- Two major international oil and gas companies purchase a working interest in Brookside Energy’s (BRK) Jewell Acreage in Oklahoma

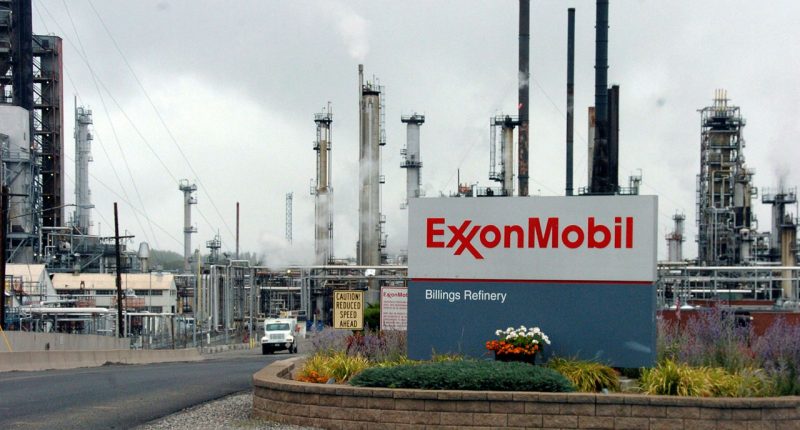

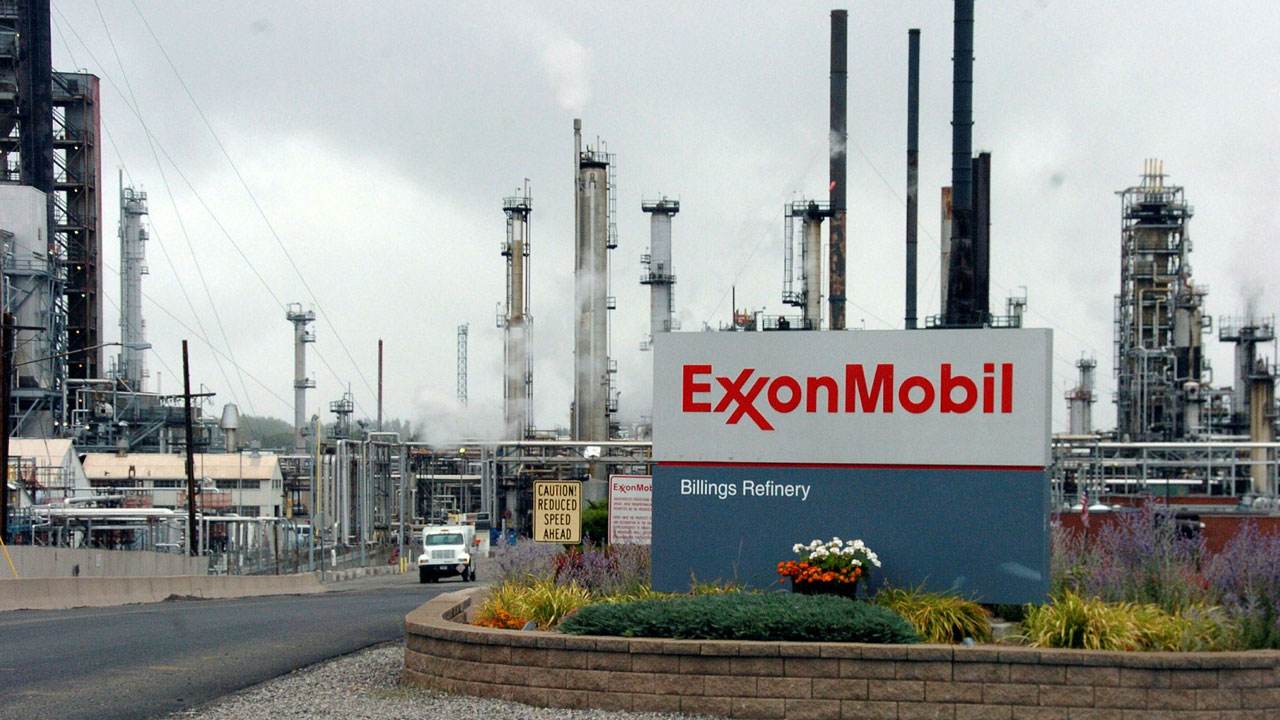

- One of the world’s largest publicly traded international oil and gas companies, ExxonMobil, agrees to a 4.5 per cent working interest

- Citation Oil and Gas Corp snaps up a 2.3 per cent working interest, with a further 5.7 per cent taken up by private equity and smaller private oil and gas firms

- Brookside is expecting to keep as much as 87 per cent working interest in the Jewell operations

- Just before the market opens this morning, Brookside is trading at 2.3 cents per share

Two major worldwide oil and gas companies have agreed to purchase a working interest in Brookside Energy’s (BRK) Jewell Drilling Spacing Unit (DSU).

One of the world’s largest publicly traded international oil and gas companies, ExxonMobil, has agreed to a 4.5 per cent working interest.

Meanwhile, Citation Oil and Gas Corp, one of the largest private oil and gas companies in the United States, has agreed to a 2.3 per cent working interest.

Additionally, a further 5.7 per cent of working interest was taken up by private equity and smaller private oil and gas firms.

Brookside is expecting to keep up to a 87 per cent working interest in the Jewell DSU, with its subsidiary Black Mesa as the operator.

Participation in the Jewell DSU includes a working interest in the high-impact Jewell Well and the opportunity to participate in further wells drilled in this DSU.

The Jewell Well is located in Carter Country, Oklahoma, and will be the company’s first operated well to be drilled and completed in the Jewell DSU.

“We are delighted by the response of these participants, some of the largest and most experienced oil and gas companies in the world, in electing to participate in the development of the Jewell DSU,” Managing Director David Prentice said.

“This is not only a significant vote of confidence in the quality of our acreage in the southern SCOOP but also a very strong endorsement of Black Mesa as operator of the DSU and their technical and operational ability to recover the maximum oil and gas reserves in the most efficient manner possible.

“We are looking forward to working with these new partners and to keeping our shareholders informed as we move closer to completion and the establishment of oil and gas sales.”

Just before the market opens this morning, Brookside is trading at 2.3 cents per share.