- Vection Technologies (VR1) trades sideways after the company said it had continued to grow its total contract value (TCV) over the 2022 financial year.

- As of November 17, Vection’s current TCV is around $9 million — an 80 per cent increase compared to the September quarter

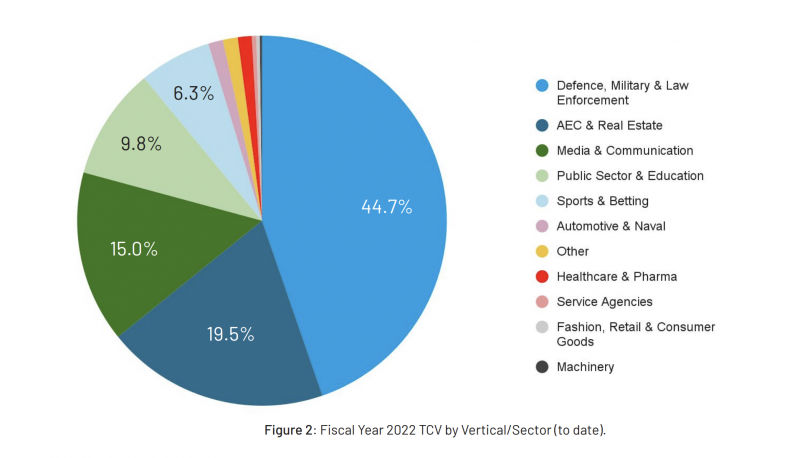

- On a sector-by-sector basis, 44.7 per cent of Vection’s TCV comes from the Defence, Military and Law enforcement sector

- Additionally, Vection notes that over 8.4 million unlisted options have been exercised for just over $951,000, bringing its total cash in the bank to approximately $7.8 million

- On the market today, Vection is in the grey and trading at 18 cents per share

Vection Technologies (VR1) shares are trading sideways today after the company said it had continued to grow its total contract value (TCV) over the 2022 financial year.

The real-time software company said as of November 17, its TCV was around $9 million — an 80 per cent increase compared to the September quarter.

Defence, Military, and Law remains the strongest sector for company TCV, accounting for 44.7 per cent of Vection’s contract value. However, the company said further suite adoption in the Media and Communications sector, which now accounts for 15 per cent of its contract value, had helped drive the December quarter TCV growth so far.

Vection expects individual sales composing the FY22 TVC to be completed, with varying dates, by the end of March 2022.

“The company looks forward to updating the market on further TCV developments as they materialise,” Vection told the market.

Additionally, Vection has noted that over 8.4 million unlisted company options have been exercised for about $951,277, bringing its total cash in the bank to roughly $7.8 million.

On the market today, Vection was in the grey and trading at 18 cents per share at 2:12 pm AEDT.