Australian uranium producer Boss Energy (ASX:BOE) has announced it’s preparing for first uranium sales as early as July.

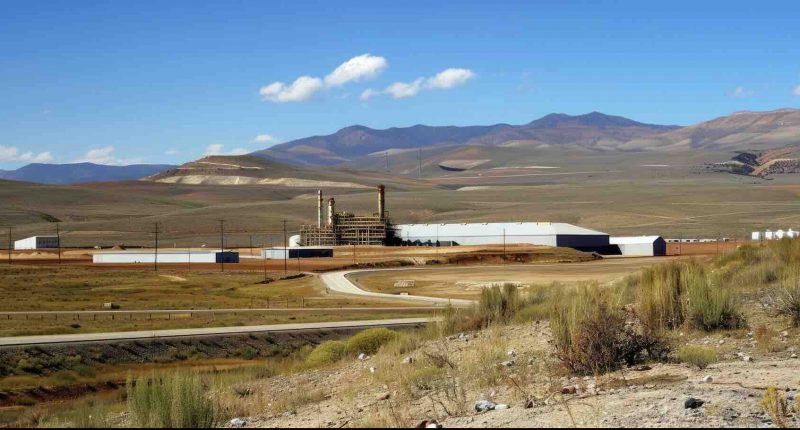

In the background, the company has been overseeing the commissioning process of its Honeymoon project in South Australia.

Boss reported on Wednesday “key metrics [exceed] feasibility study forecasts,” especially where regarding the performance of downstream leaching activities. On-site saturated sand wells have also reportedly returned higher concentrations than previously anticipated.

The company was quick to point out what uranium bulls have been watching since late 2023 – that the company remains poised to leverage high uranium prices. Currently, sales contracts cover some 1.8Mlbs over eight years, according to Boss.

Payments are set to be received in Q3 of CY2024, from major US and EU power utilities.

As of 9.45am Wednesday morning, Uranium prices on the NYMEX sit at USS$92.25/lb, up 72.75% YoY.

“The company intends to enter into further [sales contracts] as the uranium price rises,” Boss Energy wrote on Wednesday.

“We believe we will be hitting our straps as the uranium price rises in the near term,” Boss chief Duncan Craib said.

“These early production results provide confidence that we are on-track to meet our ramp up targets.

“Ramp-up timing has been designed to align with a rising uranium market.”

The company’s commodity-facing timing strategy is clearly barking up the right tree. As uranium prices have risen, so has interest in Boss Energy.

The company is up 110.5% YoY and is outperforming the ASX200 on a one year basis by 100%.

Year to date performance is up just short of 40% and the company now boasts a market cap of $2.2B – as well as decent liquidity.

BOE last traded at $5.62.