’t an exhaustive list.

BESS flow batteries – particularly Vanadium Redox Flow Batteries – are a somewhat common alternative to lithium-ion. The next most common are those based around sodium.

These two competitor technologies are the most likely to give lithium-ion a run for its money.

But first, let’s start with lithium-ion.

Lithium-ion big batteries

Lithium-ion batteries are currently in EVs all around the world and are somewhat already well-understood.

Comprising lithium and other critical minerals, the batteries contain a liquid acid within them like older generations of batteries.

While they are perfectly suitable for EVs and able to be used as big batteries, lithium isn’t the world’s most expensive formation of big battery.

Lithium’s high prices have helped make lithium miners like Allkem (ASX:AKE) and Pilbara Minerals (ASX:PLS) rich.

But other materials are cheaper, and the requirement for cobalt also raises human rights concerns with regard to contemporary industrial supply chains.

There’s also the issue of lithium prices being volatile for years to come, at least including to investment bank UBS.

While prices drop for now and into 2025, the company still expects a deficit of about 1 million tonnes per year in 2030 – meaning that company bottom lines will be up and down.

That may attract producers into more stable, cheaper commodities.

Fire and explosion risk

One of the biggest letdowns that lithium-ion batteries pose for the general decarbonisation trajectory is that they are well-established fire hazards.

“In particular, BESS using lithium-ion batteries [are] prevalent, which is mainly due to their power density, performance, and economical aspects,” the authors of a 2023 study wrote.

“As the number of installed systems is increasing, the industry has also been observing more field failures that resulted in fires and explosions.

“Lithium-ion batteries contain flammable electrolytes, which can create unique hazards.”

Thermal runaway liability

Lithium-ion batteries are packed with materials that, if they malfunction, lead to thermal runaway – in other words, an unstoppable fire.

These fires cannot be put out just by splashing them with water. In fact, often, grid-scale lithium-based battery fires will be left to burn for days, meaning that nearby residents are subjected to toxic smoke for days on end.

The bigger the battery, the bigger and longer the fire.

All authorities can really do is tell residents to close their windows. In a heating world, this carries a lot of lawsuit liability from owner-operators, infrastructure insurers, and local affected residents alike.

Sodium-ion big batteries

Now let’s turn to sodium-ion batteries.

Interesting to note is that sodium and lithium are both very chemically similar – on the periodic table of elements, lithium is sodium’s upstairs neighbour.

And sodium-based batteries pose far less fire risk than lithium-ion, one of the most appealing aspects that threatens to subvert lithium-ion batteries’ dominance.

From a business and investment perspective, sodium-ion batteries are fairly similar in the manufacturing process for lithium-ion – this has allowed early adopters to scale their operations without too much cost.

Sodium is cheaper than lithium, so from the very get-go, they’re attractive to industry. Sodium is more abundant than lithium, and, sodium-ion batteries also include less tech metals, especially cobalt, the supply chains for which are renowned for being less than ideal.

Limitations of physics

But the problem with a sodium-ion EV is that sodium boasts less energy density per cell, meaning the batteries need to be bigger.

And lithium EV batteries are already pretty big, as well as the heaviest sole component. So this makes them somewhat undesirable for cars.

Though, Chinese EV maker CATL made the world start paying attention when it framed sodium-ion battery technology as a groundbreaker. A number of other companies are also looking: SVOLT, Tiamat and Faradion among them.

Toyota also recently announced it’s set to start producing solid-state batteries in 2027, a type of battery safer than lithium-ion and compatible with a sodium basis.

But where size makes things difficult for EVs, it’s less of an issue for a sodium-ion BESS asset. If you’ve already got a battery the size of a sea container, what’s an extra tonne?

Sodium chloride variation

There’s one ASX-listed company already developing sodium-tech battery grid storage technology, and that’s battery disruptor Altech Batteries (ASX:ATC).

Headed by visionary Iggy Tan, this company is spread between Australia and Germany’s Saxony region. The company has previously worked in the High Purity Alumina (HPA) space and pivoted into batteries in recent history.

Its flagship Sodium Chloride Solid State (SCSS) Battery Project is well advanced with the company already undertaking sales and marketing of its products.

In partnership with world-class German battery science laboratory operator Fraunhofer IKTS, Altech Batteries – holding 75 per cent of a JV company – is set to commercialise 100 megawatt-hour models of its batteries for energy grids.

The company is calling its battery product CERENERGY – the exact chemical makeup classifies the batteries as sodium nickel chloride batteries.

But this is only one competitor technology to lithium-ion.

You’ve also got another proudly Australian invention – the Vanadium Redox Flow Battery (VRFB).

Vanadium flow big batteries

VRFBs fall within the larger family of flow batteries.

Flow batteries work by producing chemical energy from mixing chemical constituents dissolved in liquid.

