- Sydney-based technologist Airtasker (ART) boosted its shares by 98 per cent after debuting on the Australian Securities Exchange on Tuesday

- The company ended its first day on the market up 78.5 per cent after settling at $1.05 per share

- Airtasker is a ‘gig economy’ business — providing a web platform to outsource odd jobs ranging from manual labour to designing a website

- Co-founder and CEO, Tim Fung, saw his 12.7 per cent stake in the company valued at $52 million after the share price surge

- Airtasker is now valued at $255 million

Sydney-based technologist Airtasker (ART) closed its first day on the Australian Securities Exchange up by 78.5 per cent.

Its share price peaked at $1.16 (a gain of over 98 per cent), but eventually settled to $1.05 per share at the end of Tuesday’s session. Its initial issue price was 65 cents. The company is now valued at $255 million.

Airtasker is another business to join Australia’s ‘gig economy’ industry, among the likes of Uber, Ola, Uber Eats, Deliveroo, and Menulog.

But instead of hailing for a ride or having a meal delivered, Airtasker helps you outsource odd jobs.

Through an online and mobile marketplace, you can post an everyday task where workers will then bid on it and do the work for you for a price.

This can include anything from moving furniture to designing a website.

Source: Airtasker

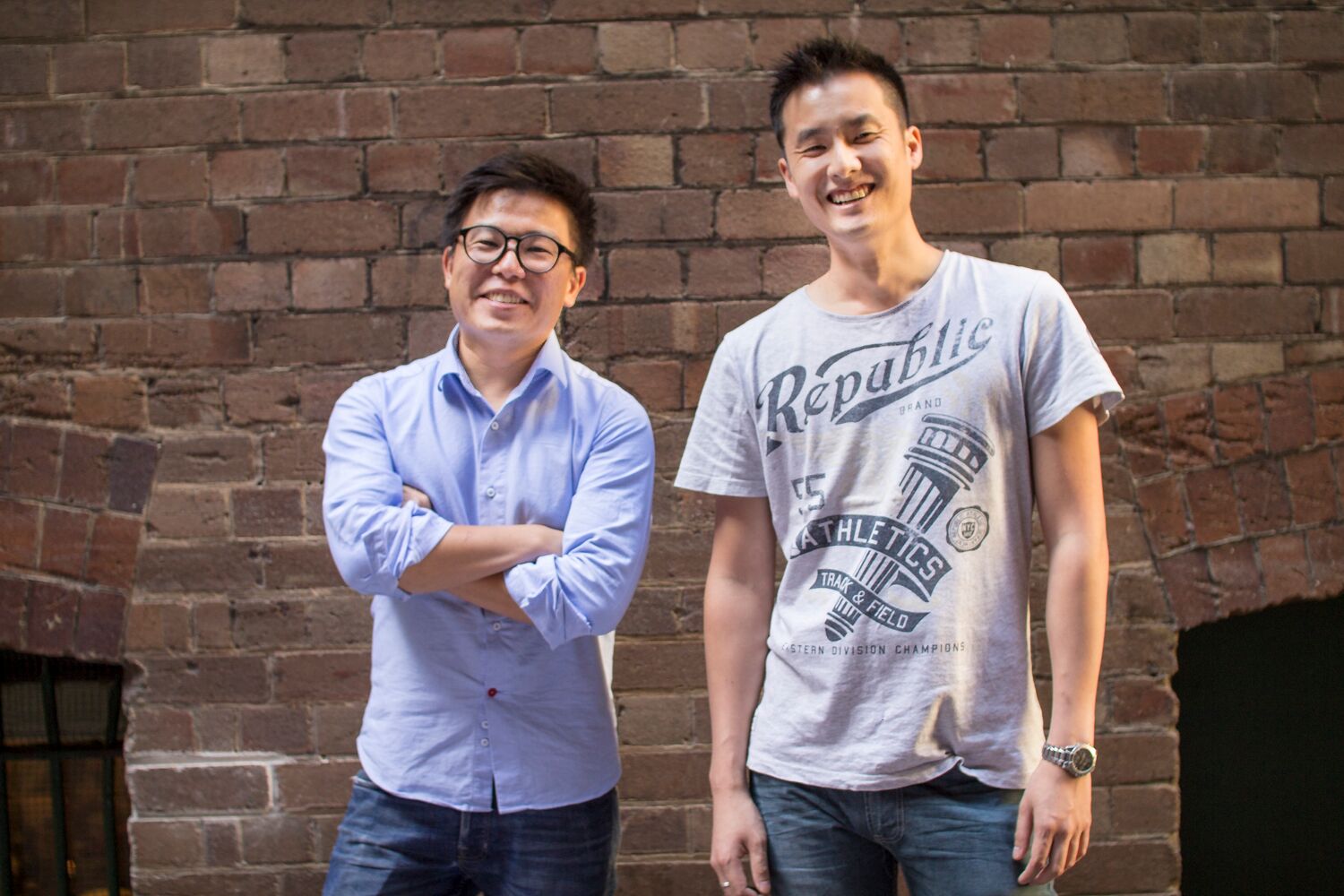

The company was founded by current CEO Tim Fung and Jonathan Lui in 2012. The two worked together at the mobile phone plan provider Amaysim.

Fung’s 12.7 per cent stake in the company hit a value of $52 million after Airtasker hit the ASX.

In the early wake of success, the CEO has stressed the importance of long term goals.

“I just want to make sure the focus is on the next five to seven years,” Fung said.

“I‘ve accepted that tomorrow morning when we walk back into the office I’m sure I’m going to see a few screens with the black, red and green charts, but the overarching thing is that our chairman, myself and many of our major investors and supporters, and our employees, aren’t selling anything today and we’re committed to the long term”.

Source: Airtasker

Airtasker Chairman, James Spenceley, shared similar sentiments.

“We’re feeling incredible,” Spenceley said.

“It’s a really great result. I haven’t really focussed too much on the share price, I think it’s up in the 90s, but it’s a good sign for tech businesses in Australia”.

Airtasker was due to debut on the ASX on Monday, but a human error paved the way for a Tuesday appearance instead.

“Things happen,” Spenceley said in response to the error.

“Everyone makes mistakes, and we’re all human. I don’t think in a year’s time we’re gonna look back and worry about whether it was the Monday or the Tuesday”.

“We’ve got an incredible foundation and I’m looking forward to the next 20 years,” he added.