- Vectus Biosystems (VBS) has received firm commitments from institutional and sophisticated investors to raise a total of $7 million

- The company intends to issue just under 7.8 million new fully paid ordinary shares at a price of 90 cents each

- Vectus said the proceeds will be used to accelerate Phase 1 clinical trials of its lead compound, VB0004, which aims to treat high blood pressure and the hardening of functional tissue

- A portion of the funds raised will also be used to advance the company’s other emerging compounds

- Shares in Vectus Biosystems remain suspended and last traded on November 20 for 99 cents

Vectus Biosystems (VBS) has received firm commitments from institutional and sophisticated investors to raise a total of $7 million.

Under the terms of the placement, which was announced on Thursday last week, the drug researcher and developer will issue just under 7.8 million new fully paid ordinary shares at a price of 90 cents each.

Gleneagle Securities acted as the lead manager for the offering, which Vectus said involved a number of notable investors within the healthcare industry.

The new shares will rank equally with the company’s existing fully paid ordinary shares and are expected to be eligible for trading on December 2, 2020.

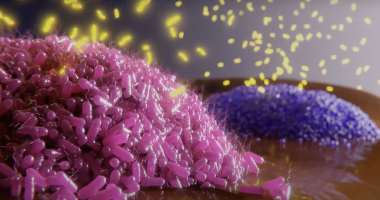

With the financing now complete, Vectus intends to use the proceeds to accelerate the Phase 1 clinical trials of its lead compound, VB0004, which targets the prevention and reversal of fibrosis in the heart and kidneys.

A portion of the funds will also be used to advance the development of its other emerging compounds, as well as for working capital purposes.

“We are very pleased with the strong support received for the placement and welcome new shareholders, and are particularly grateful for the institutional and healthcare industry investor support,” said Ronald Shnier, Chairman of Vectus Biosystems.

“Vectus now has the ability to fast track work on its additional compounds to get them to lead status and move them towards human trials,” he added.

Ronald also noted that a strengthened balance sheet will underpin the company’s ability to pursue work related to its Accugen product, which is being developed by Vectus’ wholly owned subsidiary, Accugen Pty Limited.

Shares in Vectus Biosystems remain suspended and last traded at a price of 99 cents on November 20.