LNG Canada’s liquefied natural gas (LNG) export facility in Kitimat, BC — a C$40 billion joint venture between Shell, PETRONAS, PetroChina, Mitsubishi and KOGAS — marks the first major effort to monetise Canada’s considerable natural gas resources beyond the continent.

As of 2021, these resources stood at 1373 trillion cubic feet (Tcf), the fifth-largest in the world at over 200 years of current annual demand, according to the Canadian Gas Association (CGA). Domestic gas sales for 2021 were 4.054 Tcf, while exports added another 2.730 Tcf — the vast majority of which was to the US.

The LNG Canada facility, now over 7 per cent complete, with first shipments slated for 2025, represents sales of up to 14 million tonnes of LNG or 682 billion cubic feet (Bcf) of natural gas per year into Asian markets, with potential phase-two developments doubling those numbers.

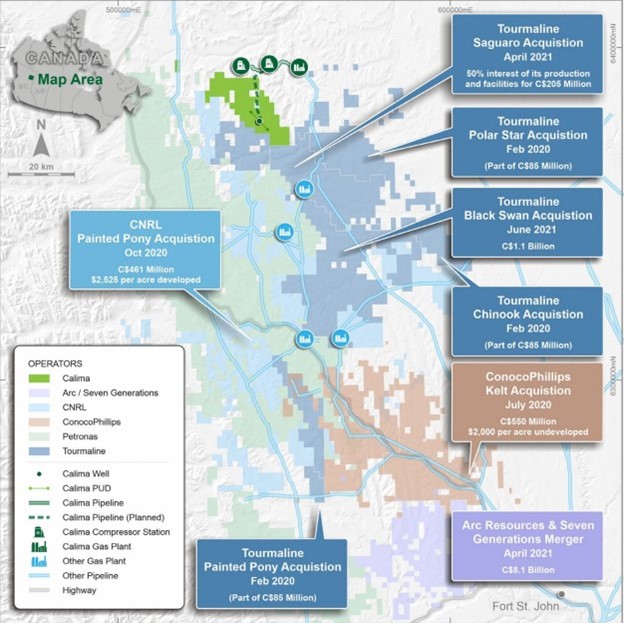

The energy investment — one of the largest in Canadian history — has prompted leading domestic oil and gas players like Cenovus, Tourmaline, ConocoPhillips, ARC Resources and Canadian Natural Resources to spend billions to position themselves in the surrounding Montney region to supply low-cost gas toward Canada’s energy diversification.

Besides ample local supply, the facility will also benefit from efficient natural gas turbines and renewable electricity from BC Hydro to ultimately emit less than half the greenhouse gasses of an average LNG facility.

TC Energy’s 670-kilometre Coastal GasLink Pipeline, now 75 per cent complete, will shepherd between 2.1-5.0 Bcf/d of gas across northern BC to LNG Canada for delivery to global markets.

This widespread interest in the Canadian LNG industry has, in turn, led investors on a search for exponential returns in smaller, undervalued energy producers operating in the shadows of these major names and the mainstream coverage they command.

One such issuer is Calima Energy (CE1), a A$76 million microcap oil and gas producer, whose profitable operations and high-quality Western Canadian assets are available at a bargain compared to their long-term prospects.

Calima produced 382,910 barrels of oil equivalent (boe) in Q3 2022 — averaging roughly 4162 boe/d (around 63 per cent oil and liquids) — from its Brooks and Thorsby plays in Alberta, which is up from 349,403 boe in Q2 2022.

This resulted in free cash flow of A$5,775,554, up from A$3,653,197 in Q2 2022, and earnings (before amortisation) of A$12,517,507, down from A$14,143,253 in Q2 2022, despite lower revenue due to a fall in WTI.

The results follow over 40 per cent production growth YoY from 2900 to over 4000 boe/d, with declines mitigated by layering on new wells throughout 2022.

An ongoing drilling program at Brooks is anticipated to grow production even further, with peak rates expected in Q1 2023, while robust commodity prices, minimal debt, and healthy cash reserves of A$9.93 million as of September 30, 2022, position Calima for continued growth throughout 2023.

In addition to achieving profitability during a historically-high inflationary period, the company is also structured for long-term success with proved, developed and producing reserves of 5.1 million barrels of oil equivalent (MMboe), and total proved, probable and possible Reserves of 24.4 MMboe (63 per cent oil) net of royalties. However, that would only begin to account for the asymmetric upside potential on offer here.

