- Shareholders have been sent into a frenzy after Piedmont Lithium (PLL) announced a new sales agreement with Tesla

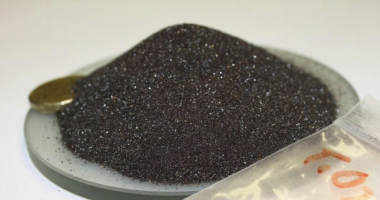

- Under the agreement, Piedmont will supply Elon Musk’s company with spodumene concentrate – which is used in lithium batteries

- The contract will last five years, with the spodumene locked in at a fixed price and 160,000 tonnes per annum to be supplied

- Piedmont expects the sale will generate between 10 and 20 per cent of total revenue from its proposed mine-to-hydroxide project

- Since the announcement, shares in PLL have jumped up over 50 per cent, after the company came out of suspension

- Currently, the stock is trading 56.7 per cent in the green, worth 23.5 cents per share

Emerging lithium company Piedmont Lithium (PLL) has been boosted via the announcement of a sales agreement with electric vehicle manufacturer Tesla.

Shareholders have been sent into a frenzy, following the agreement with Elon Musk’s globally recognised company – with shares up over 50 per cent.

Sales agreement

The contract essentially states that Piedmont will supply Tesla with its spodumene concentrate, produced from its North Carolina deposit in the U.S.

The spodumene has been locked in at a fixed price – which is yet to be revealed.

The start date is also yet to be finalised, but the agreement will run for five years and see around 160,000 tonnes of spodumene supplied per annum.

While Tesla can ask for the additional concentrate to be supplied and both parties have the option of extending the five-year partnership.

Piedmont said it expects the Tesla sales contract will generate between 10 and 20 per cent of total revenue from its proposed mine-to-hydroxide project.

The company’s President and CEO Keith Phillips said the new agreement also represented a disruption to the previous supply chain.

“We are excited to be working with Tesla, which represents the start of the first U.S. domestic lithium supply chain and disruption to the current value chain,” Keith said.

Shareholder reaction

Before today’s announcement, shares in the lithium stock had been tied up in a trading halt and suspension as Piedmont worked out the details of the sales agreement.

The company’s shares had previously spiked last week amid Tesla’s battery announcements, with Piedmont’s U.S. staff also accidentally announcing the sales agreement early on September 23.

PLL has since apologised for the error, and had its shares reinstated to official quotation after officially announcing the Tesla sales agreement today.

The lithium stock immediately shot up in price, trading up over 50 per cent early in Monday’s trading session as investors buy into the company.

Currently, Piedmont Lithium is still trading 53.3 per cent in the green at 23 cents each at 1:35 pm AEST.