- Horizon Oil (HZN) is launching two share buyback schemes as its balance sheet goes from strength to strength

- The oil and gas company will carry out an on-market buyback of up to 100 million currently issued HZN shares

- It’ll also put together an unmarketable parcel buyback for shareholdings, valued at less than $500 — or roughly 6329 shares or fewer

- Under the unmarketable parcel buyback, Horizon will offer shareholders 8.3 cents for every share they sell back to the company

- Horizon will begin buying back these shares on March 31, unless shareholders opt out or increase their shareholding

- Horizon Oil shares are currently trading for 9.1 cents each, up 7.06 per cent

Horizon Oil (HZN) is launching two share buyback schemes for shareholders.

The oil and gas company said a strong balance sheet, resilient performance from its producing assets and recent PNG divestment meant it was in a position to return surplus capital to shareholders.

The energy stock plans carry out an on-market buyback of up to 100 million HZN shares, or roughly 8 per cent of its current securities on issue.

The one-for-one, fully paid buyback will be offered to interested shareholders throughout March and September.

Additionally, Horizon is also planning to put together an unmarketable parcel buyback for shareholdings which are valued at less than $500 — or roughly 6329 shares or less.

Under this unmarketable parcel buyback, Horizon will offer shareholders 8.3 cents for every share they sell back to the company.

The company believes this buyback applies to around 1300 shareholders representing approximately 30 per cent of total shareholders.

Horizon will begin buying back these shares on March 31, unless shareholders opt out or increase their shareholding above $500.

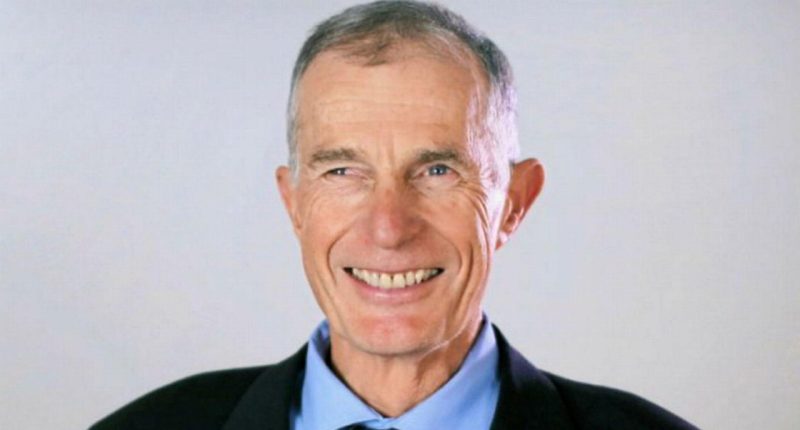

“Our aspiration is to move towards periodic capital distributions to shareholders

through a mixture of share buy-backs or dividends that are sustainable throughout the oil price cycle and where it is prudent to do so,” CEO Chris Hodge said.

“The Board has determined a target payout ratio of up to 30 per cent of free cash flow generated per annum,” Chris added.

Horizon Oil shares are currently trading for 9.1 cents each, up 7.06 per cent at the end of Wednesday’s trading session.