- Sleep apnoea specialist Oventus Medical (OVN) has received firm commitments for a $4.65 million placement

- More than 19 million shares will be issued to institutional, professional and sophisticated investors at a price of 24 cents each

- In addition to the placement, Oventus is planning a fully underwritten share purchase plan to raise an extra $2 million

- Eligible shareholders have the opportunity to purchase between $3000 and $30,000 worth of shares

- The money raised will be used to support Oventus’ Lab in Lab business model, as the company receives growing demand for its products and services

- The Lab in Lab model seeks to ensure patients can access dental or medical treatment in the same place throughout their treatment journey

- Oventus is steady today and shares are trading for 26.5 cents each

Sleep apnoea specialist Oventus Medical (OVN) has received firm commitments for a $4.65 million placement.

Approximately 19,375,000 new shares will be issued to institutional, professional and sophisticated investors at a price of 24 cents per share.

This price represents an 18.4 per cent discount to the five-day VWAP (volume-weighted average price) of 29.4 cents, and a 17.4 per cent discount to the 20-day VWAP of 29 cents.

The placement will be completed in two phases with phase one issuing 19,010,416 shares, which is expected on May 7.

The remaining shares will be for Directors, however, this is subject to shareholder approval which must be gained at the general meeting which is scheduled for June 12.

In addition to the placement, Oventus is planning a fully underwritten share purchase plan to raise an extra $2 million.

Eligible shareholders have the opportunity to purchase between $3000 and $30,000 worth of shares.

Shares will be priced the same as the placement and are expected to be issued on June 23.

For both the placement and share purchase plan, Oventus will offer one free unlisted option for every two new shares subscribed for.

These options will have an exercise price of 36 cents and will expire on June 30 2021.

The money raised will be used to support Oventus’ Lab in Lab business model as the company receives growing demand for its products and services.

The Lab in Lab model seeks to ensure patients can access dental or medical treatment in the same place throughout their treatment journey.

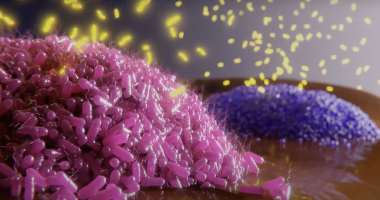

Oventus manufactures products that help those suffering with sleep apnoea.

Its O2Vent devices allow for airflow to reach the back of the mouth, bypassing obstruction from the nose, palate, and tongue.

“Our first priority is to maintain momentum with our Lab in Lab business model, which has continued to operate during the COVID-19 pandemic, with new models and workflows emerging which will positively impact Oventus’ business operations moving forward,” Chairman Dr Mel Bridges said.

“The telehealth and homeware models that we introduced in response to COVID-19 are starting to gain traction with patient bookings continuing to be taken through the pandemic,” CEO Dr Chris Hart commented.

“We are grateful for the support shown by investors through this offer. This new capital will help to increase the rate at which we can deliver upon our strong level of customer demand,” he added.

Oventus is steady today and shares are trading for 26.5 cents each at 1:40 pm AEST.