Australian shares are heading back into the green, gaining as much as +0.5% in ASX futures. Traders Down Under are preparing for the month’s big inflation update before midday – and keeping an eye on Trump again.

Listen to the HotCopper podcast for in-depth discussions and insights on all the biggest headlines from throughout the week. On Spotify, Apple, and more.

On the second, Trump has kept pushing to control the U.S. Federal Reserve with a shock sacking, ousting governor Lisa Cook on Tuesday.

Many were initially ambivalent about the news, and Wall Street eventually chose to follow Nvidia’s gains before its earnings: The S&P 500 climbed +0.4% while the Dow Jones and Nasdaq composite followed similarly.

That said, while the U.S. – and little brother Oz – are green, London’s FTSE has dropped as much as -0.6%; the Nikkei lost more, retreating -1%.

Plenty will weigh at home too, including aforementioned CPI at 11.30am this morning.

July’s forecast is 2.3%, up from 1.9%; annual trimmed mean at 2.3%.

ASX stocks to watch

And Aussie earnings season rolls on with Woolworths (ASX:WOW), Nine Entertainment (ASX:NEC), and WiseTech Global (ASX:WTC) all on the menu.

Coles (ASX:COL) will be one to watch after its earnings too; the staple shopping giant gained as much as +8% on “good, clean results.” The group’s full-year earnings topped estimates on supermarket growth.

Bookmaker Betr (ASX:BET) is again trying to buy PointsBet (ASX:PBH), too, offering $1.40 a share alongside scrip consideration and a selective buyback pool. MIXI most recently turned down a slightly cheaper deal from the Aussie hopeful.

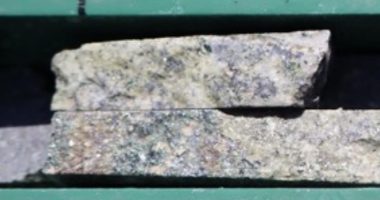

Solara Minerals (ASX:SLA) has caught early attention on HotCopper as well, drawing excitement after claiming it has found “significant gold anomalism” at its barely-worked Wilgeena Project in Peak Hill.

And while not quite ASX-related, AusPost has halted most parcel postage to the U.S. as tariffs continue to weigh on global carriers.

Buck and ore

In forex, the Aussie dollar buys 64.9 US cents.

And to commodities, all in the greenback,

Iron Ore has sunk -0.8%, selling at $102.40 a tonne in Singapore,

Brent Crude is at $67.34,

Gold has gained this morning, $3,392 per ounce, and,

US natgas futures are up +1%, selling at $2.72 per gigajoule.

That’s HotCopper’s Market Open, I’m Isaac McIntyre – good luck and happy trading.

Join the discussion: See what’s trending right now on Australia’s largest stock forum and be part of the conversations that move the markets.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.