- Punters on the Australian market are holding their breath following a trading halt from WA explorer Cyprium Metals (CYM) this morning

- The announcement comes hot off the heels of a now-completed drilling program at the Cue Copper Project — with results to still follow

- However, Cyprium only owns 80 per cent in the project, with ASX-listed Musgrave Minerals retaining the rest with a stronghold on all gold earnings

- South of Cue, Musgrave Minerals continues to dredge up impressive gold grades while Cyprium is indebted to spend $2 million in exploration at Cue over the next two years

- Shares in Cyprium last opened on the Australian market at 23 cents each

WA explorer Cyprium Metals (CYM) has announced a trading halt on the back of recent drilling at its Murchison region Cue Copper Project.

The project has a long history of gold and base metal exploration, originally explored by Westgold Resources and Tectonic Resources in the 1980s.

At the start of this week, Cyprium completed 1138 metres of exploration drilling at the Cue project’s Eelya South prospect — with results yet to be announced.

Image sourced from Cyprium Metals

Previous surface samples at Eelya South hit peaks of 19.7 per cent copper, 4.1 grams of gold per tonne, and 55.5 grams of silver per tonne.

However, Cyprium is not the sole owner of this project, with another ASX-listed company holding 20 per cent interest — Musgrave Minerals.

Musgrave represents a considerably larger market cap over Cyprium — edging $36.48 million over CYM’s $10.36 million.

Back in October, Cyprium paid Musgrave $10,000 to snag the 80 per cent interest at Cue. However, this only covers non-gold minerals at the northern tenements.

Since the option was exercised, Cyprium fronted a $250,000 payment to Musgrave. The explorer is now indebted to spend a further $2 million on exploration within the next two years to retain the majority interest.

The joint venture with Musgrave was formed in late March this year and gives CYM access to the non-gold rights at the Cue project tenements.

The explorer has already conducted drilling and reported results at the Hollandaire and Hollandaire West prospects.

Executive director Barry Cahill said, “we are extremely pleased with the stunning high-grade drill results from our metallurgical drill programme at Hollandaire.”

“The intercepts are all less than 100 metres vertical depth which is a reminder of the quality of the mineralised envelope at this project.”

Apart from reporting drilling results at Eelya South, Cyprium says it will also continue soil sampling to determine where to make their next move.

Meanwhile, sitting south of Eelya South are some more-than-impressive gold grades.

Musgrave’s wholly-owned “Break of Day” project revealed gold grades peaking at 29.2 grams per tonne this month alone.

This is combined with Musgrave continuing to lap up gold further north as Cyprium’s joint-venture agreement locks it out of the gold commodities at Cue.

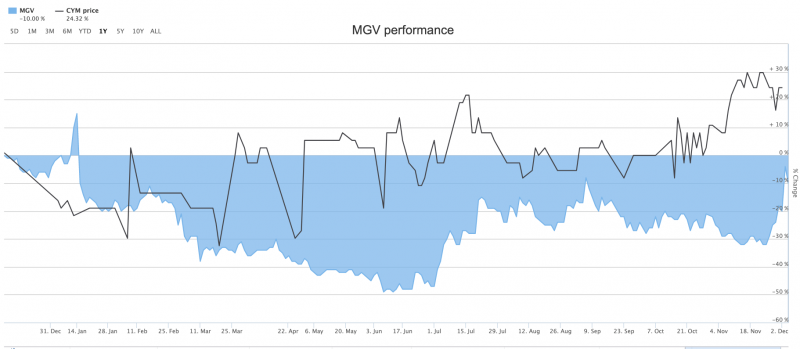

Despite this, CYM has leveraged itself to outperform the considerably higher-cap MGV on the market. Today, Cyprium is valued at 23 cents per share, with MGV trading lower for 8.8 cents per share.

Image generated from ASX.com

Without a doubt, gold and copper movements in WA’s Murchison region are something to keep an eye on in the near future.