- Imugene (IMU) slips in trade following the release of its latest financial report for the three months to the end of June

- Over the quarter, Imugene reported net cash outflows of around $4.65 million, though it ended the quarter with $29.5 million in the bank

- The majority of the company’s quarterly spending came from research and development work as Imugene develops its pipeline of anti-cancer drugs

- The company highlighted some important progress from its HER-Vaxx, PD1-Vaxx, and CHECKVacc products from over the quarter

- Shares in Imugene are down 2.86 per cent today and trading for 34 cents each.

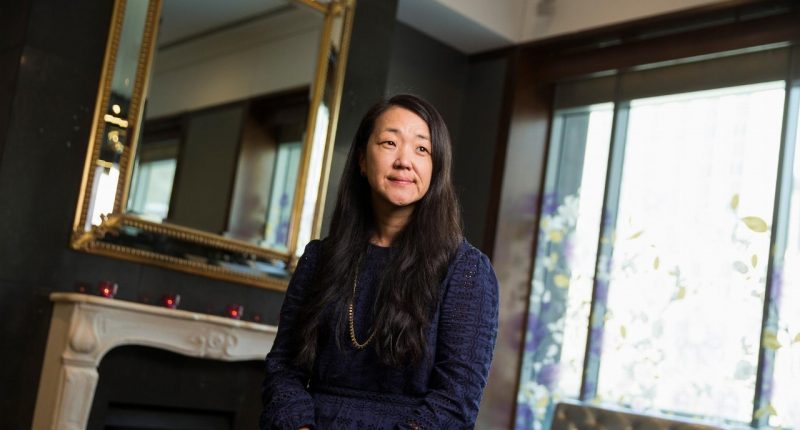

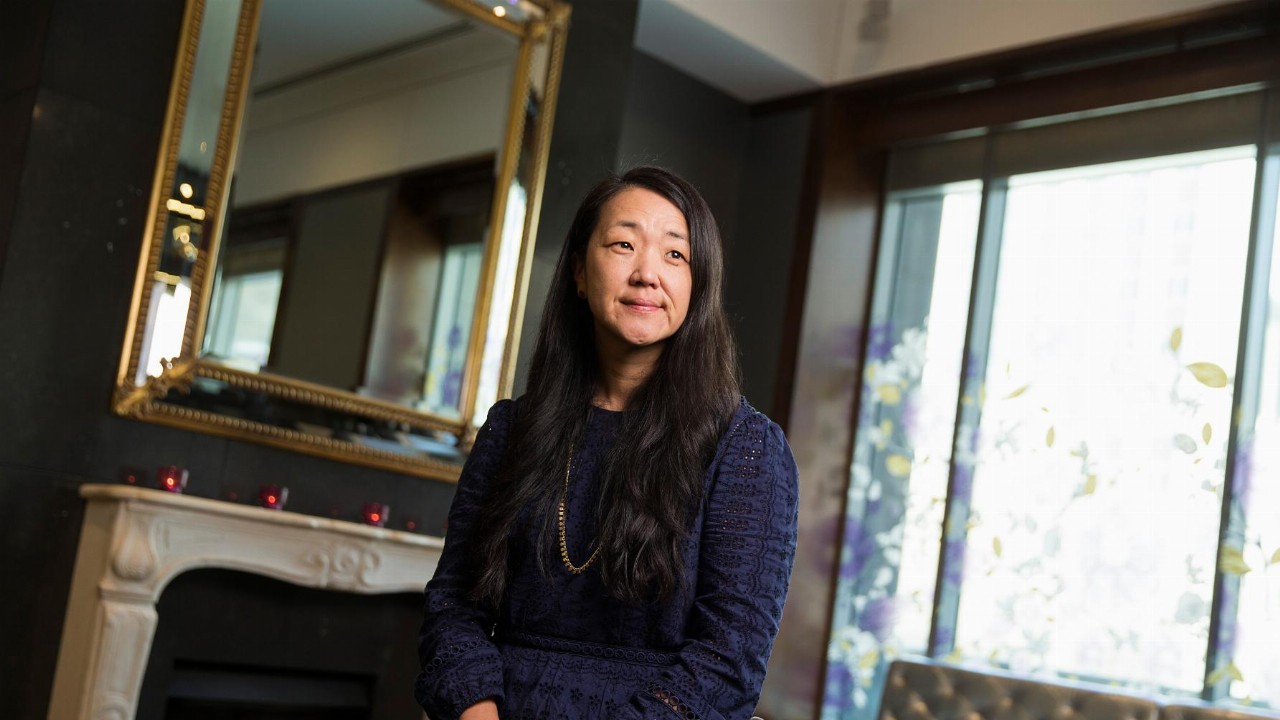

Oncology company Imugene (IMU) has slipped in trade this afternoon following the release of its latest financial report for the three months to the end of June.

Over the quarter, Imugene reported net cash outflows of around $4.65 million. Of this, roughly $3.6 million was spent on research and development work as the company continues to develop its pipeline of anti-cancer drugs.

The quarterly result takes the company’s total operational cash outflow to $15.6 million for the 2021 financial year.

Nevertheless, with some $29.5 million worth of cash left in the bank at the end of June, Imugene has enough funding to last at least another 18 months — provided future spending is consistent with June quarter levels.

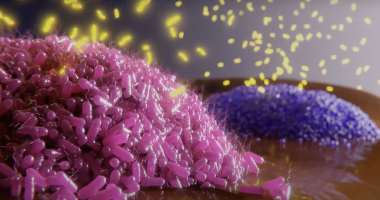

Imugene’s cancer treatments are designed to activate the body’s immune system to recognise and respond to cancerous tumours, then destroy them.

The company hit some key milestones for some of its treatments over the June quarter.

Immunotherapy development work

One of the most significant highlights from the quarter was the presentation of some new data from Imugene’s HER-Vaxx cancer immunotherapy program at the American Association for Cancer Research’s (AACR) annual meeting in April.

