- Mineral processing and consulting company Elmore (ELE) enters a trading halt ahead of a capital raise

- Currently, it is not known how much the company is aiming to raise or where the funds will be spent

- Under the halt, company shares will be paused until Tuesday, August 16, or when further information has been released to the market

- Shares in Elmore halted at 3.4 cents on August 12

Elmore (ELE) has entered into a trading halt ahead of a capital raise.

There aren’t currently any details on how much the company is aiming to raise or how it plans to spend the money.

Under the halt, company shares will be paused until Tuesday, August 16, or when further information has been released to the market.

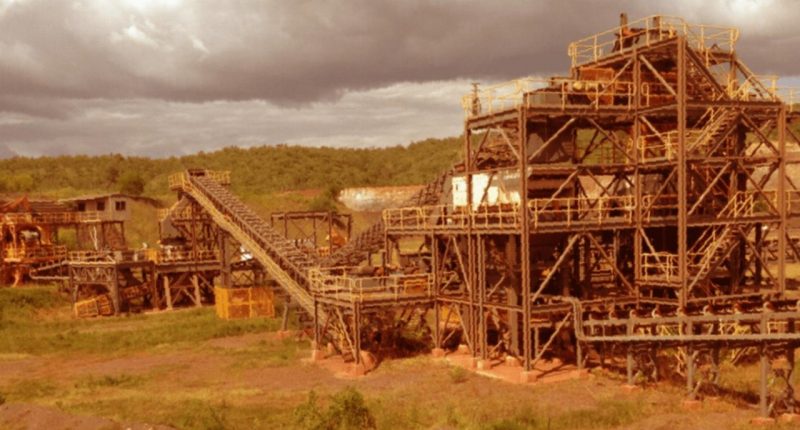

The company is a mineral processing and consulting company with a focus on gold, iron, and other minerals that are processed in a similar manner such as base metals, silver and tungsten.

In July, Elmore purchased the Peko project in the Northern Territory for $30 million via a vendor finance agreement which allows the company to widen its focus from minerals processing to known and potential open pit and underground mineralisation.

As part of the contract, Elmore will pay $30 million to buy the NT-based project and will also guarantee the performance a pre-existing royalty agreement between the ICA group and its retiring shareholders, Peko Gold Lending, to receive a total of 20,000 ounces of gold.

Following the purchase, the company had struck an ore sales agreement with Hong Kong-based Royal Advance to ship high-iron concentrate magnetite product to China.

The deal will cover the first two shipments from the project, and Peko has the option to extend it out to 12 months.

Shares in Elmore halted at 3.4 cents on August 12.