- Location sharing service Life360 (360) has seen a big drop in its share price this morning as the company reported a full year underlying net loss of US$15.3 million (A$21 million)

- The loss came after a jump in spending across research and development, TV marketing and hiring

- Life360 reported a 40 per cent revenue increase to US$112.6 million (A$156 million)

- Co-founder and CEO Chris Hulls said the company is watching Apple as its AirTag product has had allegations of stalking and what will happen with privacy concerns

- Life360 shares were down 31.7 per cent and trading at $4.49

Life360 (360) has reported a 40 per cent revenue increase to US$112.6 million (A$156 million) in its 2021 full-year results.

However, with a jump in expenditure across research and development, TV marketing and hiring, the location sharing platform saw an underlying net loss of US$15.3 million (A$21 million). This compared to the US$7 million (A$9 million) loss in the prior year.

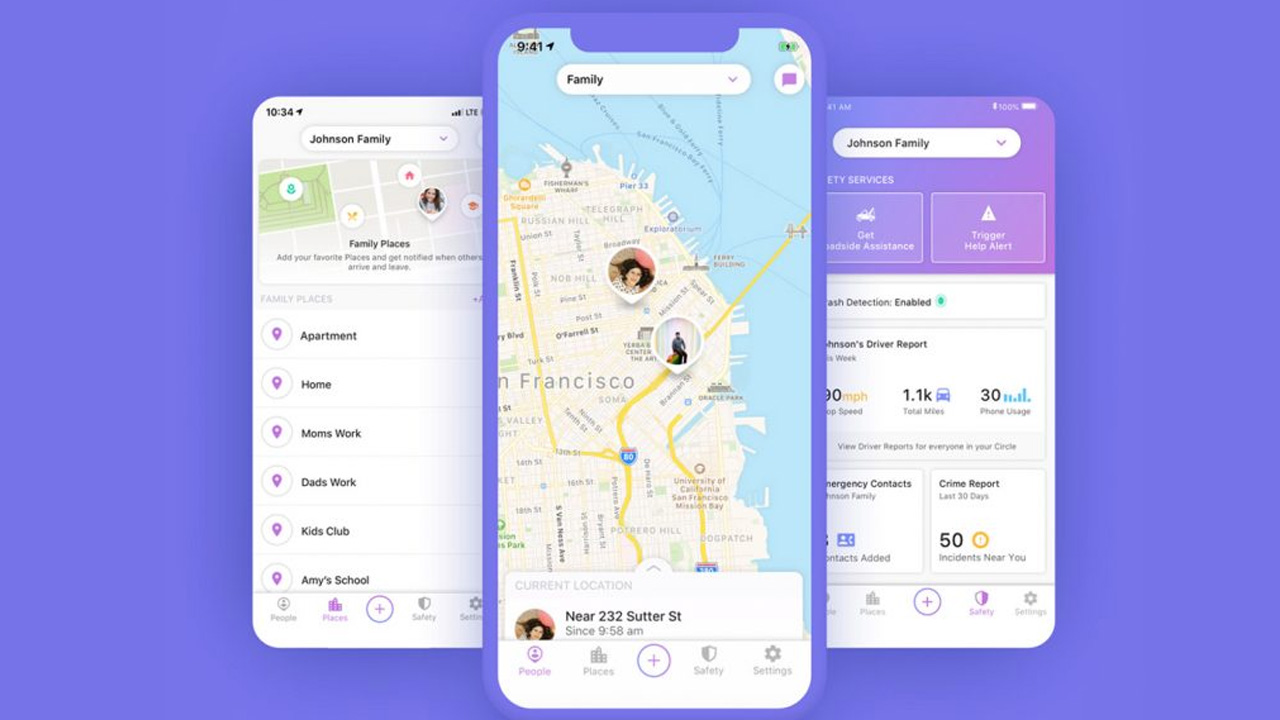

Life360 provides location-based services, including sharing and notification to consumers around the globe.

The company finished the period in a strong financial position with cash and cash equivalents at approximately US$94 million (A$130 million).

Co-founder and Chief Executive Officer Chris Hulls said: “2021 was a landmark year for Life360. We achieved accelerating operational metrics across the business, with three consecutive quarters of record subscriber additions. We finished the year with annualised monthly revenue of US$135.7 million, a year-on-year increase of 51% and a strong leading indicator of the growth opportunity ahead.

“We delivered two transformational acquisitions, with the acquisitions of Tile and Jiobit, and started 2022 with a new key data partnership with Placer.ai. Together with Tile and Jiobit, Life360 has taken a fundamental step forward in our vision of being the dominant platform

for a much broader suite of family services.”

Mr Hulls said the company is watching what will happen with privacy concerns surrounding Apple’s AirTag and how it might impact Life360’s plans.

Last year, Apple released the AirTag to find lost keys and wallets however, people have reported they are being used in stalking incidents, with the small device being slipped into a pocket or bag without the person knowing.

“The scrutiny Apple is facing in the press is moderating growth of the category overall,” Mr Hulls said.

“While this does not change our ability to drive subscription growth through integration with Life360, it may be a headwind for standalone hardware sales until the situation

resolves and the category is able to more fully emerge.”

For 2022, the company is not able to provide a specific guidance due to potential implications under the US federal securities law.

On the market, Life360 was down 30.8 per cent at $4.55 per share at 11:43 am AEDT.