- Ora Gold has upgraded its Mineral Resource estimate for its Crown Prince deposit in Western Australia

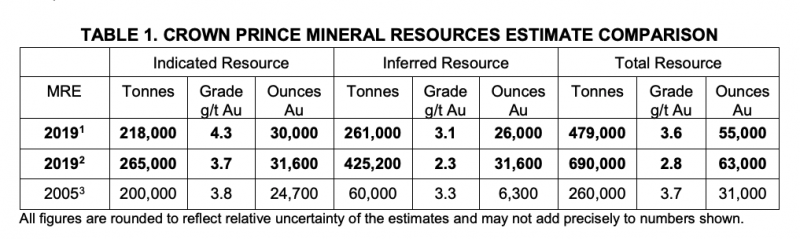

- Ora Gold now believes the total has increased to 479,000 tonnes at 3.6 grams per tonne for 55,000 ounces of gold at 1.2 grams per tonne cut off grade

- The company believes Crown Prince has a similar mineralisation style to high grade deposits – Great Fingall and Golden Crown in Cue, Western Australia

- Ora Gold is up 16.67 per cent on the Australian Securities Exchange and is currently selling shares for 2.8 apiece

Ora Gold has upgraded its Mineral Resource estimate for the Crown Prince deposit.

The company now believes the total has increased to 479,000 tonnes at 3.6 grams per tonne for 55,000 ounces of gold at 1.2 grams per tonne cut off grade.

A feasibility study has commenced supporting the development of an initial open pit based on near surface Indicated Resources of 218,000 tonnes at 4.3 grams per tonne.

Crown Prince is located about 18 kilometres north-west of Meekatharra in Western Australia on the Mt Clere Road. A mining lease application, ML51/886, has been submitted for the project and a mining proposal will be prepared based on the feasibility study.

The 2019 Mineral Resource Estimate (MRE) was undertaken by Ora Gold, consultants and Cube Consulting. Detailed information regarding input data and estimation criteria for the 2019 MRE are presented below.

“The 2005 MRE focussed on shallow mineralisation to a depth of 160 metre, while the 2019 MRE is estimated to a depth of 270 metre to include Ora Gold’s deeper drilling,” the company said.

“Note that the 2019 MRE is a combination of Indicated and Inferred Resources to 100m depth, which reflects the close-spaced drilling to that depth, and Inferred Resources for deeper mineralisation,” it added.

The company said that further drilling at the right time will outline the high-grade mineralisation below 270 metre depth.

It believes that Crown Prince has similar mineralisation style to high grade Great Fingall/Golden Crown deposits near Cue, Western Australia.

A feasibility study has commenced into the development of the Crown Prince deposit as an initial open pit followed by underground mining. An Ore Reserves estimate will be depending on the outcome of the study and prevailing economic conditions.

Ora Gold is up 16.67 per cent on the Australian Securities Exchange and is currently selling shares for 2.8 apiece at 3:45pm AEDT.