- Babylon Pump and Power has gained 14.3 per cent today after announcing the purchase of Primepower Queensland for up to $4.2 million

- The company aims to raise $1.5 million in a share purchase plan at 2.4 cents per share

- NAB has approved $500,000 in financing facilities and $1.6 million in debtor financing

- A combined annual revenue of over $25 million is expected for the 2020 financial year

Babylon Pump and Power has gained 14.3 per cent today after announcing the purchase of Primepower Queensland for up to $4.2 million.

The $4.2 million will be issued in cash, shares, delayed performance payments and assumption of asset finance debt.

The company also aims to raise $1.5 million in a share purchase plan, with further $1.5 million to be raised in a top up placement to cover the costs of the purchase.

The share purchase plan will be offered to eligible shareholders, who can subscribe for up to $15,000 worth of new shares. The shares will be issued at 2.4¢ per share.

The top-up placement will offer new shares to sophisticated and professional investors under the same price as the purchase plan.

National Australia Bank (NAB) has approved $500,000 in financing facilities and $1.6 million in debtor financing helping to assist with the growth of Primepower.

Primepower’s three-year annual revenue is approximately $8.9 million. Following the purchase, Babylon and Primepower’s combined annual revenue over the next year is expected to reach $25 million.

This is Babylon’s first move interstate and will is part of the company’s strategy to grow in the east coast.

Babylon Executive Chairman Michael Shelby said the company is pleased with the purchase

“The Primepower business is a standout opportunity and logical fit for Babylon. With our WA operations going from strength-to-strength, now is the right time to expand our footprint on the East Coast of Australia,” he said.

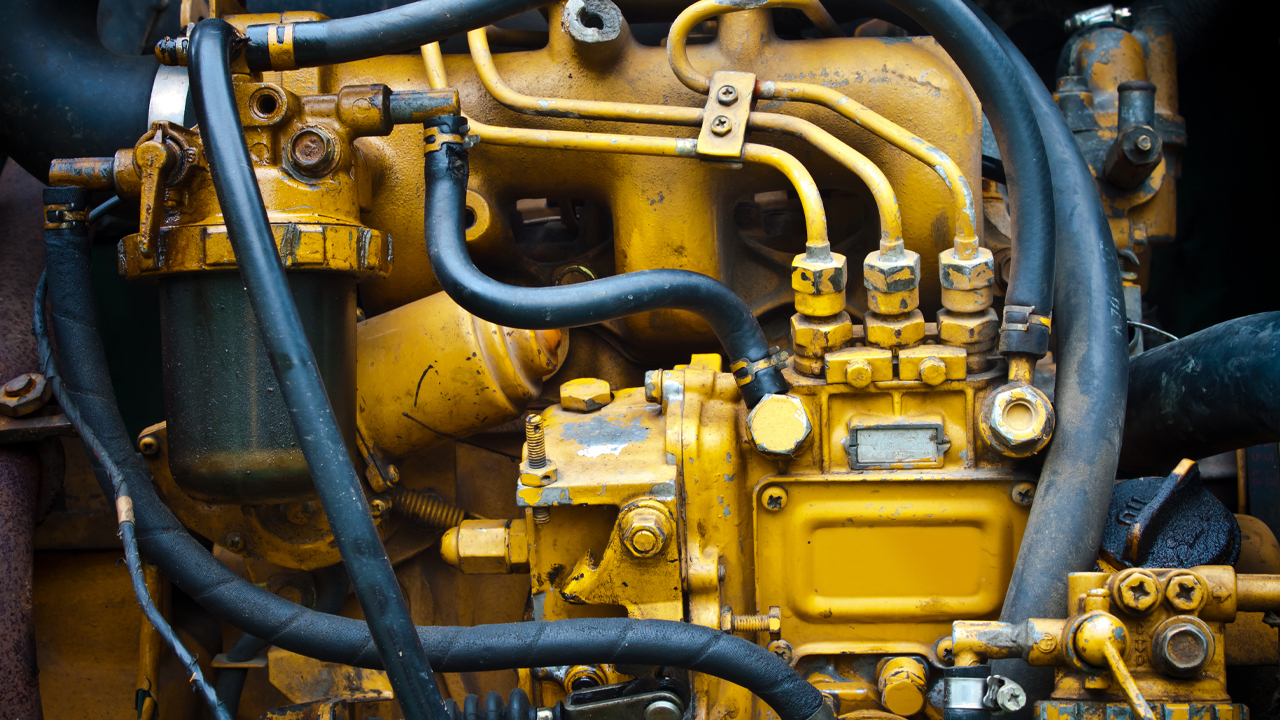

Babylon is a West Australian company focused on the oil and gas mining sectors, providing specialised equipment rental, diesel rebuild and maintenance, and project support.

Primepower Queensland is one of Queensland’s leading diesel specialists.

Since 2004 Primepower has been servicing the mining industry with genuine cummins engines and spare parts. Primepower has a first class client base including coal producers Peabody, FMG, and Wesfarmers.

“The acquisition also provides commodity diversity, exposure to a larger client base, many with national operations, and will deliver a step-change in our operating scale and revenue,” Michael said.