HER-Vaxx is a B-cell immunotherapy program designed to treat specific types of tumours the over-express a type of protein known as HER-2. Gastric, breast, ovarian, lung, and pancreatic cancers typically fall into this category.

Imugene completed the recruitment part of a phase-two trial for its HER-Vaxx program in January.

Data presented at the AACR came from fresh studies of the B-cell immunotherapy and showed a 50 per cent overall response rate (ORR) compared to a 29 per cent ORR for patients being treated with chemotherapy alone.

Moreover, Imugene said treatment with HER-Vaxx “clearly demonstrates” that patients develop higher levels of HER-2-specific antibodies during treatment, and these levels are maintained throughout.

Importantly, tumours reduce “substantially” more in response to HER-Vaxx administered alongside chemotherapy than compared to chemotherapy alone.

“Overall, this data demonstrates HER-Vaxx may provide treatment benefits consistent with traditional monoclonal antibodies with a corresponding adaptive immune response without added toxicity,” Imugene said today.

Meanwhile, Imugene is busy recruiting its first candidates for an in-human trial of its PD1-Vaxx product. The patients being recruited have non-small cell lunch cancer and have progressed from previous therapies.

The company said so far, no safety, toxicity, or tolerability issues have been reported from the PD1-Vaxx treatment, and the company expects these results to continue as it progresses to the highest dose of the treatment.

Further to all this, Imugene and the City of Hope received US Food and Drug Administration (FDA) Investigational New Drug (IND) approval for a first-phase clinical trial of its CHECKVacc product on June 30 — right before the end of the quarter.

The approval means the company can kick off a phase-one clinical trial for the product to evaluate the safety and initial evidence of efficacy for the product.

Shares in Imugene are down 2.86 per cent today and trading for 34 cents each. The company has a $1.7 billion market cap.