- Meditech innovator G Medical (GMV) has completed an oversubscribed $6 million placement to professional, sophisticated, and institutional investors

- The capital raised will be used for the repayment of loans and the termination of convertibles notes, with the balance to be used for working capital

- The company has made great strides recently in gaining approvals and opening up new markets for its proprietary medical monitoring platforms

- G Medical has faith the capital raised will enable sufficient balance sheet flexibility to fund near-term growth opportunities for its novel technologies

- While the placement has resulted in some share dilution — and an according share price drop — the opportunities still on GMV’s horizon will likely see a bounce back

- G Medical fell 8.8 per cent to 8.3 cents per share by market close on Friday

Meditech innovator G Medical (GMV) has completed an oversubscribed $6 million placement to professional, sophisticated, and institutional investors.

The capital raised will be used for the repayment of loans and the termination of convertibles notes, with the balance to be used for working capital.

Critical milestones

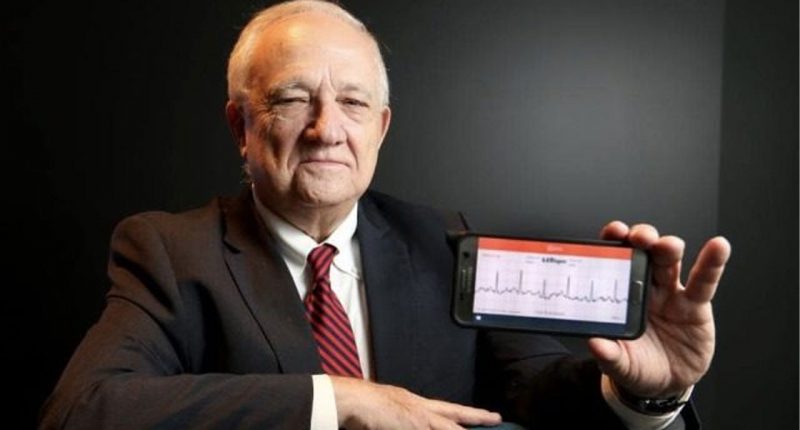

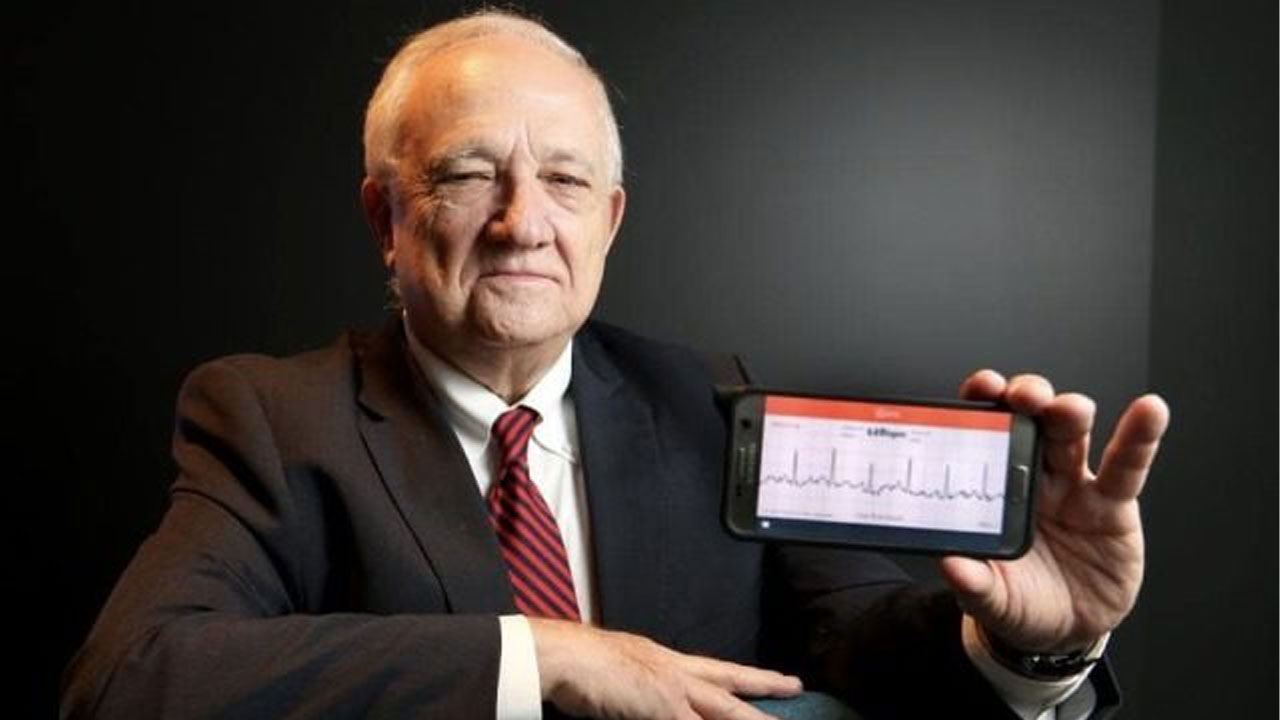

The company has made great strides recently in gaining approvals and opening up new markets for its proprietary medical monitoring platforms, including the Prizma device, the Vital Signs Monitoring System and the G Medical Patch.

G Medical has faith the capital raised will enable sufficient balance sheet flexibility to fund near-term growth opportunities for its novel technologies.

While some shareholders may be slightly off-put by yet another dilution, the share price has stayed quite solid through successive capital raises in recent months, and the market opportunities opening up for the company will re-instil some faith in GMV’s strategy.

G Medical CEO Dr Yacov Geva says the funds raised will serve as a great catalyst for growth in a time of great need for telehealth and remote monitoring services.

“Our solutions are becoming recognised as a cost-effective and scalable way to ease the burden on healthcare systems and may play a potentially pivotal role in the current environment.

“Board and management are constantly progressing a number of opportunities that will unlock considerable shareholder value and we look forward to providing ongoing updates when possible,” he added.

Next steps

The capital raise will allow G Medical to move forward with no debt burden from convertible notes, and with the funding flexibility to capitalise on emerging opportunities in key markets including the U.S., China and Europe.

While the placement has resulted in some share dilution — and an according share price drop — the opportunities still on GMV’s horizon will likely see a bounce back.

Given the share price fall has also been less than the dilutionary ratio, it seems the market mostly agrees with the sunny outlook of GMV’s management.

G Medical fell 8.8 per cent to 8.3 cents per share by market close on Friday.