- Antipa Minerals (AZY) regains the sole rights to a handful of “high-priority” WA gold targets subject to a farm-in arrangement with mining big-cap Newcrest (NCM)

- AZY says it has struck a deal with Newcrest to take back control of a 733 sqkm tenement package that includes the Tetric, Pacman and Pixel targets from Wilki

- In return, Newcrest will be entitled to a 1.5 per cent net smelter royalty over those tenements

- All former terms of the existing Wilki farm-in and joint venture agreements are unchanged for the reduced project area

- Antipa shares are trading grey a 2 cents at 11:12 am AEDT, while Newcrest shares are down 2.59 per cent to $22.60

Antipa Minerals (AZY) has regained the sole rights to a handful of “high-priority” WA gold targets subject to a farm-in arrangement with mining big-cap Newcrest (NCM).

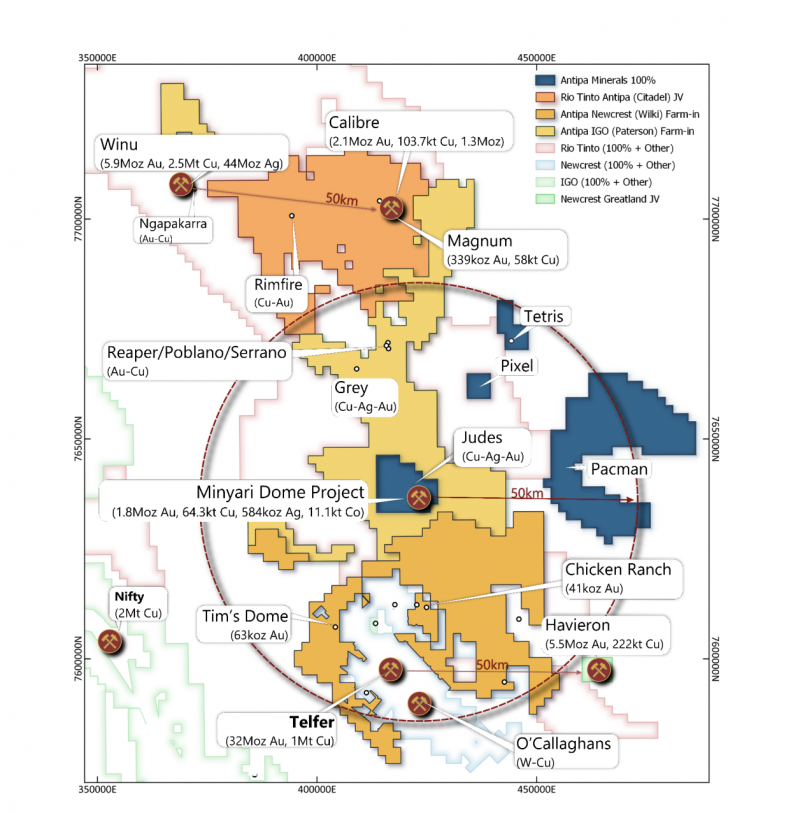

Antipa said it struck a deal with Newcrest under which it would reclaim the complete rights and operational control of a 733 square kilometre tenement package that includes the Tetris, Pacman, and Pixel targets. As a result, Newcrest will be given a 1.5 per cent net smelter royalty over those tenements.

Antipa’s Managing Director, Roger Mason, said the company was “delighted” to have regained control over these targets.

“With this regained interest, our wholly-owned landholding in this exciting gold-copper province expands to almost 900 square kilometres, all within 50 kilometres of Minyari, and provides us with significant future exploration optionality.”

The Wilki project now covers an area of approximately 1470 sqkm. The project still includes the previously defined Chicken Ranch and Tim’s Dome deposits that hold a combined 103,500 ounces of inferred mineral resource estimates. Reportedly, these deposits are close to the Telfer gold-copper-silver mine and processing facility.

Otherwise, all former terms of the existing Wilki farm-in and joint venture agreements are unchanged for the reduced project area. Newcrest can earn up to 75 per cent in the reduced project by paying $60 million in exploration expenses by March 2028.

Newcrest said it remains focused on the farm-in agreement, having spent over $8.5 million on greenfield exploration for the aforementioned targets.

Antipa shares are trading grey a 2 cents at 11:12 am AEDT, while Newcrest shares are down 2.59 per cent to $22.60.

-1200x645-380x200.jpg)