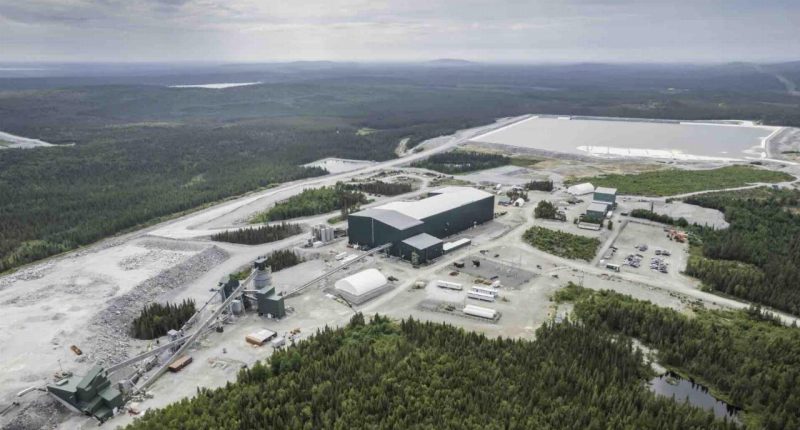

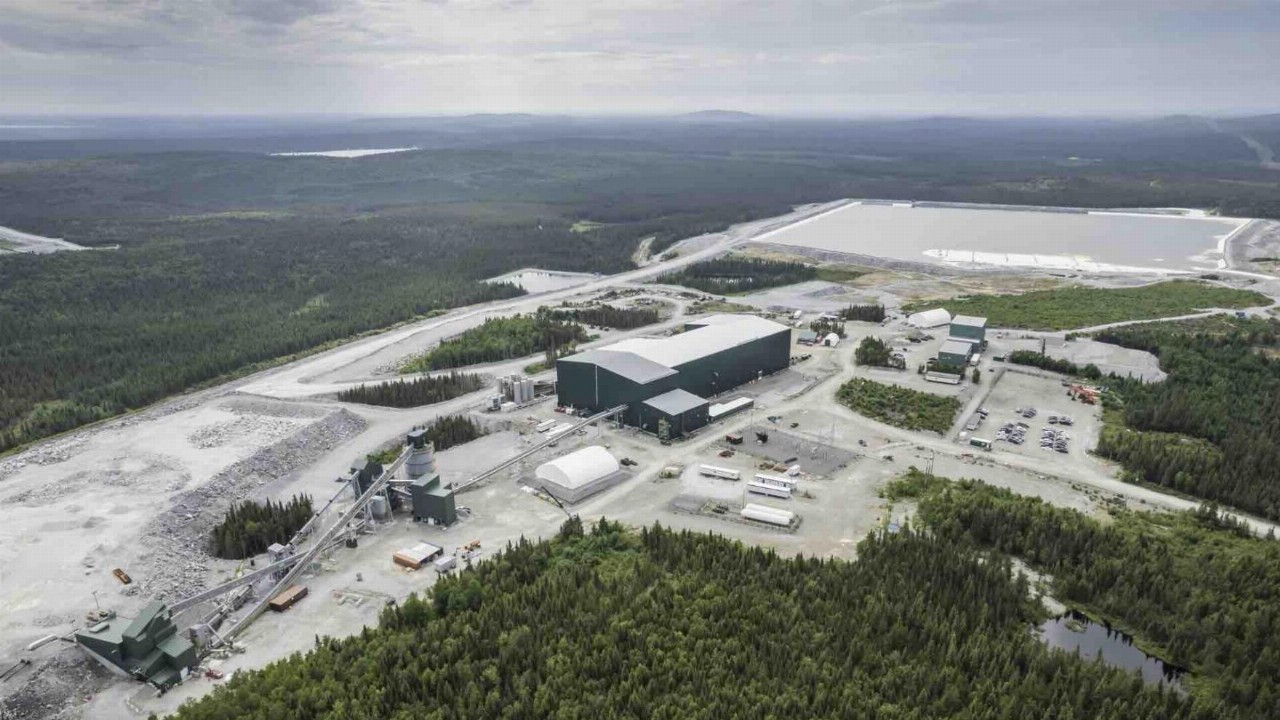

- Sayona Mining (ASX:SYA) revealed the findings of its DFS for the Moblan lithium project in northern Quebec, Canada

- The DFS outlines an annual production rate of 300,000tpa of spodumene concentrate over a 21-year LOM

- This is utilising open-pit mining with estimated ore reserves of 34.5 million tonnes at a grade of 1.36 per cent lithium oxide

- Sayona last traded at 6.2 cents

Sayona Mining (ASX:SYA) has revealed the findings of its definitive feasibility study (DFS) for the Moblan lithium project in northern Quebec, Canada.

The project, owned 60 per cent by Sayona and 40 per cent by Investissement Québec, demonstrates robust financial metrics and potential for long-term profitability.

The DFS outlines an annual production rate of 300,000 tonnes per annum (tpa) of spodumene concentrate over a 21-year life of mine (LOM), utilising open-pit mining with estimated ore reserves of 34.5 million tonnes at a grade of 1.36 per cent lithium oxide.

“We are delighted by the results of this DFS, which demonstrate that the Moblan lithium project is an incredibly strategic and valuable asset for Sayona, representing one of the single largest hard rock lithium resources in North America,” SYA Interim CEO James Brown said.

The process plant’s feed rate is set at 4,800 tonnes per annum (tpa), with an average LOM recovery of 74.7 per cent and spodumene concentrate grade at 6 per cent lithium oxide.

Key financial indicators include a post-tax Net Present Value (NPV) of A$2.495 billion, net cash flow of A$6.8 billion from LOM net revenues of A$16.3 billion, a post-tax Internal Rate of Return (IRR) of 34.4 per cent, and a payback period of 2.3 years.

Sayona last traded at 6.2 cents.