Kingsland Minerals Ltd (ASX:KNG) has provided an update to its exploration target for the Leliyn Graphite Project in the Northern Territory, with the latter now sitting at a globally significant 700 million to 1.1 billion tonnes at 7 to 8 percent total graphitic carbon (TGC), for an overall 50 to 90 million tonnes of contained graphite.

And the market has responded positively, sending the company’s share price to 22.5 cents by 12:41 AEST, a rise of 21.62 percent since the market opened.

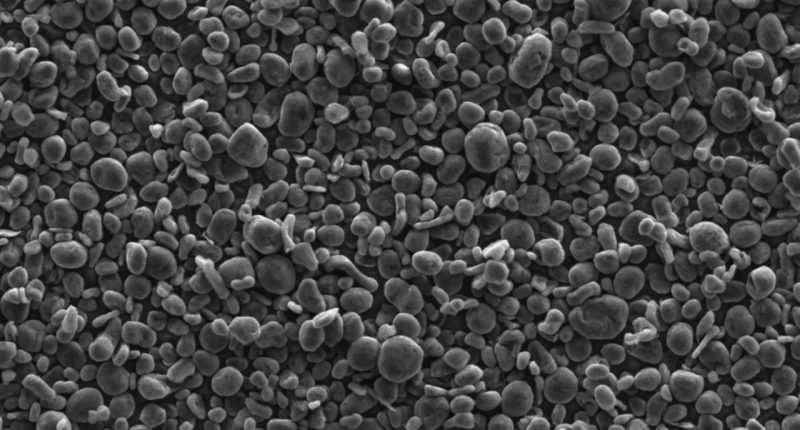

The update came hot on the heels of the company’s release of a mineral resource and initial metallurgical test work which showed potential for a commercial-grade graphite concentrate – at grades of 94 percent and above – to be yielded from the project.

The project’s mineral resource is inferred at 194.6 million tonnes (Mt) at 7.3 percent TGC for 14.2Mt of contained graphite, and its exploration target does not include this, instead revolving around the 12 kilometre strike length of graphitic schists to the north of Leliyn.

Managing Director, Richard Maddocks said that by reaching these goals, Kingsland had shown the potential of the project, which is already Australia’s largest for graphite.

“This updated Exploration Target has been estimated now we have confirmation Leliyn can produce a fine flake concentrate of commercial grade, >94% TGC,” he said.

“This Exploration Target confirms the exceptional scope of Leliyn to become one of the world’s largest graphite deposits.

“We will continue to undertake metallurgical test work to optimise graphite concentrate properties and have commenced discussions with strategic end users and potential customers.”

Kingsland has been trading at 18.5 cents.