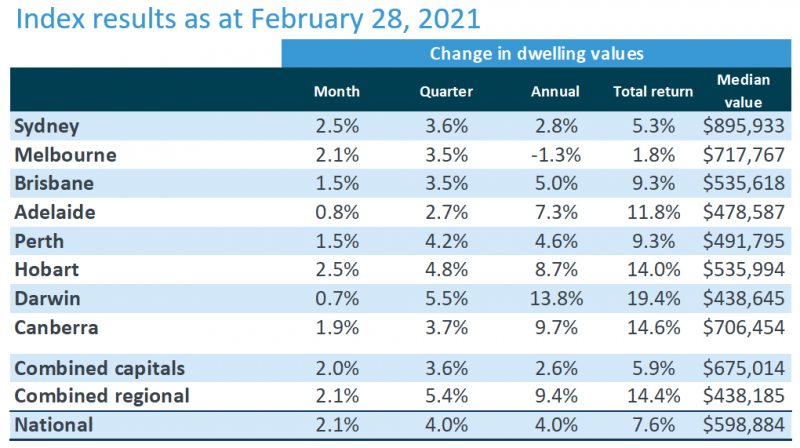

- Australian house prices have skyrocketed at their fastest rate in 17 years, according to new figures from CoreLogic

- The average house price across the country grew 2.1 per cent in February, the biggest monthly increase since August 2003

- Sydney and Hobart were the best performing capital cities during the month, each recording average value increase of 2.5 per cent

- However, Darwin was the best performing city on a quarterly and annual basis, recording increases of 5.5 per cent and 13.8 per cent, respectively

- The rise is being credited to record low mortgage rates, improving economic conditions, government incentives and low advertised supply levels

New data shows Australian house prices have skyrocketed at their fastest rate in 17 years.

The latest figures from property database CoreLogic show average house prices increased by 2.1 per cent in February, the biggest monthly increase since August 2003.

The rise is being credited to a number of factors, including record low mortgage rates, improving economic conditions, government incentives and low advertised supply levels.

CoreLogic’s Research Director Tim Lawless said growth like this hasn’t been experienced across the country in more than a decade.

“The last time we saw a sustained period where every capital city and rest of state region was rising in value was mid-2009 through to early 2010, as post-GFC stimulus fuelled buyer demand,” he explained.

Sydney and Hobart were the best performing capital cities during the month of February, each recording average value increases of 2.5 per cent.

However, Darwin was the best performing city when compared on a quarterly and annual basis, recording increases of 5.5 per cent and 13.8 per cent, respectively.

Looking ahead, the property database flagged a number of issues for continued growth amongst the housing sector.

“Whether this new found growth in Sydney and Melbourne can be sustained is unclear,” the CoreLogic research director said.

“Both cities are still recording values below their earlier peaks, however at this current rate of appreciation it won’t be long before Australia’s two most expensive capital city markets are moving through new record highs,” Tim added.

“With household incomes expected to remain subdued and stimulus winding down, it is likely affordability will once again become a challenge in these cities.”