- From streaming services to weekly meal deliveries, the last decade has seen a mammoth shift towards a subscription-based economy

- These businesses rely implicitly on understanding customer relationships can’t typically be quantified with traditional accounting measures

- Among the company of Netflix and Xero (XRO) is software provider PayGroup (PYG) which provides human capital management and payroll services

- PYG relies on Annual Recurring Revenue to offer investors clear insight into its growth and revenue stability

- PayGroup shares are trading at 51 cents in a $58.6 million market cap

From myriad of streaming services to weekly meal deliveries, the last decade has seen a mammoth shift towards a subscription-based economy.

According to a report by think tank Subscribed Institute, subscription-based business revenue has grown 437 per cent over the last decade, six times faster on average than S&P 500 listed companies.

Even businesses that have long used traditional product or services exchanges are considering ways they benefit on a market gearing towards “access over ownership”.

Characterised by consumers with a low tolerance for perceived poor service and a trigger happy attitude when it comes to cancellation, it’s crucial that companies operating in this space have the right performance measures to maintain long term relationships with their customers.

A measure for success

Annual Recurring Revenue (ARR) has been the metric of choice for some of the world’s leading subscription services.

From Netflix to Apple Music and Adobe to Xero (XRO), companies under the subscription model banner are choosing ARR as a way to convey performance in an area that is fundamental to the success of their businesses.

Software provider and keen adopter of the ARR metric, PayGroup (PYG), affirms the measure provides investors with a sense of confidence in a company’s forecasted revenue and growth trajectory.

Just as revenue does for a traditional exchange, ARR is a way for companies to not only put a tangible value on the recurring revenue of its subscription income but gain insight into the calibre of its consumer relationships.

This is particularly the case with software businesses. These rely on leveraging customer loyalty in ways that can’t be quantified with traditional accounting measures, which PayGroup affirms leads to long relationships and enhanced up-selling opportunities.

Through its payroll solutions and scalable human capital management software, PayGroup processes more than six million payslips in 40 countries across 2100 customers per annum.

While it maintains numbers are integral to its operations, Chief Executive Officer Mark Samlal said it is relationships that drive subscription-based businesses.

“When we sign a client, we aim to sign them for life.”

PayGroup Chief Executive Officer, Mark Samlal

“Our ability to provide them with payroll and mission-critical services gets us through the front door, and our focus on long term relationships provides the foundation for further growth.

“Pleasingly, this is reflected by our 99 per cent customer retention rate and increasing share of customer wallet.”

The growing cloud-based accounting software provider said it is grounded in the rapidly expanding Southeast Asian workforce, and relies on annual recurring revenue to determine how successfully its approach to reaching enterprises in this market have been.

This includes the rate businesses are bringing paying customers on board, upgrades, downgrades, lost customers and importantly, renewals.

Ultimately, ARR acts as a “health check”. Stagnant annual recurring revenue might indicate, as an example, that a company isn’t reaching new customers or converting them to paid users.

Investors are not likely to see ARR on a profit and loss statement, but PayGroup affirms its a metric that is crucial for business and finance professionals to monitor as the subscription-style businesses cement themselves into the economy.

The rise of subscription services

PayGroup Chief Executive Officer Mark Samlal attributed the growth of software subscription services to several reasons.

“Customers want to sleep at night knowing they are protected from key risks such as the recent underpayment scandals engulfing corporate Australia,” Mr Samlal said.

“They want proven, trusted performers who they can depend on, and as such are willing to agree to subscription-style contracts for this protection.

“Recognising this trend, we offer our clients three-year contracts with automatic renewals, which provides surety in our future cash flows and delivers our shareholders added value, as they know our future prospects are de-risked, and our revenues are reliable.”

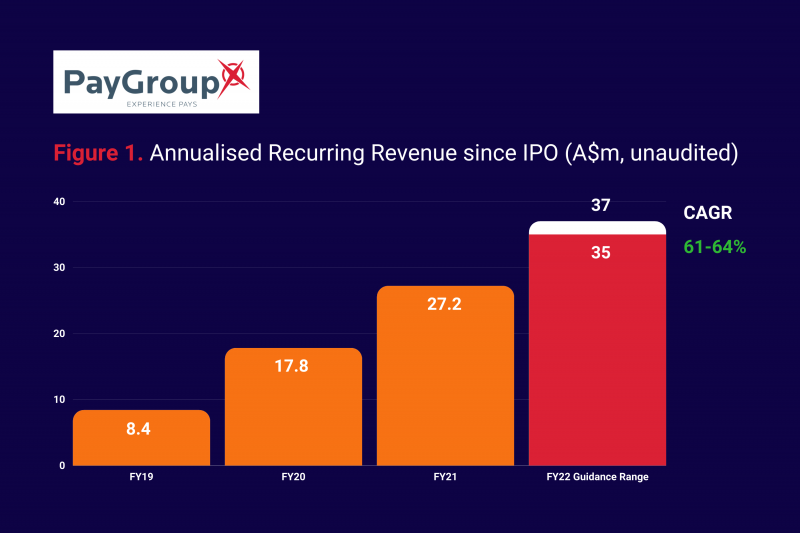

The company is looking to book $35 million to $37 million in ARR according to its latest unaudited FY22 guidance as it remains focused on executing a “pipeline of opportunities” in the Asia Pacific region.

With a number of strategic acquisitions under its belt, the company said it is looking to capitalise on significant demand for its payroll solutions and high margin human capital management software.

By providing annual recurring revenue, PayGroup affirms investors can gauge a clear insight into a company’s growth, stability in revenue and be granted an element of reassurance as the company progresses.

PayGroup shares were trading at 51 cents in a $58.6 million market cap at the open of market on Wednesday, August 18.