To better understand Calima’s role in the Canadian energy market, we must turn to its Montney project in BC, whose 2C contingent resource of 160.5 MMboe (78 per cent gas) and prospective resource of over 126 MMboe, are strategically positioned northeast of LNG Canada’s forthcoming link to the Emerging Markets.

Montney Project

The 130,000 sqkm Montney Formation of Alberta and BC has been undergoing oil and gas exploration since the 1950s. As part of Western Canada’s Deep Basin system, it hosts pervasive shales and siltstones with reservoirs near mature hydrocarbon-expelling source rocks.

Thanks to innovations in horizontal drilling, multi-stage hydraulic fracturing and completion design, developers have been able to work through the formation’s 100-metre-to-300-metre thickness to transform it into Canada’s most active oil and gas play.

Beginning in 2005, initial fracturing yielded four-to-five times greater production than previously drilled vertical wells.

As of 2021, officially recognised Montney reserves totalled 81.5 Tcf. However, geological surveys by the BC Oil and Gas Commission estimate the figure at an astounding 1965 Tcf, suggesting that the over 1200 wells in the area have yet to delineate the resource’s true size.

Since 2014, Calima has amassed a 100 per cent interest in over 34,037 acres of Montney drilling rights in BC, with a 10-year continuation lease over 49 sections following the 2019 drilling campaign that produced the 287 MMboe equivalent estimate.

The company’s efforts in Montney are backed by the Tommy Lakes Infrastructure, acquired in April 2020, which offers existing processing capacity of over 11,000 boe/d, and a replacement value of A$85 million, which surpasses the company’s market cap.

The BC Oil and Gas Commission has also approved the construction and operation of a multi-well production facility, as well as the construction of a pipeline between the Montney wells, Tommy Lakes, and regional pipeline and processing infrastructure. The tie-in and restart at Tommy Lakes would only take one winter season.

Investment case

Calima’s set-up in the Montney should allow shareholders to benefit as Asian coal-burning countries do business with LNG Canada, recognising LNG’s potential as an affordable and clean-burning fuel — which is non-toxic, and harmless if released into the environment — to expedite their transition to a lower-carbon future.

Coupled with Europe’s shunning of Russian supply due to the invasion of Ukraine, LNG demand from tier-one jurisdictions, such as Canada, is only poised to rise, with the delivered cost of natural gas rising from C$7.56 to C$12.05 per gigajoule from 2020 to 2021, according to CGA, though it has since reverted to its long-term average amid recessionary fears.

The LNG Canada facility will source an estimated 2.5 Bcf/d of natural gas from the Montney alone, maxing out at 60 per cent of the current base production from the region, which is likely to add significant value to Calima’s holdings as 2025 approaches.

To facilitate this value accretion, Calima is evaluating a 2022-2023 winter operations program to further de‐risk its Montney project and support a potential sale or joint venture with one of its multi-billion-dollar neighbours. This includes a planned retest of the 2019 wells in Q1 2023, which is expected to improve gas and condensate rates compared to the original tests.

Future drilling is intended to substantiate a 20,000 – 50,000 boe/d development program in 2025. Such a ramp-up would place Calima on a substantial playing field with some of its peers such as Tourmaline Oil, Canada’s largest natural gas producer, which generates 135,000 boe/d (including 350-360 million cubic feet of natural gas per day (MMcf/d)) from its NEBC Montney operation.

Using a conservative development type curve 35 per cent lower than the contingent resource report type curve, Calima estimates the Montney project’s full-cycle internal rate of return at over 50 per cent, supposing a less-than-$3.90-per-million British thermal units (MMbtu) BC station two gas price. The estimate is based on phase-one production of around 22,000 boe/d in 2025 to 2027.

As an efficiently-managed microcap company, overlooked among major energy players, the scale of Calima’s growth potential in the Montney is much like the resource itself: the tip of an iceberg revealing only a fraction of the vast wealth to be uncovered.

This massive opportunity puts individual investors in a privileged position to capitalise on the shares, priced at A$0.12 as of December 12, 2022, before future drilling yields more positive results and these major players are prompted to fund Calima’s development or step in for an acquisition.