Smallcap Metals Australia (ASX:MLS) is confident its Canadian graphite development will be a perfect fit with Quebec’s new critical and strategic minerals strategy, the Australian explorer told investors on Wednesday.

Listen to the HotCopper podcast for in-depth discussions and insights on all the biggest headlines from throughout the week. On Spotify, Apple, and more.

The Quebec government’s new plan is focused on making the Canadian province a strategic hub for critical and strategic minerals, mainly by supporting the acceleration of materials projects and bolstering the development of a value chain, including infrastructure and partnering support.

The timely announcement comes as Metals Australia and its wholly owned Canadian subsidiary, Northern Resources, are progressing study programs for the Lac Carheil graphite (LCG) project in Quebec.

Those CY25 studies across the site include a new plan for an open-cut mine at the 2.8 million tonnes of contained graphite operation.

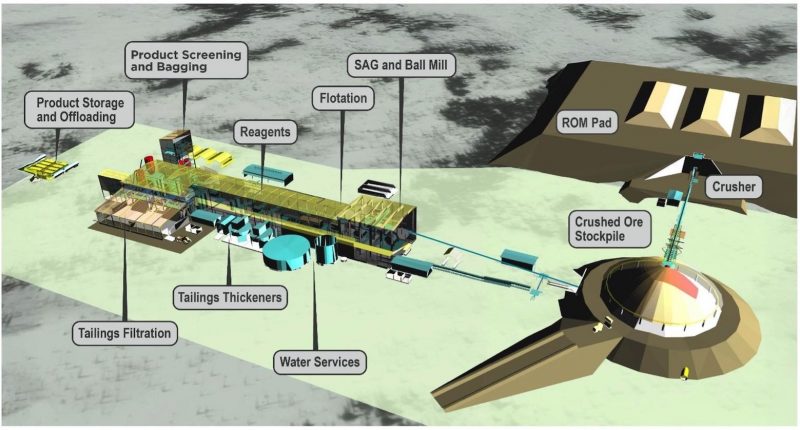

Elsewhere, Metals Aus’ engineering work product reviews are complete for the 100K tonne per annum flake graphite concentrate plant at Lac Carheil.

Metals Aus chief executive Paul Ferguson declared they’d made excellent progress across a wide range of work programs as it advances prefeasibility studies for the mine and flake graphite concentrate plant and a scoping study for the downstream BAM refinery. “Both plants are largely designed – with CAPEX and OPEX profiles being finalised,” he told investors in the update today.

“The new mine plan, based on the substantially enlarged resource, is also well advanced – as are the tailings and water management plans. This latter work, together with geochemistry analysis, will remain critical path work to complete the studies and is a function of efforts in 2025 to grow the project’s resource substantially.”

The mineral resource estimate is already 3.3 times larger than that used in the scoping study, with plenty of upside as it covers just 2.3km on one of 10 graphite trends over 36 km that have been mapped and sampled.

Metals has also made strong progress in investigating market options for the flake graphite concentrate; approximately 25% of large and medium flake is projected to be sold into high-value industrial markets in America and Europe. The remaining 75% of fine concentrate will become feedstock.

MLS – market cap $19.02M – held a steady 2.6c share price today.

Join the discussion: See what HotCopper users are saying about Metals Australia Ltd and be part of the conversations that move the markets.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.