- Toys’R’Us (TOY) reports a slight drop in revenue for the first half of the 2023 financial year, attributed to its UK launch and a new facility in Victoria

- The toy retailer doubled its half-yearly loss to $9.1 million

- The company achieved year-on-year growth in direct-to-consumer order volumes due to the UK expansion, but this was offset by costs associated with setting up the UK operations

- TOY also paused its website order processing while it consolidated its Australia-based operations into a single distribution facility in Clayton, Victoria

- Moving forward, Toys’R’Us says its short-term focus is on margin and a pathway to achieving a balanced combination of top-line growth and break-even position

- TOY shares are down 5.3 per cent and trading at 1.8 cents at 2:11 pm AEDT

Toys’R’Us (TOY) has reported a drop in revenue for the first half of the 2023 financial year, attributed to its UK launch and a new facility for its Australian operations in Victoria.

The toy retailer doubled its half-yearly loss to $9.1 million

While the company achieved year-on-year growth in direct-to-consumer order volumes due to the UK expansion, this was offset by costs associated with the set-up of its UK-based logistics operations, initial induction of inventory and costs associated with the first peak-season trading period.

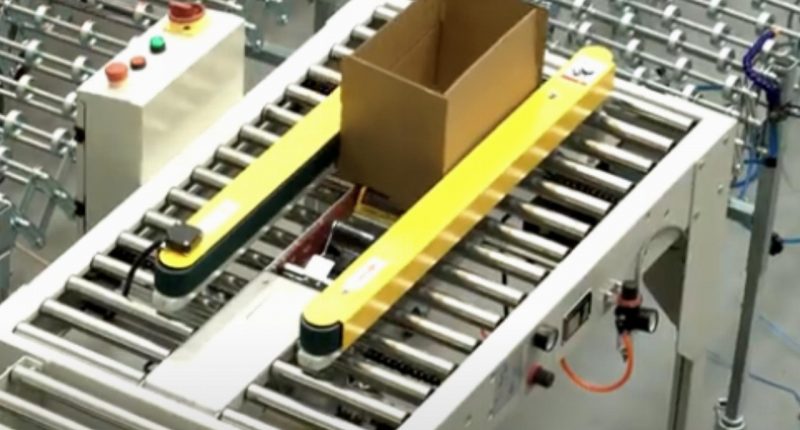

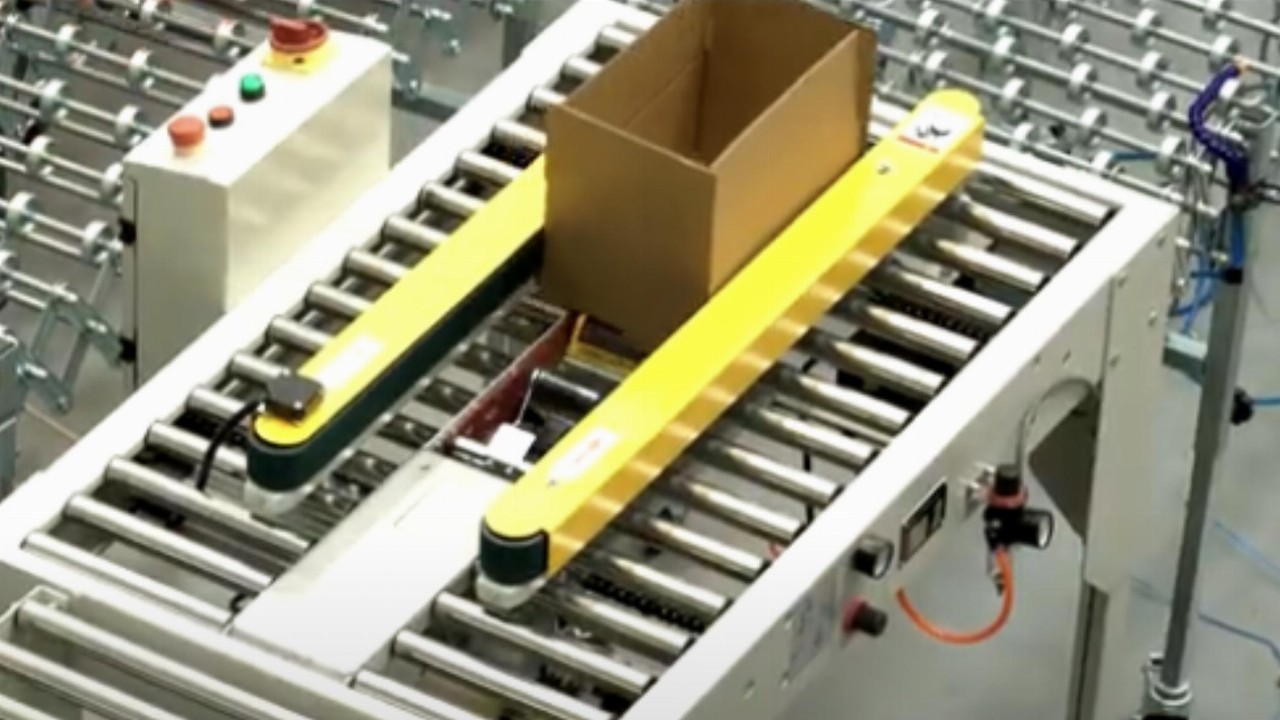

TOY also consolidated its Australian-based operations to a distribution facility in Clayton, Victoria. The relocation was completed in January and included the transfer of autonomous mobile robot assets.

The move necessitated a temporary closure of Toys’R’Us’ website order processing, which the company said impacted revenue.

However, moving forward, Toys’R’Us said the new facilities would provide cost savings by consolidating multiple sites to a single premise while enabling operations to scale up four-fold.

TOY said it would concentrate on deploying capital conservatively, with a short-term focus on margin and a pathway to achieving a balanced combination of top-line growth and break-even position.

In the medium term, the company said its goal remained to achieve 5 per cent market penetration in the toys, baby and hobby markets in all licensed territories.

At the end of the half year, TOY had $5.6 million in cash and cash equivalents — around half of what it had at the end of the corresponding period.

TOY shares were down 5.3 per cent and trading at 1.8 cents at 2:11 pm AEDT.