Port Adelaide AFL star, turned media personality, Warren Tredrea talks with co-host Jack Hudson on The Big Deal this week on the revenues of the largest sporting clubs in Australia.

Breaking down the Australian sport commercial revenue

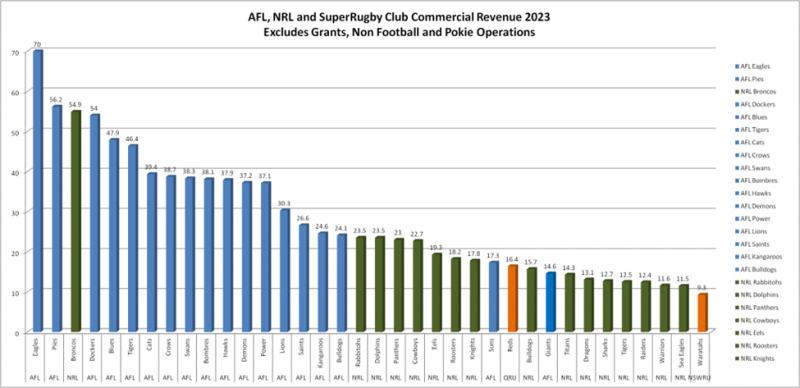

The AFL is on top of the world, taking out grants, non-football and pokie operations when ranking against NRL and SuperRugby clubs.

The West Coast Eagles, despite a wooden spoon season, raking in $70 million in revenue.

Collingwood is not far behind with $56.2 million, while the NRL’s best side sits third overall, with the Brisbane Broncos coming in with $54.9 million.

The NRL is a bit behind all but the AFL’s newest clubs, Gold Coast and GWS Giants.

For SuperRugby, the Reds sit behind the Suns with $16.4 million.

Contracts, Crows & Curtin – oh my!

Will Hayward has signed on with the Sydney Swans for five-years, believed to be on $600,000 a season, which is less than what other clubs, particularly Carlton and Adelaide, were willing to pay.

Meanwhile, GWS defender Sam Taylor and Brisbane midfielder Hugh McCluggage have both signed on with their respective clubs for a further seven years.

The Crows have missed out on stars, having failed to pry both Harrison Petty and Clayton Oliver out of Melbourne last season, and now Hayward.

They are also currently chasing Harry Perryman from the GWS Giants, with an offer believed to be around $800,000 a season.

However, they might need to keep an eye on the exit door, with first-year draftee Dan Curtin rumoured to be eager on a return to Western Australia. However, the Crows hold all the keys with the young swingman.

NRL’s Origin success

State of Origin is a jewel in the crown of the NRL and for the Nine Network, with Game 1 reaching a national TV audience of 5,306,000, a total TV audience of 3,436,000 and a BVOD audience of 760,000.

It was also the highest rating Game 1 since 2016 in a massive win for the NRL and Nine.

Major League Cummins

Aussie skipper Pat Cummins has signed a four-year deal with the San Francisco Unicorns in Major League Cricket.

Cummins’ deal is believed to be at least seven-figures, and joins a raft of Aussies in the fledgling competition including Jake Fraser-McGurk, Glenn Maxwell, Travis Head and Steve Smith.

The MLC has also gained List A status for its season season, and is now recognised as an official Twenty20 league – which allows records to count towards official T20 stats.

Wildcats ownership bid

A non-binding indicative offer from the MT Arena Capital Investment Pty Ltd has been made to Sports Entertainment Group Limited (SEG) for a 90 per cent stake of NBL giant, Perth Wildcats.

The offer is $36 million, which is a significant increase on the $8.5 million Craig Hutchison paid for the franchise in 2021.

The SEN owner sold off a 3.75 per cent stake in SEN Teams for $1.5 million faced financial struggles over a $20 million loan owner to the Commonwealth Bank.

Melo joins the Next Stars

In another huge coup for the NBL, NBA legend Carmelo Anthony has signed on to lead an expansion of the Next Stars program, which has so far produced eight NBA draftees.

