- Hastings Technology Metals (HAS) places its shares in a trading halt pending the release of a capital raising announcement

- The company will remain in the halt until the earlier of Wednesday, September 7, or when the announcement is released to the public

- Further, Hastings has yet to disclose how much it intends to raise or what it will use the funds for once received

- Shares in Hastings last traded at $5.42 on September 2

Hastings Technology Metals (HAS) has placed its shares in a trading halt pending the release of a capital raising announcement.

The company will remain in the halt until the earlier of Wednesday, September 7, or when the announcement is released to the public.

Further, Hastings has yet to disclose how much it intends to raise or what it will use the funds for once received.

The upcoming capital raise is not the first major fundraising of the year for the company, with one in March where Hastings received $40 million from its largest shareholder, L1 Capital via a strategic placement.

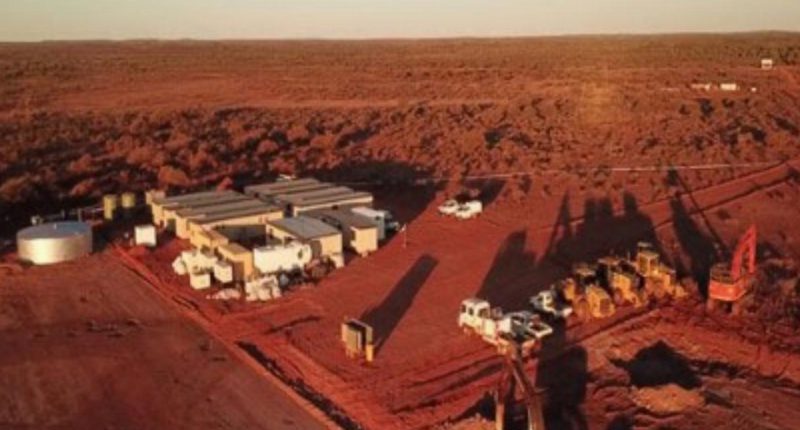

Funds raised during the strategic placement were used to accelerate key work streams and mine site works at its flagship Yangibana rare earths project in the Gascoyne region, Western Australia.

In July, the company received its last lot of results from Yangibana which the company said have defined strong mineralisation.

Shares in Hastings last traded at $5.42 on September 2.