There are thousands of altcoins in the crypto market, and while some have limited worth, some cryptocurrency projects provide genuine value and are about solving real-world problems.

Join us for this weekly, four-part series of articles on HotCopper, where we’ll explore various categories of altcoins and why they’ve been developed.

Advances in crypto can be compared to progress in other everyday tech applications.

For example, ride-sharing apps like Uber made transportation more convenient by eliminating the need to call or wait for a taxi, and, online banking allowed us to send and receive money from our phones without ever visiting a branch.

Similarly, most cryptocurrencies have specific uses and objectives that investors can evaluate to determine their potential.

Altcoins are not Bitcoin

Altcoins (short for ‘Alternative Coins’) refers to any coins that are not Bitcoin.

Many definitions, however, widen that to: ‘Altcoins are any coin or token that isn’t Bitcoin or Ethereum’. That’s because Ethereum too, has a huge market capitalisation.

It’s already widely used around the world and is constantly evolving and improving.

In the early days, cryptocurrency and blockchain tech primarily served one purpose: To facilitate transactions on a blockchain.

As the industry evolved and matured (and continues to do so), there’s an increasing number of crypto categories for investors to understand.

The use cases have significantly broadened thanks to the flexible and secure nature of blockchain technology.

So, in this four-part series, we’ll cover the following Altcoin categories:

Part 1: Crypto Infrastructure

- Layer 1 blockchains: The most popular type of blockchain, providing a foundation for applications to be built above.

- Layer 2 networks: Networks built on top of Ethereum to reduce congestion and facilitate quick transactions with low fees.

Part 2: Emerging Technologies in Crypto

- Artificial intelligence (AI) and crypto: Cryptocurrencies that intersect AI technology with blockchain.

- Decentralised Physical Infrastructure (DePIN): Solutions for building real-world infrastructure through blockchain technology.

Part 3: Community-Driven & Entertainment Crypto

- Memecoins: Highly speculative cryptocurrencies inspired by internet memes.

- Crypto gaming: Blockchain technology powering online video games, including in-game economies and currencies.

Part 4: Redefining Finance & Tokenisation

- Decentralised finance (DeFi): Enables financial activities like lending and trading on the blockchain without traditional banks.

- Real World Assets: Assets represented on blockchains through tokenisation.

Part 1: What are Layer 1 Blockchains?

Layer 1 blockchains are the core networks in the crypto space, acting as the foundational platforms for various applications and digital assets.

Ethereum is the most well-known and widely used Layer 1, known for its high security and vast ecosystem.

However, Ethereum’s popularity also makes it slower and more expensive to use during times of high demand.

Other Layer 1 blockchain, like Solana, Avalanche, and SUI, offer different benefits, such as faster transaction speeds and greater scalability.

These networks can support a wide range of applications, including decentralised finance (DeFi), gaming and artificial intelligence (AI).

Some Layer 1s are optimised for specific purposes, such as for the gaming-focused chain Ronin (RON) or AI-focused chain Bittensor (TAO).

Layer 1 cryptocurrencies for investors to watch

Ethereum

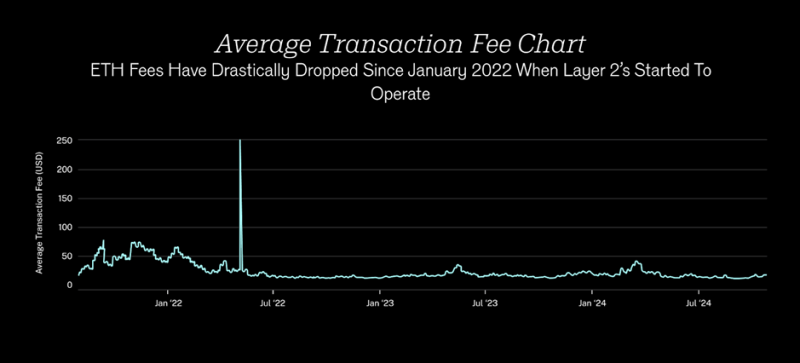

Ethereum (ETH) is the top Layer 1 blockchain by many measures, such as developer activity, total value locked, user fees and stablecoin supply. However, its popularity has led to high demand, making it a victim of its own success.

Despite its strengths, Ethereum has struggled with scalability, leading to very high user fees during periods of heavy network use.

Solana

Solana (SOL) is an L1 blockchain optimised for fast and cheap transactions while maintaining a sufficient level of decentralisation.

It has made great strides in 2023 and 2024, and has even surpassed Ethereum in overall network activity on a number of occasions.

Sui

Sui is a new layer 1 blockchain that was founded by former Meta (Facebook) employees. Since going live in May 2023, Sui has shown strong early adoption and has gained traction launching distinct products like SuiPlay, a handheld gaming device (similar to PSP or Nintendo Switch).

What are Layer 2 networks?

Layer 2 networks are built on top of existing Layer 1 blockchains, primarily to address issues like slow speeds and high transaction costs, like we’ve mentioned with Ethereum.

Layer 2 solutions, such as Arbitrum and Optimism aim to solve these problems by processing transactions more efficiently.

They reduce congestion on the main Ethereum network, offering lower fees and faster speeds without compromising security. By doing so, Layer 2 networks make it more practical for users and developers to interact with Ethereum-based applications.

And that helps restore Ethereum’s value proposition by making the network more user-friendly and accessible.

Swyftx: Start your crypto investing journey

Swyftx is an Australian-based crypto exchange with over 750,000 users. Start your investment journey off with $20 of free Bitcoin when you sign up and verify.

We’ll be back next week with Part 2, looking at emerging technologies in crypto.

Disclaimer: The information provided by Swyftx is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets.

It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice.

Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results.

Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.