- Hexagon Energy Materials (HXG) highlights an under-explored area at the McIntosh Project’s Melon Patch prospect in WA

- Investigation of historical data highlighted a 2.2-kilometre strike within the Panton Suite of Melon Patch that has known PGE mineralisation

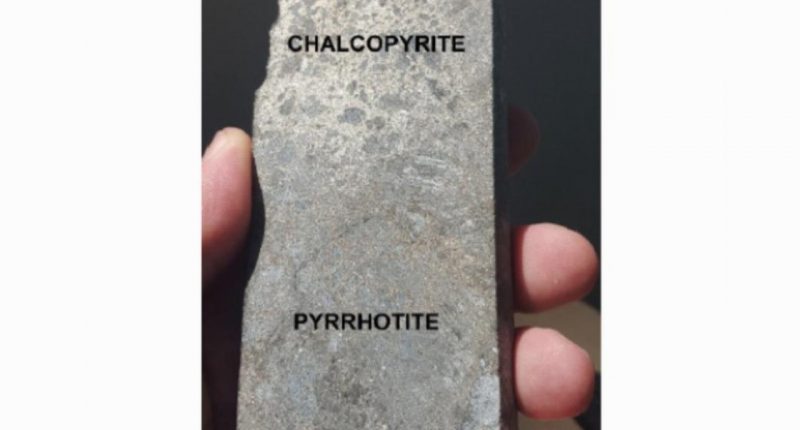

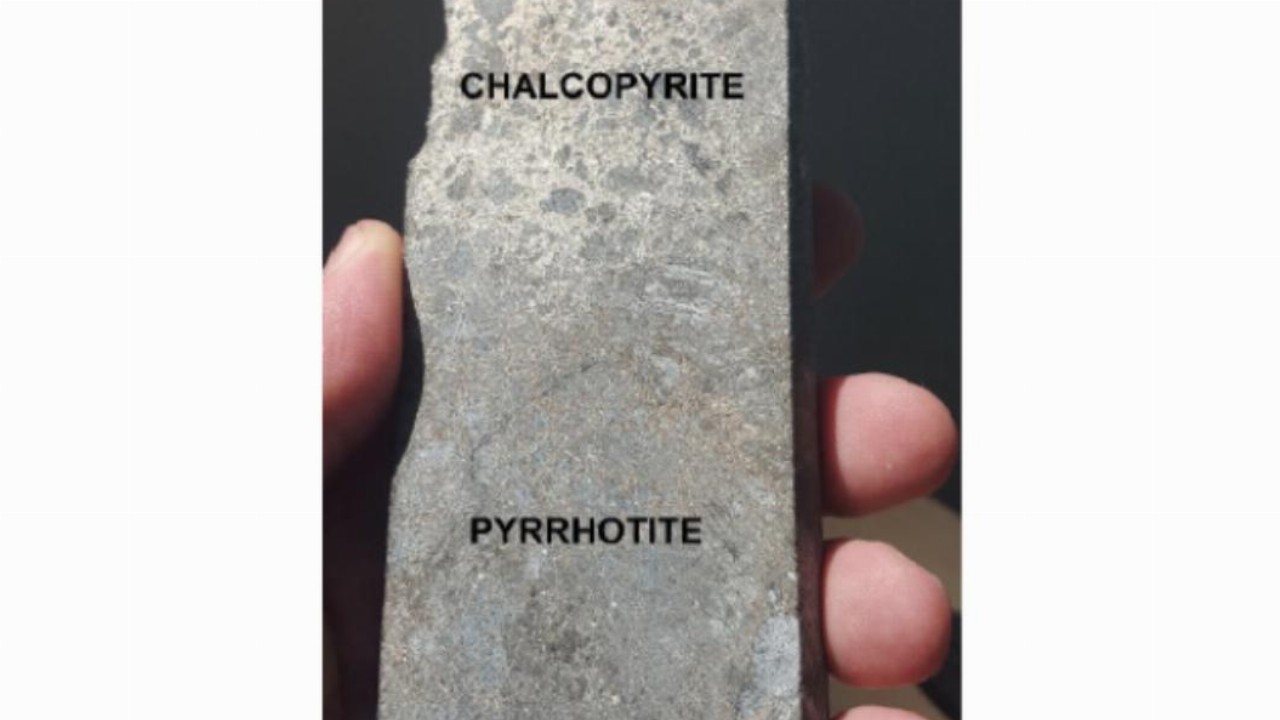

- The discovery prompted a review, resampling and analysis for nickel-copper-PGEs of all drill core held by Hexagon

- Final laboratory results from a separate 2021 soil sampling program have been returned, with a comprehensive review expected to be complete this month

- Hexagon shares down 14.3 per cent, trading at 5.4 cents

Hexagon Energy Materials (HXG) has highlighted an underexplored area at the McIntosh Project’s Melon Patch prospect in the East Kimberley of WA for further investigation.

Further analysis of historical data highlighted a 2.2-kilometre strike of Panton Suite within the Melon Patch prospect that has known mineralisation.

Historical drill intersections of platinum group element (PGE) mineralisation included 20 metres at 0.75 grams per tonne PGE.

The discovery prompted a review, resampling and analysis for nickel-copper-PGE of all drill core held by Hexagon.

Additionally, final laboratory results from a 2021 soil sampling program of 5,200 samples has now been returned to the company. Following this, a comprehensive review is expected to be complete in February.

Results of this review are hoped to further aid the refinement of Hexagon’s McIntosh Project 2022 field season work plans.

“McIntosh is core to Hexagon’s future energy materials strategy moving forward,” said Hexagon’s Managing Director Merrill Gray.

“We are focused on unlocking this asset’s value at a time where nickel prices are at a ten year high and there is great value being placed on PGEs for use in fuel cell and electrolyser manufacture – key to the hydrogen energy transition.”

“The upcoming 2022 exploration program at McIntosh comes at a time well suited to future market demands.”

Hexagon Energy Materials shares were down 14.3 per cent, trading at 5.4 cents at 3:48 pm AEDT.