Key economic estimates have been released today by the Australian Bureau of Statistics (ABS), revealing that the economy grew by three per cent during the 2022-2023 financial year.

The data includes gross domestic product (GDP), consumption, investment, income, capital stock, productivity, and balance sheets.

Australia’s national net worth has risen by $1.3 trillion to $19 trillion during FY23. However, in the background, a significant drop in the household savings ratio was experienced, decreasing from 12.6 per cent to just over four per cent for the financial year.

The ABS reported that labour productivity fell by 3.7 per cent. Furthermore, throughout the quarter, overall demand for goods and services, excluding exports, increased by 1.8 per cent. This rise marks an increase of almost four per cent in the last 12 months.

Australia’s future economic outlook

Earlier this week, the Australian Government’s treasury department Secretary, Doctor Steven Kennedy, provided an update on the Treasury’s near-term economic and fiscal outlook for Australia and globally.

Dr Kennedy outlined several key developments within the global economy.

“The most severe bout of global inflation in decades peaked in mid‑to‑late 2022 and is now slowing,” he said.

“Global goods price inflation has fallen as pandemic supply constraints fade and the post‑pandemic boost to household demand eases.

“Elevated energy prices due to Russia’s invasion of Ukraine have also eased, although the recent rebound in oil prices has partially reversed this trend.”

The Treasury Secretary warned that there is still some time before core inflation settles back to its target rate.

“In the near term, there will be volatility in headline inflation, we have observed this in other countries, particularly with increases in headline inflation driven by petrol, and we are likely to see similar instances in Australia,” he said.

“However, we still expect inflation to steadily fall toward the target band although its descent toward the target band may be slower than initially expected due to higher petrol prices.”

Global economic events

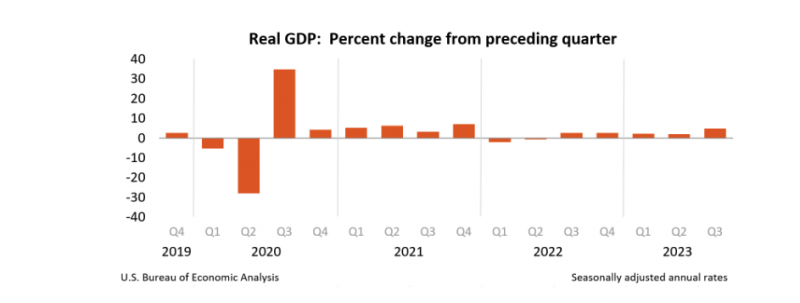

The United States of America released its GDP data overnight, flagging an increase of 4.9 per cent, more than double the previous quarter.

The US Bureau of Economics reported that the increase reflected higher consumer spending, private inventory investment, exports, state and local government spending, federal government spending, and investments.

Multi-asset investment broker, Saxo commented on the US data overnight. The company provides leading online trading information for global financial markets.

“Oil prices saw another sharp drop yesterday despite US economic data staying strong and ECB loosening its hawkish posture,” a spokesperson commented.

“However, demand outlook remains weak and war premium continues to wobble, bringing volatility in crude oil prices. Gold stays supported with yields slipping, dollar range-bound and safe-haven demand underpinning.

“Strong US GDP and a dovish ECB outcome could not propel the dollar materially higher, supporting the case that upside is starting to get limited as positioning is stretched.”

Furthermore, China’s market activities remain weak as investors assess the magnitude of the impact of recent stimulus measures in the region.

-1200x645-380x200.jpg)