- DY6 Metals (ASX:DY6) has hit high-grade heavy REEs on-site its project in Malawi, East Africa

- This comes as China has banned the export of downstream refining technology

- DY6 is interested in dysprosium, yttrium and terbium

- Shares last traded at 10 cents

As China places further bans on exports of rare earth technology to maintain dominance in the rare earth element (REE) sector, ASX-listed companies like DY6 Metals (ASX:DY6) are suddenly looking more important than ever before if critical rare earths such as dysprosium or terbium are next.

At the same time, a “government-led crackdown” on unsustainable mining operations is shrinking domestic production as 40 per cent of all HREEs are sourced from Myanmar, according to DY6 CEO Lloyd Kaiser.

DY6 is a heavy REE (HREE) explorer operating in the East African nation of Malawi, near Tanzania – that latter country being one of the African continent’s only true economic power players.

For the uninitiated, HREEs specifically relate to a class of REEs that contains eight elements. Those are: dysprosium, yttrium, terbium, holmium, erbium, thulium, ytterbium, yttrium and lutetium.

Explaining heavy rare earths

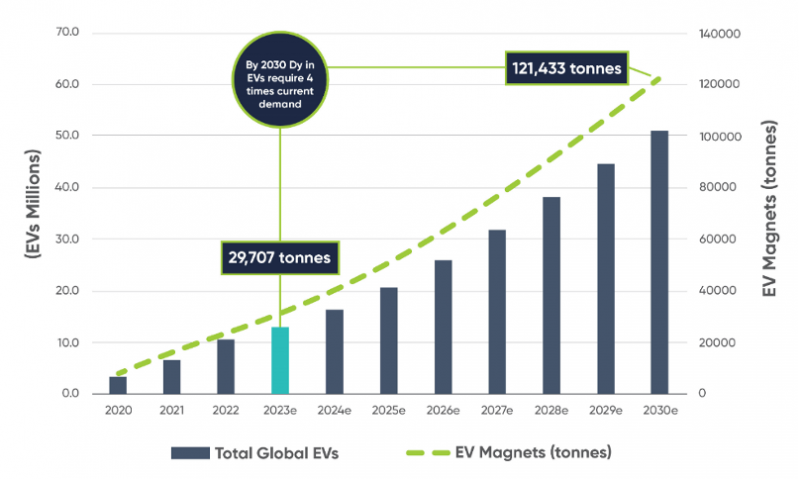

All of these obscure minerals have their uses, but DY6 is principally interested in dysprosium (Dy) and terbium (Tb) – critical to high-temperature magnets used in EVs and critical for the ongoing global green transition challenge.

China dominates the market for these two minerals, responsible for 90 per cent of global Dy and Tb oxide production and supply.

At the same time, despite this market dominance, the supply of Dy & Tb is insufficient to support forecast demand as the EV market could explode in the future.

But heading into the new year, the company has renewed enthusiasm for a big year of potential gains.

Late 2023 drill hits prove potential

Hitting high-grade HREEs on-site its Machina project late last year – and tech metal niobium – DY6’s Geotech team is gearing up for a busy 2024 with fresh evidence of a mineral system under their belts.

In late December, DY6 highlighted the following from diamond drilling:

15.1 metres @ 1.01% TREO, 0.36% Nb2O5 from 23.9m (3.71% DyTb/TREO) incl. 4m @ 1.75% TREO, 0.63% Nb2O5 from 33m (3.8% Dy/Tb/TREO) (MDD007).

Geopolitical situation report

Two big geopolitical governmental actions shook up commodity markets in the dying days of 2023.

The first was the USA’s ban on imports of uranium from Russia, which helped the nuclear energy commodity jump higher on its already established recovery.

Then, much closer to Christmas, there was a move that a lot of people missed – China banned exporting any technology related to rare earths refining from being exported.

Many who were keeping an eye on things mistook this for a REE ban wholemeal – but that’s not quite the case.

What we got instead was the Chinese government basically telling producers: ‘Make sure downstream purification technology stays with us’.

While not quite a full-on commodity disaster, the move does highlight how Chinese dominance in the REE sector could be further weaponised (though, given how it’s currently going, the country probably can’t afford to stop sales).

Many critical minerals were already being prioritised for removal from global supply chains by most world governments long before the uranium or REE developments late last year, but they are sobering reminders of what can go wrong when two countries at odds decide to make their fight economic.

Of course – that could be an upside opportunity.

DY6 shares last traded at 10 cents.