Vysarn (ASX:VYS) was approaching the cusp of posting +100% 1Y returns intraday Wednesday with the stock price hitting a record high above 80cps for the first time – closing (pre-settlement) at 81cps.

Listen to the HotCopper podcast for in-depth discussions and insights on all the biggest headlines from throughout the week. On Spotify, Apple, and more.

That isn’t hard to find right now (a stock up +100% YoY) but what’s most interesting, perhaps, is what Vysarn does. It doesn’t operate in the tech space, it certainly isn’t doing anything with Artificial Intelligence (or at least not that the company harps on about), and it isn’t a biotech either.

And get this: the company doesn’t mine anything. Well, sort of. Because what Vysarn actually does? it’s in the water industry.

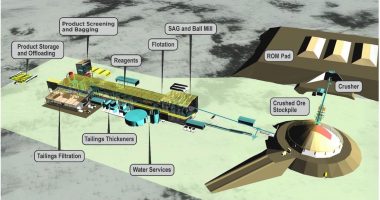

For a long time, Vysarn has been a water engineering and hydrogeological services company. It has a network of subsidiaries that cover wastewater management, an engineering consulting arm and outright engineering arm, as well as pump testing and aquifer recharging.

But Vysarn has kicked off another subsidiary in relatively recent history: its company Vysarn Asset Management (VAM) which is aiming to hold and sell water in northern West Australia.

The long-term implications here may or may not become more obvious when one considers a term that starts with ‘C’ and rhymes with ‘Limate Change.’ Because in a world where drought is more probable than not, more often, and for longer – it will be water that becomes gold, assuming natural reservoirs become increasingly unpredictable, or, unreliable. (Read: declining rainfall).

“VAM intends to target investment opportunities in water, infrastructure assets and associated opportunities to control, own and toll water,” the company writes on its own website. So it’s not like this is something the company is being quiet about, necessarily, and it was the subject of an October 2023 ASX announcement.

That was when the company first began to take off. So if we ever see water wars in Australia, Vysarn could one day become part of a defence investing thematic. Just look at EOS to see the value there.

VYS last traded at 79.5cps.

Join the discussion: See what HotCopper users are saying about VYS and be part of the conversations that move the markets.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.