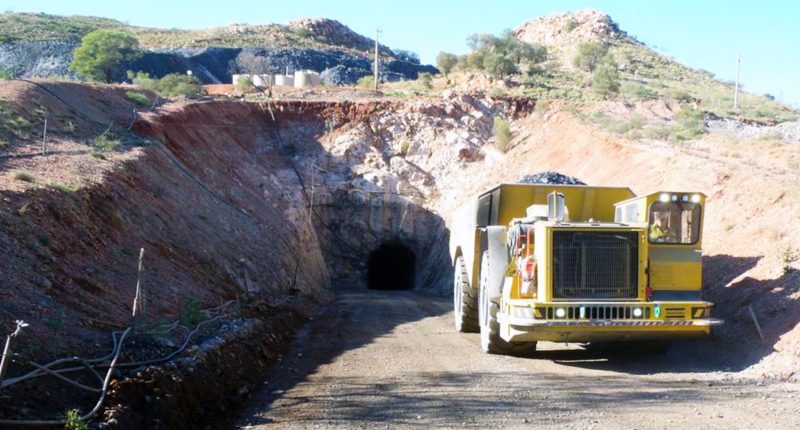

Black Cat Syndicate (ASX:BC8) has scored a golden victory right before Christmas, with the Western Australian explorer recording its first pour at its recently refurbished and now restarted Paulsens gold operation.

Investors have been waiting for news on this note since the Perth-based gold miner collected $36 million to get the Ashburton mine going again in June.

Even further back too, many interested in the Ashburton Mineral Field mine have been eagerly awaiting a first gold pour since Black Cat Resources scooped up the mine from Northern Star Resources (ASX:NST) in 2022. That $40 million sale came five years after priority work at the deposit was halted back in December 2017.

It’s also a particularly glamorous windfall for Black Cat because the company has already several times pledged to produce 100,000 ounces by the time 2025 ends.

“This is a significant milestone,” Gareth Solly, Black Cat’s managing director, explained on Monday, “as we grow our gold production. Our Paulsens team, combined with Maca Interquip, should be immensely proud that they have now successfully achieved our targets and poured first gold safely, on time, and within budget.”

Mr Solly added he and the mining company see it as “the perfect time to become a gold producer” – very likely referencing the precious metal’s long climb through 2024 – as they celebrate the all-important milestone.

Despite in-company celebrations though, shares only moved slightly – and down.

Through Monday’s early trade, the WA gold explorer shaved 0.4% to its share price; a relatively paltry move compared to its strong 136% lift year-to-date.

Join the discussion. See what HotCopper users are saying about Black Cat Resources and be part of the conversations that move the markets.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.