In this edition of Moves and Moods, we reflect on the key changes in the month just gone and our view on the outlook to come.

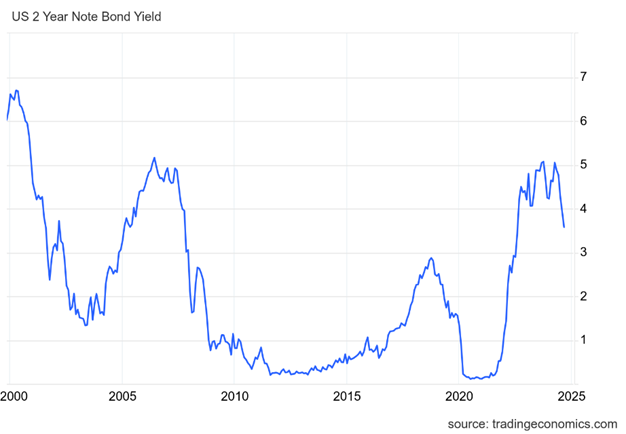

Firstly, the Federal Reserve in the USA made a 50bps jumbo interest rate cut, which set off a risk on rally in many markets.

While there remains risk from the US slowdown, the loosening of rates has set off a great rotation in global markets to prepare for a weaker US dollar.

This signals a period where the US economy is slowing, but global liquidity is loosening.

Rates are going down, Figure 1.

There are risks of a US recession.

However, emerging market economies that were squeezed by high interest rates, will now see looser conditions.

Secondly, the People’s Bank of China (PBOC) finally stepped up with a package of stimulus measures to support recovery.

The market reaction for China sensitive stocks was immediate.

Luxury stocks in Europe soared on a possible bling-led recovery on the China High Street and Australian iron ore miners shot the lights out, went through the ceiling, flew across the nation, and ruined a Sydney/Perth/Brisbane/Melbourne/Adelaide/Darwin day for those caught short!

Investment Opportunity

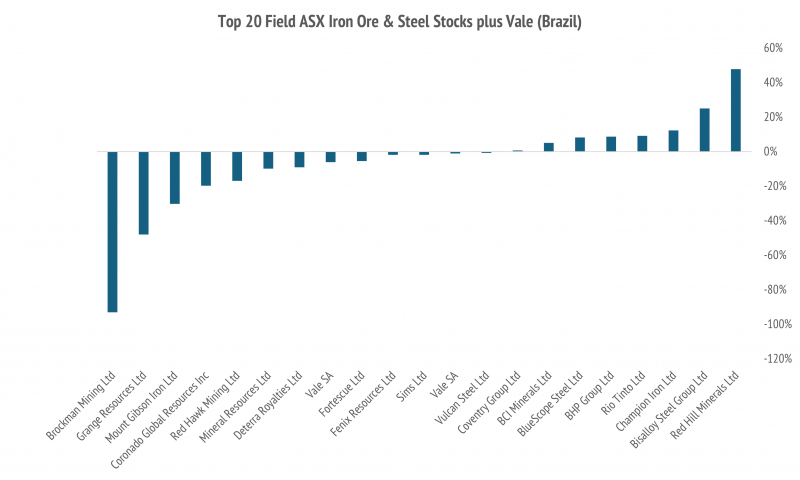

Using our trusty unrealized profit and loss indicator, we can estimate which investors have been made whole on their positions, by the recent market move, and which investors are still nursing losses.

The picture for the top ASX-listed names, along with Brazil-listed major Vale is improving, Figure 3.

The steel makers Bluescope Steel (ASX:BSL) and Bisalloy (ASX:BIS) are doing well.

This is due to cheaper steelmaking input costs, and their largely Western market exposure.

Note that Fortescue (ASX:FMG) and Mineral Resources (ASX:MIN) are still in mild bear territory, with investors nursing unrealized losses of -5.5% and -9.9% respectively.

Look for a test of confidence at $21.26 for FMG and $54.51 for MIN.

Stocks investors are favouring now

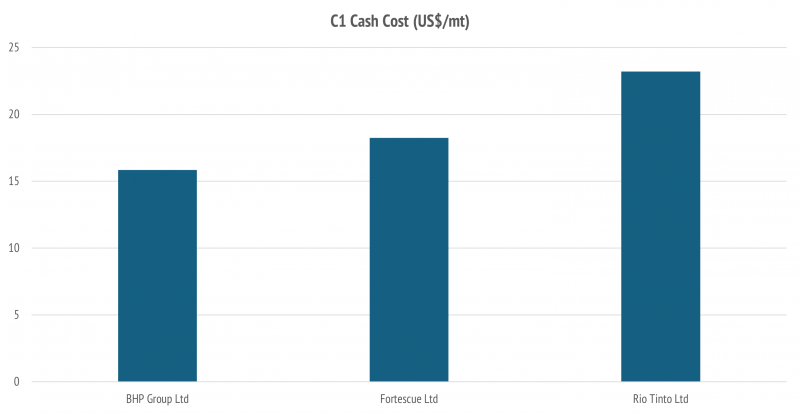

Investors still seem to be favouring BHP Group (ASX: BHP) and Rio Tinto (ASX: RIO).

