- Otto Energy (OEL) has posted a 35 per cent increase in production and a 65 per cent decrease in exploration and admin costs for the first half of FY21

- The increase was driven by the second Green well which is located on the onshore Lightning Field in Texas and began production early last year

- The drop in exploration expenditure led to underlying earnings before interest, taxes, depreciation and amortisation increasing by 718 per cent

- However, a hefty impairment charge on the Green Canyon 21 field led to a net loss after tax of US$14.3 million (roughly A$18.4 million)

- This loss marks a significant increase to the US$2.7 million (roughly A$3.4 million) loss in the prior corresponding period

- Further, Otto ended the half-year with about US$9.7 million (roughly A$12.4 million) in cash compared to the US$16.6 million (roughly A$21.3 million) it started with

- Otto ended the day down 5.56 per cent with shares closing at 0.9 cents

Otto Energy (OEL) has announced a 35 per cent production increase and a 65 per cent decrease in exploration and admin costs for the first half of the 2021 financial year.

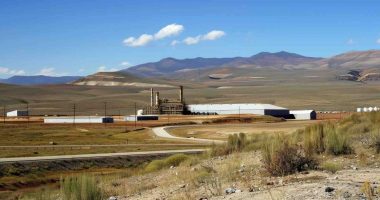

Otto is an oil and gas producer that focused on the Gulf of Mexico region.

The company says the increase in production of natural gas and natural gas liquids was driven by the second Green well which is located on the onshore Lightning Field in Texas. This well began production right after it was completed in February last year.

Despite this, total oil production did decrease by a slight 2 per cent year-on-year which is mainly due to the South Marsh Island 71 (SM71) being shut in for about 21 days due to a record number of hurricanes.

Production generally increased across the board, costs were down, and gross profit totalled US$6.5 million (roughly A$8.3 million). However, Otto still recorded a net loss after tax of US$14.3 million (roughly A$18.4 million) which is much greater than the US$2.7 million (roughly A$3.4 million) loss in the prior corresponding period.

The decrease can be attributed to the US$12.9 million (roughly A$16.6 million) impairment charge on the Green Canyon 21 field, as well as lower sales revenues, higher financing costs and a larger loss on derivatives.

Positively, the significant drop in exploration expenditure led to underlying earnings before interest, taxes, depreciation and amortisation (EBITDA) increasing by 718 per cent to US$2.5 million (roughly A$3.2 million).

At the end of the half-year, Otto had about US$9.7 million (roughly A$12.4 million) in cash compared to the US$16.6 million (roughly A$21.3 million) it started with.

Otto ended the day with shares trading 5.56 per cent in the red to close at 0.9 cents.