- Ardiden (ADV) enters a mid-week trading halt while it plans the details of an upcoming capital raising

- The company will remain in the halt until February 11 or when an announcement regarding the capital raise is released, whichever occurs first

- On January 27, Ardiden began drilling at its Pickle Lake Gold Project in Canada with around 4000 metres planned to test two highly prospective structural targets

- Once completed, a further 3000 metres of diamond drilling will be undertaken to target the Dorothy-Dobie deposits which have multiple high-grade historical intersections

- Shares in Ardiden last traded at 1.7 cents on February 7

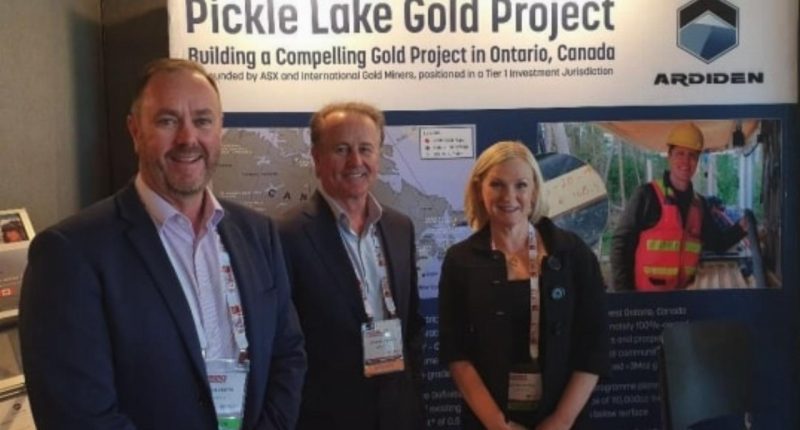

Ardiden (ADV) has entered a mid-week trading halt while it plans the details of an upcoming capital raising.

The company will remain in the halt until February 11 or when an announcement regarding the capital raise is released, whichever occurs first.

Ardiden is yet to disclose how much it intends to raise or what it will use the funds for once received.

On January 27, Ardiden began drilling at its Pickle Lake Gold Project in northwest Ontario, Canada.

Around 4000 metres of drilling will be undertaken to test two large and highly prospective structural targets; the Fold Hinge and Dilational Shear.

Once completed, a further 3000 metres of diamond drilling will be undertaken to target the Dorothy-Dobie deposits which have multiple high-grade historical drilling intersections yet to be followed up.

A day later, Ardiden released its December quarterly report, revealing it had burnt through $535,000 with the majority going towards administration and corporate costs. The company also invested $559,000 in exploration and evaluation.

The company ended the quarter with more than $2.76 million in total available funding, representing 2.5 quarters of use if spending levels remain the same.

Shares in Ardiden last traded at 1.7 cents on February 7. The company has a $36.86 million market cap.