Market Mood

In this edition of Moves and Moods, we continue looking at the rise of emerging market economies, like China and India, into a larger role across industrial, financial and military powers.

Our focus here will be the future of nuclear energy and fuel.

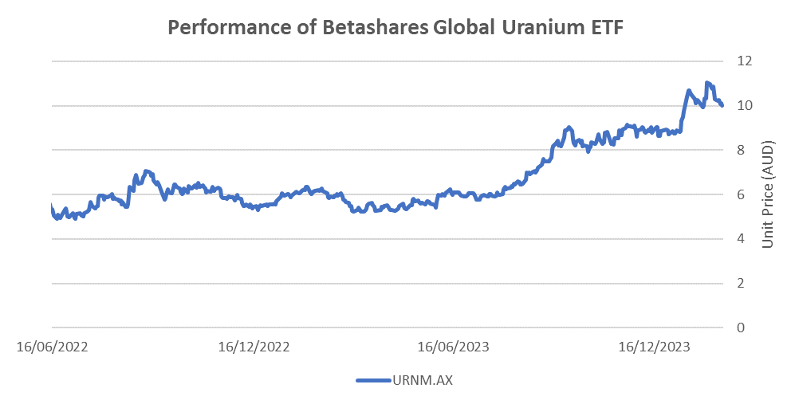

Let’s start with nuclear fuel and the recent spectacular move for uranium, Figure 1.

There are several reasons for this turnaround, but the primary driver is future growth in nuclear capacity in the developing world.

The West has largely curtailed the development of any new nuclear plants, while countries including Germany and Japan have either closed or shut down existing rectors.

China and India on the other hand, plus other Asian nations, are forging ahead with new reactors.

According to the International Atomic Energy Agency (IAEA), there are 437 operating reactors worldwide, with another 58 under construction. These are largely in the developing world, Figure 2.

China has a huge program of nuclear reactor construction, indeed China and Russia now dominate new reactor design.

Evidently, the Global Power Transition is not limited to trade, AI, and semiconductors.

It also involves strategic competition in the design of nuclear reactors.

Uranium Supply and Demand

China was the first to open a commercial small modular nuclear reactor, called a pebble-bed reactor. This fourth-generation reactor design uses a high-temperature helium gas coolant, operating with graphite coated fuel pellets, Figure 3.

Fourth-generation reactors are designed to be fail-safe in the face of coolant disruptions, or failure of the containment vessel. The pebble-bed design ensures that the nuclear reaction should stop, without intervention, to avoid any catastrophic meltdown, such as that occurred at Fukushima.

The Chinese are not alone in pursuing novel designs for small modular nuclear reactors (SMR). There has been considerable press coverage about plans by Rolls Royce, and others, to develop new designs which are safer to operate, faster to commission, and have lower capital costs.

The other factor that is affecting the supply and demand balance for uranium is the draw-down of the peace dividend from nuclear arms reduction. In the aftermath of the first Cold War, Russia and the USA entered into agreements to reduce their arsenals of long-range nuclear weapons. This led to two treaties, the Strategic Arms Reduction Treaties I and II, known as START I and START II.

The dismantling of Cold War I nuclear warheads liberated considerable quantities of Highly Enriched uranium (HEU), which generally contains upwards of 90% enriched U235. The thing about uranium is that has several different isotopes. These are chemically identical but have different nuclear uses.

Nuclear reactors and nuclear weapons share one trait in common. They both require special isotopes of uranium that are fissile, meaning that they can be split, to release energy by nuclear fission. Most uranium in nature is the non-fissile U238. This is useless in a nuclear reactor or nuclear weapon.

However, where nuclear reactors and nuclear weapons differ is that you only need about 5 per cent of the U235, so that, kilogram for kilogram, one unit of nuclear warhead material can be blended down to almost twenty units of nuclear fuel material. This is done by mixing it with the plentiful U238. For almost three decades, Western civilian nuclear reactors burned this peace dividend, which is now abating.

Move for this Mood

Uranium seems set to enter a long-term bull market that is driven by new reactor builds in developing nations combined with the end of the peace dividend drawdown of former military inventory.

While Western nations can likely cover their own reactor fuel requirements, we should recognize that supply chain security is subject to geopolitics.

This fact is made stark when we examine the countries which control the ten largest uranium producers, as Figure 4 shows, China, Russia and mid-Eurasia dominate.

The uranium price is around US$100 USD/lb, which is well above the US$50/lb break-even at which many prior producing mines were placed on care and maintenance.

The pipeline for mining restarts, and for greenfield development now seems ripe.

In Australia, the only remaining publicly-listed firm that produces uranium is BHP Group Ltd (ASX:BHP), through the massive Olympic Dam deposit. However, that exposure is no pure play, due to the dominance of iron ore in the revenue mix. Furthermore, while Olympic Dam is the largest uranium resource globally, it is a complex orebody, where expansion of the uranium production must go hand in hand with copper, and other minerals.

On paper, Australia has the largest uranium reserves globally, at around 28 per cent of the world’s total.

The limitation in Australia is politics, and environmental issues with some of the more prospective ground in the Northern Territory.

There are ongoing bans on uranium mining in Queensland, NSW and Victoria. Presently, only Western Australia, South Australia and the Northern Territory permit uranium mining. The latter is subject to a federal veto in mining approvals, which has led to stop-go activity. The most famous examples of this include the Ranger Mine, now under rehabilitation by Energy Resources of Australia (ASX:ERA), and Rio Tinto’s (ASX:RIO) Jabiluka.

The World Heritage-listed Kakadu National Park contains much prospective ground, but it is unlikely that community and social licenses will be granted to future mining. Future Australian uranium mining will be tied to sites and mining methods that meet contemporary social license, native title, and ESG expectations.

Among the major ASX-listed developers, we prefer restarts of former operating mines, and those with potential for minimally invasive In-Situ Recovery (ISR) mining, Figure 5. Note that ERA is presently focused on mine rehabilitation of the Ranger site, and so is greyed out.

Two noteworthy examples are Paladin Mining (ASX: PDN), which is well-advanced on restarting the Langer-Heinrich open pit mine in Namibia, and Boss Energy (ASX: BOE), which aims to restart mining at the Honeymoon project in South Australia, with In-Situ Leaching. Present uranium pricing will support such restarts and Greenfield projects.

We will consider some of the exploration and development projects in a future note.

Disclosure: the author does not hold any current position in the stocks mentioned.

Disclaimer

This article contains information and educational content provided by Jevons Global Pty Ltd, a Corporate Authorised Representative (AR1250727) of BR Securities Australia Pty Ltd (ABN 92 168 734 530) which holds an Australian Financial Services License (AFSL 456663). The Market Herald does not operate under a financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given.

The information is intended to be general in nature and is not personal financial advice. It does not take into account your personal financial situation or objectives and you should consider consulting a qualified financial professional before making any investment decision. All brands and trademarks included in this report remain the property of their owners.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.