You may be surprised to learn the USA’s non-fuel mining industry contributed a whopping US$3.64 trillion towards the largest economy’s GDP in 2022.

In a world where North American mining is more closely associated with Canada than America, the United States – home of the NASDAQ – can be overlooked as a standalone mining heavyweight jurisdiction.

In arguing for the US as its own mining superstate, the numbers from 2022 don’t lie.

The US GDP in 2022 sat around US$25.5 trillion for 2022, meaning that 14.2 per cent of the country’s GDP was derived from non-fuel mining that year, per the United States Geological Survey (USGS).

There is one caveat: every single state in the US through 2022 produced construction gravel, or hard-rock products otherwise used in construction.

Crushed rock for the construction sector, for instance, is the biggest hard rock mineral resource produced in Texas, a state better known for its behemoth status on the world oil and gas market.

(Fun fact: in 2022, Arizona, Nevada and Texas were all the biggest contributors in terms of national value share of the USA’s overall mineral extraction sector that year.)

Minerals “fundamental” to US: USGS

But whether we’re talking construction material or high-end tech metals, the USGS still refers to mineral extraction, and sales, as “fundamental to the US economy.”

In 2022 – the latest year for which USGS yearly summaries are currently available – copper was by far the most valuable metal mined in terms of overall export value share.

Copper actually beat out gold in 2022. While the value of mined copper reflected 33 per cent of the USA’s overall mineral bounty in 2022, gold came in lower at 28 per cent.

This is partially reflective of the global overhead push towards electrification, notwithstanding variables like copper demand year-on-year and fluctuations in the USD.

Of course, one can’t overlook the presence of Canada right to America’s north, when looking at the North American mining sector.

Outside of China, the US is next most reliant on mineral imports from Canada.

Between both economies, the USA receives 50 per cent of its yearly mineral import requirements (needed for industry) from these two countries – making it accurate to claim the US is principally reliant on Canada.

Given the huge trade flows between the two countries – particularly in the hard rock minerals space – one would be wise to keep in mind that what happens in Canada’s mining space affects the US (and to a lesser extent, vice versa).

There’s one factoid that most effectively underlines this fact – according to the Canadian government, almost half of all global publicly listed mining companies are in Canada.

So what lies ahead for 2024?

Before we talk any more about Canada, let’s turn back to the US. After all, as the US does, the world tends to follow – especially for their nearest developed ally.

There are three major thematics likely to dominate the North American mining sector in 2024.

They probably won’t surprise you, given there aren’t really any major catalysts coming to define the industry beyond commodity price movements (read: uranium).

Those three thematics are:

- The ongoing uptake and manufacture of electric vehicles (EVs)

- The ongoing recovery of the ESG thematic post-COP28 and post-COVID

- Ongoing geopolitical incentive to prioritise domestic critical mineral supplies

First, some bad news.

The North American mining sector will also continue to tackle macroeconomic trends generally affecting the industry globally.

Those trends include a general decline in mining CapEx as costs rise across the board.

S&P Global Market Intelligence expects iron ore to be the only commodity that sees major capital expenditure on development increase globally this year. (This it expects to occur even as iron ore prices continue to fall in early 2024.)

Fitch Ratings has also downgraded its rating for the global mining sector outlook for 2024 to Neutral, essentially given still-subpar expectations of global GDP growth through 2024.

It goes without saying a surprise intra-year Chinese economic recovery could paint an entirely different picture, but nobody at this stage is meaningfully expecting this to happen.

So let’s look at our first thematic for 2024 – the onward march of the EV market.

EVs and Biden’s IRA interlinked

In the Atlantic Council’s most recent report on the American EV market, the council is quick to point out that Biden’s Inflation Reduction Act (IRA) is a necessary piece of legislation to analyse.

Benchmark Minerals Intelligence (BMI) has said the legislation single-handedly “changed the battery landscape” in the US.

Biden’s IRA was originally branded as, ultimately, a climate change bill. The Republicans and broader GOP, perhaps unsurprisingly, balked at this.

So did other Democrats – Joe Manchin, the biggest Democrat recipient of oil and gas donations, single-handedly kept the legislation from making it to law for months.

Eventually, he was satisfied, especially after the act was renamed to the IRA, straying somewhat from its climate-facing ambitions.

But for all intents and purposes, the IRA remains first and foremost a climate change spending bill.

