- The Australian public is demanding answers and a plan from big-four-bank Westpac after recklessly allowing the use of its banking services by parties with known links to human trafficking and sexual child exploitation

- With 23 million alleged breaches of anti-terrorism and money laundering laws pinned on the company from the Australian Transaction Reports and Analysis Centre (AUSTRAC) — newsreaders are experiencing déjà vu

- 2017 saw Commonwealth Bank bid its Chief Executive and Chief Financial officer goodbye from a lesser 53,506 late reports on similar crimes

- Westpac Chief Executive Brian Hartzer is now looking like a man without a plan, with a ticking clock hanging above his head as AUSTRAC readies the guillotine

- The questions remain for what will change behind Westpac’s doors — and when?

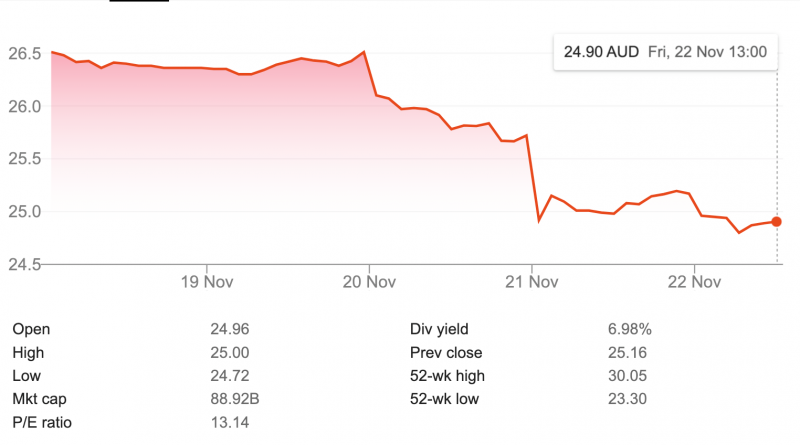

- Shares in Westpac continue their downward trend this week — trading 1.95 per cent lower today for $24.67 cents

Money laundering, breaches of anti-terrorism laws, and rampant accounts of child exploitation and sex trafficking have smeared Westpac’s name this week.

Australians around the country have spoken up in disgust following reports that the banking giant providing its services recklessly for clients linked to money laundering and the abuse of young children.

The bank is under fire for 23 million alleged breaches of the laws, facing a maximum penalty of an unworldly $400 trillion. Each penalty carries a fine of anywhere between $17 million and $21 million.

Although it is unlikely to see one of Australian banking’s ‘big fours’ get hit with a Doctor Evil-esque number, precedence from Commonwealth Bank indicates at least $700 million in fines is on the cards.

A human-aspect to the legal scuffle also highlights the disgust from Australian investors, as Westpac’s failure to carry out due diligence paved the way for live-streamed child sex shows.

Shareholders pulling out of the company over the past week has highlighted a shattered image of the company and its Chief Executive Brian Hartzer.

Image sourced from Google

From the start of trading this week, shares in Westpac have fallen as much as 6.05 per cent. This represents a $1.61 downgrade from $26.51, to $24.90.

All eyes are on Westpac’s Chief Executive Brian Hartzer and his board members to see what changes could be made.

“These are things that the [Westpac] board and the management need to determine themselves.”

Australian Prime Minister Scott Morrison to ABC‘s AM radio program

Prime Minister Scott Morrison spoke up about what was on many Australians’ minds this week, calling the use of Westpac’s banking services as “disturbing”.

“These are some very disturbing, very disturbing transactions involving despicable behaviour,” he said.

Image sourced from Westpac

Most importantly, the Australian leader firmly shifted expectations of responsibility for dealing with the issue away from the Federal Government and towards Westpac’s board members.

“These are things that the board and the management need to determine themselves,” Scott Morrison said.

“It’s not for the government to say who should be in those jobs or not, but they should be taking this very seriously, reflecting on it very deeply, and taking the appropriate decisions for the protection of people’s interests in Australia.”

Although Morrison does sound like he’s fobbing off any firm decision on the matter, he was swift in urging Commonwealth executives’ resignations last year when it came under fire for similar money laundering law breaches.

The Prime Minister may be urging Westpac to do the ‘right thing’.

What to expect from Westpac’s board

Westpac’s scandalous week is oddly déjà vu-like from Commonwealth’s breaches of 2017.

The bank was slapped with $700 million in fines from the Australian Transaction Reports and Analysis Centre (AUSTRAC) — the same watchdog now gunning for Westpac.

The problem transpired after the bank failed to keep an eye on transactions coming through its new “intelligent deposit machine” ATMs. These special ATMs allowed customers to transfer physical money into their accounts through the outlets in an instant.

It became a hotbed for criminally obtained cash and Commonwealth was supposed to keep an eye on transactions reaching $10,000 — except it didn’t.

The bank ended up filing 53,506 late reports that exist to curb terrorism and money laundering.

AUSTRAC requires banks to file these claims within 10 days of occurrence.

It’s clear that precedent exists for hefty fiscal punishments. But while Commonwealth was fined $700 million for late reports detailing dodgy ATM use, it remains to be seen how far Westpac will be dragged through the mud.

Westpac vs. Commonwealth — who handled it better?

There’s more than just numbers when it comes to comparing the Westpac disaster and Commonwealth’s risky ATM flub from last year.

Image sourced from The Centre for Independent Studies

In the fallout of Commonwealth’s fallback, Chief Executive Ian Narev left his post with Chief Financial Officer Rob Jesudason in tow.

Westpac board meeting today for an update on money laundering scandal as pressure grows on CEO Brian Hartzer & directors where the buck stops. AFP confirms it’s working with Austrac and is “aware” of individuals linked to pedophile activity in SE Asia @abcnews @AUSTRAC @Westpac

— Peter Ryan (@Peter_F_Ryan) November 21, 2019

Faith in Westpac’s board has already been standing on shaky ground, as its shareholders vehemently voted down remunerations plans for Brian Hartzer and his team at the 2018 annual general meeting.

With the AUSTRAC allegations in place, Brian Hartzer and the board look more up against the wall than ever.

A conference call by the Chief Executive this week showed he was “appalled” over the claims circulating in the news — but no clear plan from the bank has been announced.

For now, we wait.

Shares in Westpac continue their downward spiral this week — trading 1.95 per cent lower today for $24.67 cents.