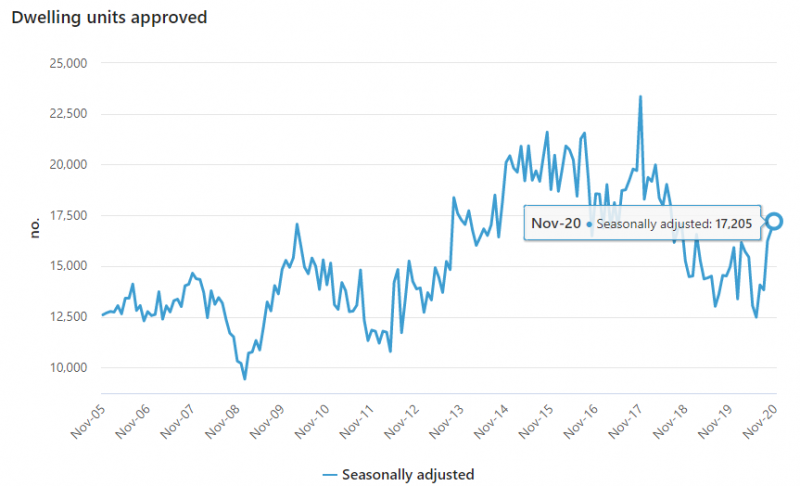

- Homebuilding approvals across Australia have risen for five consecutive months, according to the Australian Bureau of Statistics (ABS)

- On the back of a government stimulus, the approvals haven’t been this high since December of 1999

- From June of last year, approvals for private homes grew 40 per cent

- This growth was recorded across the board for all states, with Queensland leading the pack by a large margin

- South Australian Premier Steven Marshall claims this stimulus has led to an increase in local building gigs

- However, many applicants for the scheme are still waiting for approval

Homebuilding approvals across Australia have risen for five consecutive months, according to the Australian Bureau of Statistics (ABS).

On Thursday, the ABS released a report claiming that building approvals have risen for five straight months now.

“Approvals for private houses have surged 40 per cent since June [2020],” ABS Director of Construction Statistics, Daniel Rossi, said.

Such growth marks the country’s highest recorded level of building approvals since December of 1999.

“Federal and state housing stimulus measures and low interest rates have resulted in strong demand for detached dwellings,” Rossi also said.

From June, all Australian states have recorded a rise in private home building approvals.

Queensland led the pack considerably, showing 17 per cent growth. Western Australia followed with 7.5 per cent, South Australia with 2.8 per cent, Victoria with 1.5 per cent, and New South Wales in last with 0.7 per cent.

However, new buildings being approved actually fell in total value by 8.4 per cent by November. This was driven by the business sector, likely due to the COVID-19 climate as businesses downsize and cutback to survive.

Buildings approved for the business sector fell by a massive 27.4 per cent, following a strong October which was the highest since August of 2019.

While the business sector dragged down building values, residential value bumped by 5.7 per cent.

Such a drive in the private sector of homebuilding is likely helped by Prime Minister Scott Morrison’s ‘Homebuilder’ scheme, introduced in June of last year.

In response to the COVID-19 pandemic, Morrison offered grants totalling $25,000 for singles and families looking to build or renovate.

The scheme was estimated to cost $688 million in taxpayer funds.

Although the scheme ended in December, many applicants are still waiting for their money — meaning this boost to home approvals may last for some time.

For example, Tasmania alone received 428 applicants for the scheme, with only roughly 107 receiving their money so far.

This bottleneck has seen an extension to the scheme for existing applicants to the end of March.

According to Finance Minister of Tasmania, Michael Ferguson, only 15 per cent of the state’s applicants were looking to complete renovations, while the rest plan to build a new home.

Meanwhile, in South Australia, the homebuilding scheme is just as popular.

According to South Australian Premier Steven Marshall, “…local builders hire hundreds of new staff just to keep up with demand”.

South Australia has had 5851 applicants — 461 have already been paid and another 757 are on conditional approval.