The cash costs for BHP are the best, followed by Fortescue and Rio, Figure 4.

Expect the smaller names to perform in line with their breakeven costs once the iron price rallies out of the danger zone below $US100/mt.

Move for This Mood

We have just been through a major market panic over the iron ore price falling back towards the Australian Treasury forecast of $US60/mt.

Never say never, but our recent research suggests that this price is too low.

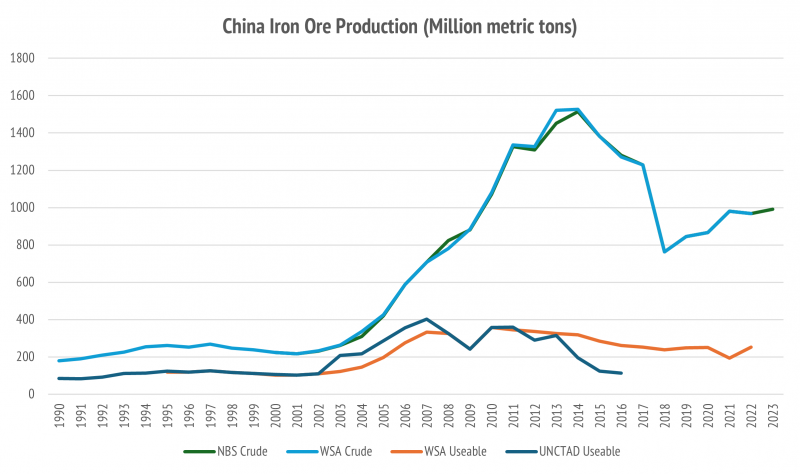

The key reason is that China is perhaps more dependent on imported iron ore than may have been previously thought.

Furthermore, our estimates of the average grade of crude ore in China have been revised down from a former 30% to a figure more like 15%.

The reason for this change lies in a reporting anomaly buried in the National Bureau of Statistics (NBS) data from China.

The two steep lines below show the raw data from Chinese domestic iron ore production from the NBS, and the World Steel Association (WSA).

The lower lines restate this to a useable ore grade (62% Fe). This adjustment was first carried about by UN agency UNCTAD, and later refined by the WSA, Figure 5.

Don’t be giving up on China yet, because of the stimulus, and don’t be giving up on the lucky country trading partner from which it buys the bulk of its iron ore requirement.

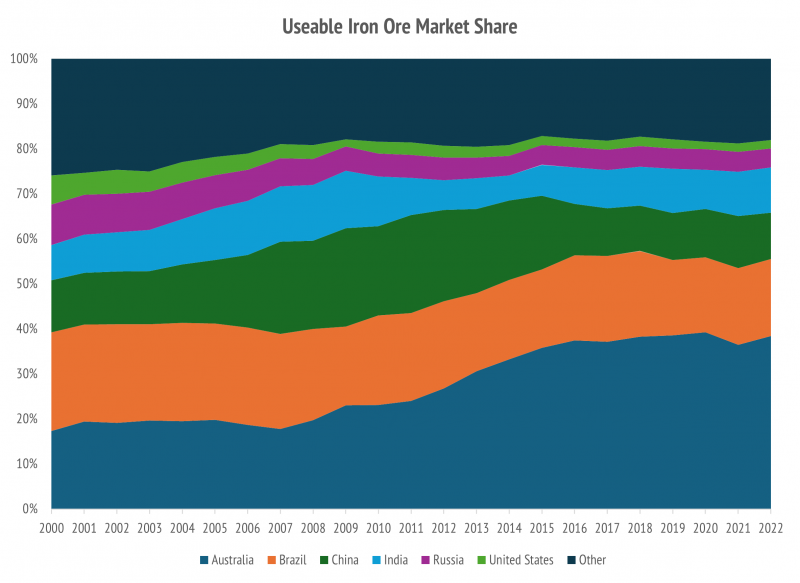

You see, because of the above data anomaly the official market share of Chinese ore for world use looks like 40%.

Once you adjust properly for the lower grade it is more like 10%. The Chinese need our ore, and we could do with the cash if we are sensible enough to put the stuff on a boat and sell it to them.

The global Australian iron ore market share is considerably more robust when you make these adjustments, Figure 6.

We continue to like the majors BHP Group and Rio Tinto. The first for lower costs, and the second for its superior growth exposure and the geopolitical hedging provided by their Simandou project.

Industry geopolitics

The geopolitics today is fraught. The USA is clearly pressuring Australia to not sell minerals to China, which is fine for them, but bad for us.

Rio Tinto, in Guinea, West Africa, and Vale, in Brazil, provide natural hedges to the risk that Australia loses its greatest and most valuable export market.

Disclaimer: This article contains information and educational content provided by Jevons Global Pty Ltd, a Corporate Authorised Representative (AR1250727) of BR Securities Australia Pty Ltd (ABN 92 168 734 530) which holds an Australian Financial Services License (AFSL 456663). The Market Online does not operate under a financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given.

The information is intended to be general in nature and is not personal financial advice.

It does not take into account your personal financial situation or objectives and you should consider consulting a qualified financial professional before making any investment decision.

All brands and trademarks included in this report remain the property of their owners.

The material provided in this article is for information only and should not be treated as investment advice.

Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.