- Testing, inspection and certification company ALS (ALQ) is growing its pharmaceutical business with the acquisition of Investiga

- With operations in Brazil and the east coast of the U.S., Investiga generated around $20 million in revenue in the 2020 financial year

- The company will be integrated with the existing ALS Life Sciences network, with a focus on expanding in the U.S.

- ALS will wholly acquire Investiga in exchange for 11 times its adjusted EBITDA for the 2020 financial year using existing debt facilities

- ALS is up 1.79 per cent to $9.66 per share

Testing, inspection and certification company ALS (ALQ) is growing its pharmaceutical business with the acquisition of Investiga.

With operations in Brazil and the east coast of the United States, privately-owned Investiga was founded in 1993 and currently has around 360 employees. Specialising in the cosmetic and personal care market, it provides services to a portfolio of major global clients and generated roughly $20 million in the 2020 financial year.

ALS will wholly acquire Investiga in exchange for 11 times the company’s adjusted EBITDA for the 2020 financial year, which will be paid on a deferred basis using existing debt facilities. As such, the transaction will not require shareholder approval.

Once the transaction is complete, Investiga will be integrated with the existing ALS Life Sciences business with a focus on expanding in the U.S., which represents more than a quarter of the global market.

Investiga’s key management will remain with the business, reporting to the General Manager of ALS Life Sciences in Latin America.

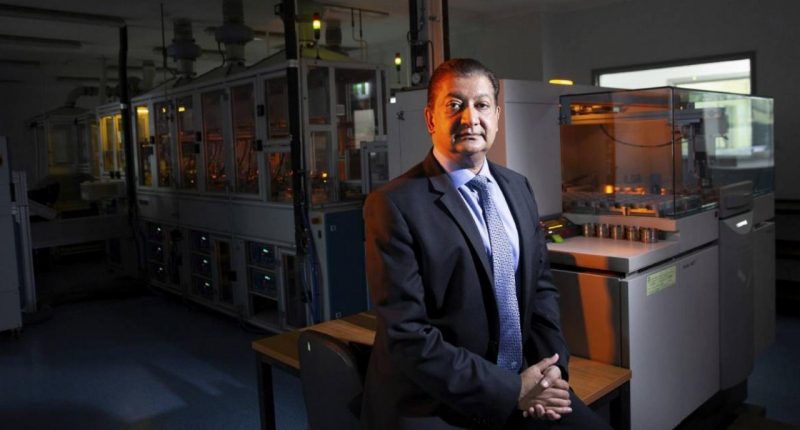

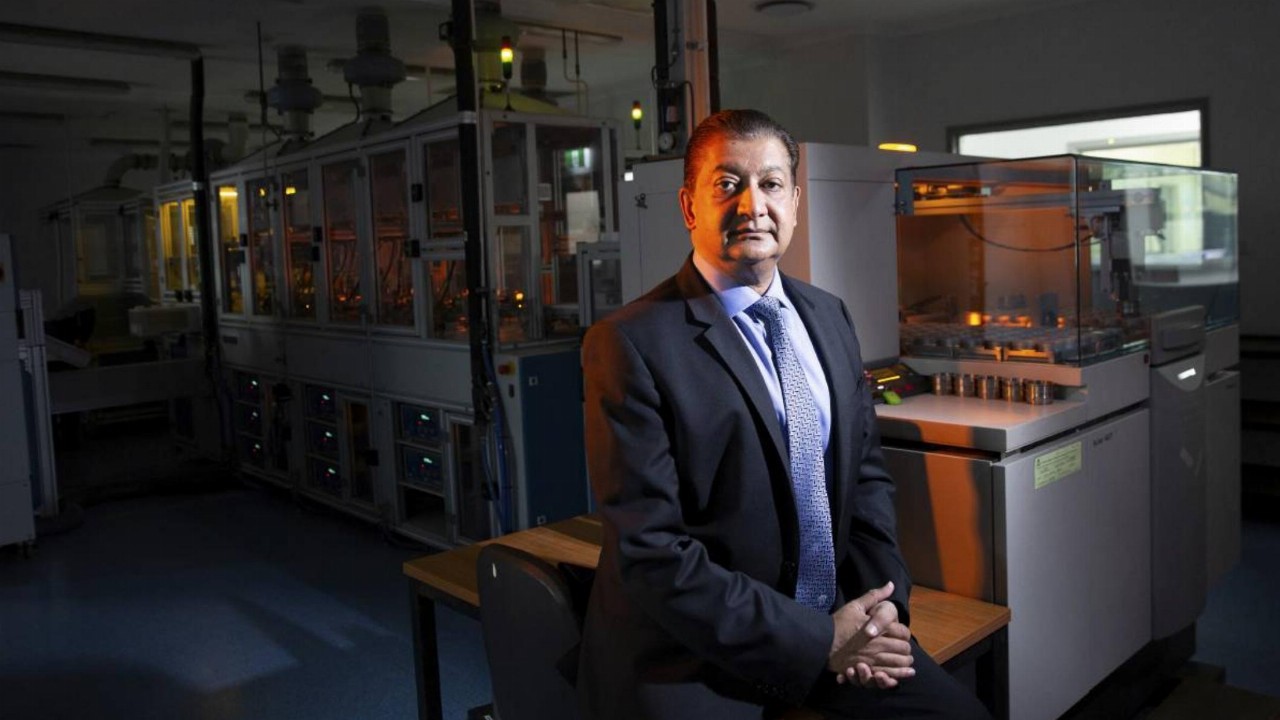

“Growing the Life Sciences division is a key part of the ALS strategy and Investiga significantly increases our presence in the pharmaceutical market,” said Raj Naran, Managing Director and CEO of ALS.

“We have a strong track record of integrating acquisitions into our existing Life Sciences network and Investiga provides us with the platform to grow our cosmetic and personal care offering, particularly in the USA,” he added.

Despite the impact of the COVID-19 pandemic, ALS said its Life Sciences volumes have been predominantly stable, with laboratories providing their essential services to clients in major markets.

The company also noted that its balance sheet remains strong, with around $600 million of liquidity available.

ALS is up 1.79 per cent to $9.66 per share at 2:27pm AEDT.