And that spending bill has billions set aside for the development of the US EV market, from rolling out charging networks, the establishment of the domestic lithium mining industry, and, incentives for consumers and local governments to adopt EVs.

Not that the US hasn’t already been working on this for a while.

Per the Atlantic Council, the US EV market is 20 years old, starting with the introduction of the Toyota Prius in 2000 (Tesla wouldn’t come onto the scene for another six years.)

In 2009, the US government put US$115 million towards EV charging networks. In 2016, EV sales hit 100,000 units in the US for the first time – three per cent of total market share.

Even under Trump – whose entire shtick was being against anything remotely progressive enough to be linked to ‘leftism’ – EVs hit 130,000 sales, despite the sensationalist President’s policy reversals.

While lithium prices remain on a downtrend, largely due to the commodity cycle, BMI expects that lithium demand could hit 2.8 million metric tonnes per year in 2028. At the same time, BMI expects lithium prices to go on a bull run again in that same year.

And talking of progressive policy – that brings us to the second thematic of 2024, the ESG theme.

ESG to come back to fore in 2024

Ernst & Young, for one, expects ESG to be a leading thematic for the global mining and metals market through the next eleven-and-a-half months.

Analysts at UBS also predicted ESG stocks, in particular, to receive an uplift in the second half of 2024 (in between the lines: following the first US Fed rate cut predicted for H2 CY24.)

UBS noted in particular that COP28 and settling of COVID-era supply chain constraints (particularly for energy) are two factors likely to see a renewed enthusiasm for ESG – and renewables stocks – in mainstream investor psychology.

Looking at commodity markets – and ignoring the ongoing copper megatrend – there is one standout theme in the ESG space likely to shine brighter than others.

That theme is uranium – the feedstock of nuclear power, an energy solution towards which most developed economies have recently bolstered support of.

This is where Canada comes back into the picture.

One of the top five uranium producers in the world (alongside Australia,) Canada in particular is likely to be a North American mining hotspot for uranium through the rest of the year.

While the US gets a lot of uranium from Russia, a recent Biden administration move to limit the movement of Russian uranium into the US was a leading factor pushing up prices last year.

It’s likely the US will increasingly look to Canada to supply it with the feedstock it needs to power nuclear reactors, notwithstanding ongoing issues with domestic capacity to produce the grade of uranium needed for use in small modular reactors – next-gen reactor technology the US economy (and Canada) are heavily banking on.

But that’s not the say the US hasn’t got companies operating there mining uranium. More on that shortly.

There’s one big issue overhanging the entire decarbonisation and energy transition trajectory that brings us to our third thematic for the North American mining sector in 2024 – the locking-in of domestic critical mineral supply.

Critical mineral supply remains key concern

According to the International Energy Agency (IEA), the cost of critical minerals is ultimately the key factor that informs the cost of the national (and global) energy transition.

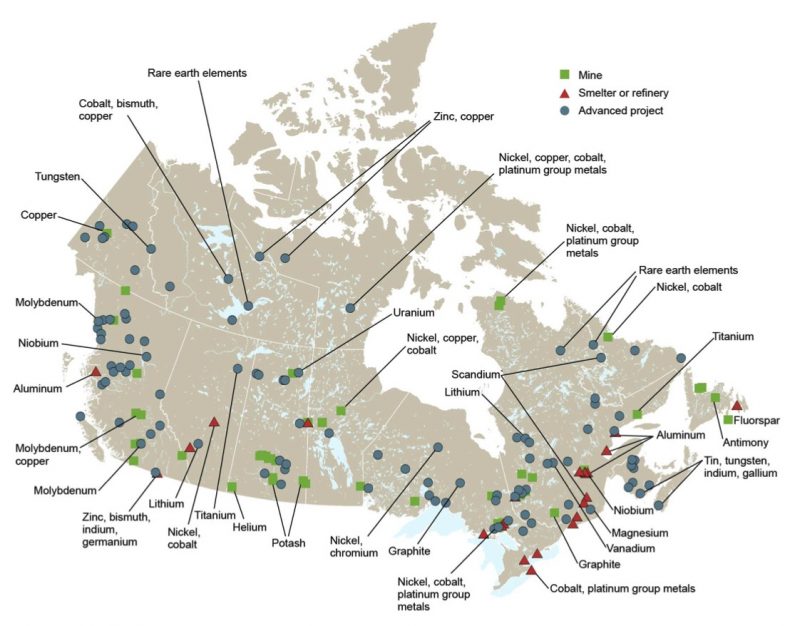

In this light, and exacerbated by the geopolitical supply chain realities brought to the fore by COVID (and the wars that followed), both the US and Canada have introduced critical minerals strategies.

