Australia’s iconic BHP Group (ASX:BHP) confirmed overnight an A$7.7 billion investment into its Canadian potash project expansion.

The news stands as one of BHP’s biggest investments in recent years.

And that’s not even considering the same project in Canada, called Jansen, has already received huge investments from BHP.

In fact, its total investment now exceeds $23.7 billion.

So what is Potash, and why is the company making such a big contribution?

A basic rundown

Potash is a fertiliser, and you may be familiar with the term potash from a historical lens.

Regular woodfire ash can be used as fertiliser, and in times gone by, woodfire leftovers would be sprinkled over crops.

So it was quite literally potash – ash from the bottom of a pot.

But today, it’s typically derived from more industrial methods, including mining and evaporation.

In hard rock mining scenarios, miners chase after potassium-bearing crystalline minerals – which is what the Jansen project aims to achieve.

Why is BHP going into potash?

BHP management has described potash as, in its own words, fundamental to a “global megatrend”.

That global megatrend in question is Earth’s growing human population, which reached eight billion last year.

“As the world’s population rises, access to arable land decreases and diets improve, potash is essential for more sustainable farming,” BHP writes on its project webpage.

“At a time when fertilisers enriched by potash are critical for food security, BHP is well positioned to become one of the leading potash producers in the world.”

The first production is slated for 2026.

Ukraine war consideration

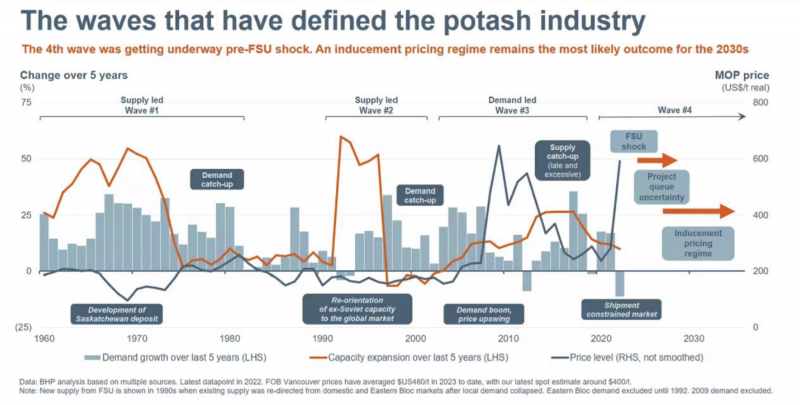

Likely motivating BHP further is Ukraine-borne supply disruptions caused by Russia’s invasion of the country.

At nameplate capacity, the Jansen project – assuming bullish forecasts for potash demand are correct – could provide a quarter of global supply.

That would be a very valuable position to be in, no matter what happened. Especially if there was a shortage.

Diversification aspect

There’s also the diversification consideration.

BHP is exiting coal in the coming years and is widely expected to spin off its oil and gas businesses.

That will leave BHP dangerously close to being a pure-play iron ore miner (as well as copper and nickel).

But as we’ve seen many times this year, the iron ore price has more to do with China than with us.

Copper and nickel shortages are often forecast, too, but markets have a habit of staying in surplus more often than not.

So, firing up a major stake in a commodity set to see booming demand separate from metals makes sense.

The move to Canada also gives BHP access to another jurisdiction.

3 potash stocks to watch

There are 17 companies on the ASX in total that produce potash or otherwise operate around it.

BHP is by far the largest. So what other companies are involved?

Find below the four next-leading potash stocks, selected by top-down market cap size.

BCI Minerals (ASX:BCI)

BCI Minerals is the second largest market cap potash stock after BHP, boasting $333.72 million at 2:00 pm AEDT Wednesday, November 1.

The former iron ore miner has pivoted into potash supported by revenues it made from producing steel feedstock.

Its Mardie salt project – potash ores coincide with salt in nature – has recently seen it secure a $981 million credit approval.

AustralianSuper – the same entity blocking Origin’s takeover bid – is also interested in the project.

Key sealed roadways facilitating the WA-based project were in the September quarter.

Five brokers rate the stock a ‘buy’ with one broker rating the stock a ‘hold’.

Shares last traded at 28 cents.

Highfield Resources (ASX:HFR)

Highfield Resources is the third largest market cap potash stock at 2:00 pm AEDT November 1 at $145.11 million – a steep difference from BCI.

The company’s share price was up 8.82 per cent at the same time on the back of BHP’s much-publicised news.

At the same time, the company has today confirmed its execution of a salt offtake agreement with Maxisalt in Spain.

The company’s Spanish potash project is to produce salt – a byproduct of potash mining – for the first five years.

Highfield ended the September quarter with $16.42 million in cash.

Shares last traded at 37 cents.

Agrimin (ASX:AMN)

Agrimin is the fourth largest stock by market cap on this list, boasting over $55 million at 2:00 pm AEDT on November 1.

Compared to BHP in particular, Agrimin is a microcap and the most speculative on this list.

Consider that one-year returns are down 52.63 per cent.

However, the stock has shot up 12.5 per cent today following BHP’s news.

The company’s flagship project is called Mackay and is located in WA.

It seeks to produce sulphate of potash (SOP), a superior form that fetches higher premiums compared to muriate.

Agrimin’s acreage makes it the owner of the largest SOP development outside of Africa.

The company has secured long-term offtakes covering 70 per cent of production with China as the main customer, followed by Europe, and also penetrating Africa and the Middle East.