The ASX200 is expected to add around a third of a per cent on open this morning (0.35%), topping up yesterday’s gains.

Finally, the Nasdaq and S&P broke their six-day losing run, with the Nasdaq up 1.1% and the latter gaining 0.9%. The Dow Jones added 0.7%.

Nvidia jumped nearly 4.5%, but Tesla shed nearly 3.5% after it cut its Model 3 EV prices in both Germany and China. It had already cut prices in the US on contracting sales last quarter.

It’s an earnings week in the US, with the Magnificent Seven all due to report, as well as companies including Visa, Spotify and GE.

Back home and Tax Revenue figures will be released by the Australian Bureau of Statistics today and Consumer Price Index & Labour Force numbers will come out tomorrow.

In stocks to watch, Westpac Banking Corporation (ASX:WBC) has revealed its first half Net Profit After Tax is being dealt a $164 million blow; Sky Network Television (ASX:SKT) has renewed an expanded multi-year content deal with the BBC; and micro cap explorer, Galileo Mining (ASX:GAL) has begun a five-week, 3000-metre RC drilling program in its search for nickel and palladium at its Norseman Project.

One Australian dollar is just below US64.5 cents, gold is at US$2327.28, iron ore US$108.25 a barrel, Brent crude is above US$87 and natural gas is nudging US$1.80.

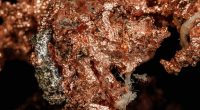

A reminder to those that have signed up, our webinar ‘Recharged Prospects: ‘Watts on the horizon for Copper and Lithium’ begins at noon eastern states time, 10am Perth time.