These strategies, once you get past the government speak and noise, all point towards one reality – Western countries need to boost domestic supply and manufacture of end-use-ready critical minerals products.

The entire world depends on China for refined rare earths; while Russia-linked Kazakhstan remains among the world’s largest uranium producers (if not the largest, up until recent history).

Uranium supply concerns hitting Kazakhstan’s Kazatomprom are another reason why futures have soared past US$100/lb in the first month of 2024.

That tidbit aside, there are two dominant pieces of legislation basically too big to fail which guarantee the North American mining sector to be shaped by critical mineral supply chain concerns through 2024.

That is the USA’s IRA, which we’ve already gone over, and Canada’s aptly named Critical Minerals Strategy (CMS).

According to the IEA’s critical mineral market review for 2023, the agency outlines that in 2022, the world saw US$1.6 billion raised for critical mineral start-ups globally.

Canada, alongside Australia, led the world in exploration investment spend, per the IEA’s research from July of 2023.

Given the level of government focus in North America (and across other Western economies) to critical minerals, it’s beyond safe to say the thematic will continue to inform the market through 2024.

So with all of that said – which ASX companies are worth keeping an eye on this year? All of the below information is accurate as of 12 pm Monday, January 22, 2024.

Magnum Mining and Exploration (ASX:MGU)

- Shares: 2.6 cents

- Market cap: $21.04 million

- 1-year returns: flat

- 4w share volume: 1.4 million

Magnum Mining, developing an iron ore project in Nevada, USA (and with a footprint that extends to Saudi Arabia) is a good first place to start.

First and foremost, the company is gearing up to list on an American stock market, to which end it has recently appointed a NY-based law firm.

S&P Global Market Intelligence expects investment into iron ore developments to increase this year – one of the very few commodities to see operators actually boost CapEx, per those analysts’ forecasts.

While demand is expected to remain more or less stable – notwithstanding a surprise raft of data from China suggesting a shock recovery – Magnum stands positioned as one of the more affordable stocks exposed to the US iron ore space.

Infini Resources (ASX:I88)

- Shares: 30.5 cents

- Market cap: $10.8 million

- 1-year returns: 52.5 per cent

- 4w share volume: 5.8 million

A new ASX-lister boasting lithium and uranium tenements across Canada and Western Australia, Infini has been catching eyes in January.

The stock jumped over 80 per cent on its first day on the ASX, driven by residual lithium enthusiasm and, more importantly, uranium prices.

NYMEX futures for uranium have climbed over US$106/lb in the last week as Kazakhstan output issues and rejuvenated pushes for nuclear power from world governments continue to inform the price.

We are well beyond pre-Fukushima levels now – uranium traders are enjoying prices at 17-year highs. Infini is going along with it.

Chariot Corporation (ASX:CC9)

- Shares: 36 cents

- Market cap: $26.3 million

- 1-year returns: -20 per cent

- 4w share volume: 195,680

Drilling is underway for Chariot at its Wyoming-based Black Mountain lithium project in the US.

The company’s IPO saw it list in 2023 and the company was one of few microcap explorers that listed last year which came out stronger than it started.

The company had been roadshowing in Australia and also presented pre-IPO information to investors in New York. Chariot boasts the largest lithium landholding in the US, though, this doesn’t necessarily mean it has the most lithium.

Black Mountain is far from Chariot’s only asset. The company listed with 10 projects under its belt, 7 of those located in Wyoming. Much acreage is underexplored.

Aurora Energy Metals (ASX:1AE)

- Shares: 13.5 cents

- Market cap: $21.49 million

- 1-year returns: -20.59 per cent

- 4w share volume: 759,455

Aurora is another US-based company listed on the ASX boasting a dual lithium-uranium resource – though, it’s recently pared off its lithium to pivot towards uranium.

Based in Oregon, the company has been drilling at its uranium project on-site since late 2022.

In August last year, the company began running its uranium ore through the metallurgical ecosystem. The company is headed by former Deep Yellow (ASX:DYL) chief Greg Cochran.

In the background, the US has boosted its domestic policy landscape to encourage further extraction of uranium ore in the US, for the US.