- Barton Gold (BGD) announces that replacement costs for its Central Gawler Mill have been valued at more than $100 million through an independent evaluation

- The report values the Mill and its infrastructure at more than $100 million, based on an “as new” replacement value basis, and over $50 million on an “as is” indemnity value basis

- The independent valuation forms part of an ongoing assessment of Barton’s Central Gawler Mill for future stage-one operations

- BGD is continuing with regional development and assessment of potential production options to accelerate its stage one gold operations

- BGD shares are up 5.77 per cent, trading at 27.5 cents at 12:35 pm AEST

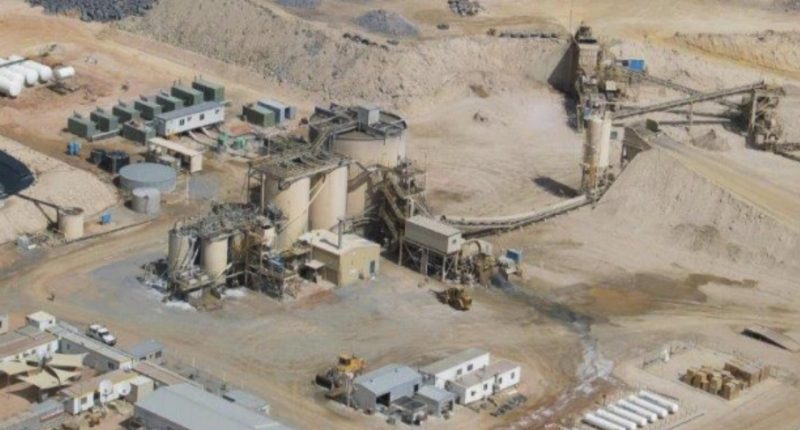

Barton Gold (BGD)‘s Central Gawler Mill has been valued at more than $100 million in replacement cost through an independent evaluation.

Barton completed a preliminary preservation program at the Central Gawler Mill in December 2022 to define recommissioning scope and cost estimates, which included key equipment being disassembled, cleaned and stored.

Following this, Barton engaged a contractor to complete an independent valuation report of the mill and associated site infrastructure to identify the correct level of insurance coverage needed to protect its assets ahead of starting its stage one operations.

The report valued Central Gawler Mill and its associated infrastructure at more than $100 million, based on an “as new” replacement value basis, and over $50 million on an “as is” indemnity value basis.

Barton Managing Director Alex Scanlon said the Central Gawler Mill was a “uniquely valuable strategic infrastructure” for Barton.

“It provides considerable leverage to the regional development of gold mineralisation via either third party toll milling or accelerated commissioning of stage one operations utilising Tarcoola mineralisation,” Alex Scanlon said.

“The mill provides Barton a significant advantage in “crossing the drawbridge” into operations on a much lower cost-and-risk basis, while potentially generating significant early cash to fund our larger long-term ambitions.”

The company is continuing with the regional development and assessment of potential production options to accelerate stage one gold operations at its Central Gawler Mill.

BGD shares were up to 5.77 per cent, trading at 27.5 cents at 12:35 pm AEST.