With the deal, he’ll also have some ownership in a future NBL franchise.

It’s similar to the deal which lured Andrew Bogut back from the US to join the Sydney Kings on a two-year deal.

Breaking down Mbappe’s Madrid move

In the worst kept secret in world football, French superstar Kylian Mbappe has left Paris Saint-Germain on a free transfer for Spanish giants and reigning Champions League winners Real Madrid.

He has signed a five-year deal, worth A$24.5 million a season, which includes a massive $245 million signing bonus, paid over five years.

The total package is A$351.5 million, which is still a pay cut from his PSG deal and a lot less than the offer put to him by Saudi Arabian team Al-Hilal a year ago.

It’s a fairytale move for the boyhood Madrid fan, which had social media support from club greats Sergio Ramos and David Beckham.

However, Portuguese superstar and former Real Madrid legend Cristiano Ronaldo also offered his support, and in the meantime, broke the record for the most liked social media comment ever – 4.3 million ‘likes’.

Madrid took home $21 million USD for the Champions League triumph over Borussia Dortmund last week, who received $16.12 million USD as runners-up.

Manchester City to sue Premier League

Reigning English Premier League champions Manchester City have launched legal action against the Premier League.

City has accused the Premier League of ‘discrimination’ as the battle between the two bodies begins to heat up over the league’s associated party transaction (APT) rules.

The Premier League had tightened rules regarding APTs, relating to clubs signing sponsorship deals with club-associated companies.

City’s rapid rise since the end of the 2000s has been benefited by sponsorships, notably Etihad Airways, which is City’s stadium and shirt sponsor.

Separately, City are facing 115 Premier League charges for alleged breaches of regulations and financial rules between 2009 and 2023, which they deny.

The hearing is set for November.

Champion sold for $1.2 billion

HanesBrands has sold sportswear brand Champion to Authentic Brands Group in a US$1.2 billion deal.

Shares of HanesBrands surged 15.6 per cent in premarket trading and the deal could reach up to $1.5 billion through additional contingent cash.

Ocon to depart Alpine

The fallout from the Monaco Grand Prix is apparent, with Alpine set to end its five-year association with Esteban Ocon at season’s end.

Ocon was believed to be earning US$6 million this year, while Carlos Sainz, who has been linked with the vacant seat, has been earning a US$12 million.

Both are well short of Lewis Hamilton at Mercedes with $45 million and Max Verstappen at $55 million at Red Bull.

Sports brand on brink of collapse

Le Coq Spotif is in strife, and right when it’s set to deliver the French Olympic team with 370,000 uniforms for the Paris Olympics.

The company is the main supplier for French athletes at the Pairs games, but on Monday, shares in Le Coq’s Swiss holding company Airesis were suspended on the Swiss stock exchange after it missed a deadline to publish its 2023 financial results.

They had already delayed issuing them in April.

The company had a revenue of more than $230 million USD, but ongoing costs have put them in a tough spot.

Le Coq reportedly required a $10.8 million USD state-backed loan at the start of last year to help.

Jordan breaking records…again

And finally, a 2003-04 Upper Deck Ultimate Collection autographed Michael Jordan Logoman card – 1/1 – sold for $2.928 million through auction company Goldin.

It broke records as the most ever paid for a Jordan card and Logoman cards are usually limited to one copy, featuring the NBA logo cut from a game-used jersey.

It was a PSA graded 10 – making it perfect and it had been ‘long lost’ before it surfaced with PSA in 2022.

The record is still the 1952 Topps Mickey Mantle which sold for $12.6 million in August 2022.

For more sports business news and insights, subscribe for free at www.thebigdeal.au.

Disclaimer: The information provided by The Big Deal does not constitute personal financial/product/investment advice. The information provided is of a general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice. The Big Deal recommends that you obtain your own independent professional advice before making any decision in relation to your particular requirements or circumstances. Past performance of any product discussed is not indicative of future performance. We may at times refer to third parties. Details of these third parties have been provided solely for you to obtain further information about other relevant products and entities in the market.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.