- Automotive industry darling Bapcor (BAP) has announced it is withdrawing its earnings guidance for 2020 due to COVID-19

- Retail shutdowns in New Zealand, Thailand and Australia have forced the move, which has triggered financial uncertainty

- These regions represent a key area for Bapcor

- The company operates in over 500 locations across Australia through subsidiaries like Autobarn and Midas

- Despite this news, sales at the company’s Burson auto parts retailer have stayed strong

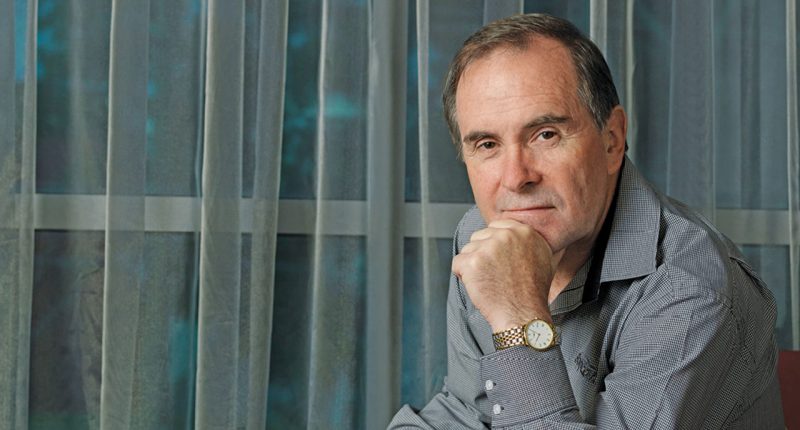

- Nevertheless, CEO and Managing Director Darryl Abotomey says the business is not immune to the ‘drastic actions’ taken to fight COVID-19

- Following the withdrawal, Bapcor stock is up 2.45 per cent to $3.36 a share

Bapcor (BAP) has announced it will withdraw its earnings guidance for the 2020 year due to the COVID-19 outbreak.

The automotive retailer says shutdowns in the countries the company operates in, namely New Zealand, Australia and Thailand have forced them to reassess previous estimates.

The company operates a host of retailers, including the company’s core businesses like Autobarn, Burson auto parts, Midas and others.

It also operates in the trade, service, wholesale and retail sectors of the auto industry.

Bapcor has over 500 retail locations across Australia and New Zealand, with Autobarn holding some 130 locations on its own.

With shutdowns to non-essential services across the three countries the company operates in, sales will inevitably dip.

Because of this, Bapcor says it cannot “reliably forecast where the 2020 financial year will finish.”

The company’s CEO and Managing Director, Darryl Abotomey, said the business was not immune to the impacts of the shutdowns, and the drastic actions being taken to contain COVID-19.

“Bapcor’s team members are dedicated to ensuring they have available the parts and services that are necessary to keep the nation’s vehicles, including cars, light and heavy-duty trucks and emergency vehicles operating,” Darryl explained.

“To ensure the safety of our team members and our customers, additional levels of precautions are being undertaken,” he said.

Following the withdrawal, Bapcor stock is up 2.45 per cent to $3.36 a share at 11:42 am AEDT.