While these batteries also include acid, they boast the same benefits over large lithium-ion batteries – they’re safer, more resistant to high temperatures, and hold charge for longer.

VRFBs can also discharge 100 per cent of contained power without incurring damage; respond to rapidly fluctuating demand at peak hour, the vanadium electrolyte can be re-used minimising waste profiles, and, they boast a 20-year-plus life.

The Queensland Government is currently developing a large-scale iron-flow BESS industry, with that state’s own Stanwell Corporation to trial the batteries.

To that end, a domestic manufacturing facility is being built in Maryborough.

But these iron-flow batteries are not the most well-known or most of-interest types of flow batteries.

That goes to VRFBs, based on tech metal vanadium – a market that could see the price of that metal soar in the coming years.

Vanadium in the spotlight

It makes sense that Australian vanadium producers could see huge potential revenues down the line based on VRFB tech.

It’s an Australian invention after all, first established at UNSW in the 1980’s.

And the rush on vanadium driven in part by storage tech is already underway.

In late September, Australian Vanadium CEO Graham Arvidson noted to the press he is closely watching an anticipated $217 million merger with Technology Metals Australia (TMT), headed by Ian Prentice.

That partnership wants to benefit from vanadium’s status as a critical mineral, a label it enjoys at home, in the US, in the EU, and elsewhere abroad.

Even as companies balk at ‘green tape’ threatening domestic critical minerals mining operations, Australian Vanadium is busy working on an electrolyte plant, which it expects would be a huge part of the value proposition.

And then there’s China.

VRFBs are well established on the energy radar in China, where Dalian recently launched a 400-megawatt-hour version in the country’s northeast – one of the world’s largest.

Key marketing boasts surrounding that project relates to the increased duration capacity and fire safety considerations.

Vanadium producers likely to benefit

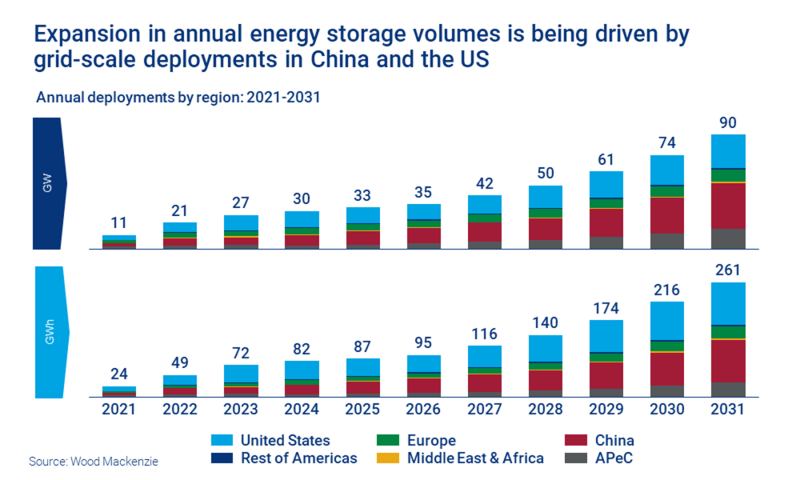

The big battery grid storage market is expected to grow at a Compound Annual Growth Rate (CAGR) and with vanadium flow batteries holding something of gold-standard status, the implications for vanadium miners are promising.

Vanadium has mainly always been a steel alloy. When added to steel, it greatly increases it strength, meaning that less amounts of vanadium alloy steel can be used on aircraft and even spacecraft.

This means the critical mineral has always been of interest to aerospace applications.

The Royal Society of Chemistry (RSC) attributes 80 per cent of current global vanadium demand to its use as an additive.

But as that changes and battery markets open up more and more, vanadium explorers are likely to benefit.

Vanadium Resources a strong contender

Vanadium Resources’ (ASX:VR8) Steelpoortdrift vanadium project in South Africa is a perfect example of a Vanadium project set to benefit from this growing demand.

The company recently expanded its stake in the project to 82 per cent.

Framed as one of the world’s largest undeveloped vanadium deposits, Steepoortdrift could easily become a feedstock-producing hub for the flow battery market within the relatively near future.

South Africa’s government fully supports the project, with that jurisdiction also interested in securing the critical mineral – perhaps a reassuring point for any traders nervous about the jurisdiction.

A large injection of Chinese-backed capital should also be considered as a strong point for Vanadium Resources’ project, given that China is a dominant vanadium player.

An existing DFS for the project whacks a 25-year mine life onto Steelpoortdrift, a net present value of US$1.2 billion, and an internal rate of return of 42 per cent.

Tides may be changing

While lithium-ion batteries, or variants thereof, remain the dominant technology across EV and energy storage markets, this practice may not survive the arrival of VRFBs at scale.

The assets are also threatened by other technologies – sodium-ion batteries are among the most intimidating contenders in that cohort.

The question is: how long can investors ignore the emerging world of competitor value?